- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The type of "Accrued Interest" that you are trying to report for EE- or I-bonds is different from what the original poster is asking about. The original post is asking about bonds they bought on the secondary market...where they are paying the original owner for some of the interest that was accrued since the last interest payment occurred for that bond....usually semi-annually.

(For actually Treasury bonds/Notes, see my comment at the bottom)

_________________

For I-bonds or EE Bonds....EITHER:

1) you are not required to report accrued interest, until you either cash in that bond, or it matures. And at that time you report the total of all the accrued interest in box 3......and no adjustment is made on the follow-up page, since that page is referring to a different situation entirely.

....or....

2) You are also "Allowed" to instead report the smaller 1-year of interest that has accrued on the EE- or I-bond every year. But if you do this, you are responsible for looking up, and determining exactly how much that interest was each year, for the entire life of the bond (or until you redeem it if earlier). This reduces the one-time lump-sum interest reporting of situation #1, but keeping the record every year, requires meticulously-kept spreadsheets, and at times, frustration in finding out how much interest accrued in that one year...especially for paper bonds.

___________________

Yes, you are apparently allowed to change form one to the other...messy..but read:

See: Tax information for EE and I bonds — TreasuryDirect

___________________

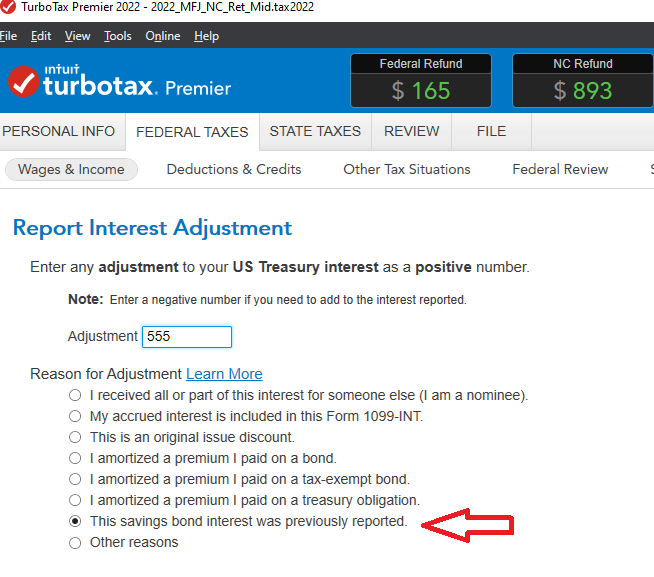

IF you do use situation #2, you report the total of all yoru EE&I-bond Year's interest in box 3 of a 1099-INT....from the US Treasury. Then, in the year the bond matures, or you redeem it (or one), there will also be an actual 1099-INT for any bond redeemed/matured that reports ALL the interest, from purchase-to-date in box 3. .....and on the follow-up page in TTX, you select a checkbox

...."I /We need to adjust the taxable amount"

and on a later page, you get to enter the total of all interest previously reported in prior years (For whatever bond was redeemed..not everything you own), and check the box:

..."This savings bond interest was previously reported."

_________________

Thus for Situation #2 only, the previously reported interest for any bond redeemed in that year:

__________________

______________________

_________________________

Now, if you did buy actual regular Treasury Bonds/Notes, with interest that had already accrued, then those are treated entirely differently from EE- and I-Bonds.....and the $ are entered every year in box 3, and the first year you get an actual interest payment yourself, you will enter the accrued interest you initially paid, on the follow-up page...as already noted as "My accrued interest is included in this 1099-INT" just that one time