- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where can I file the "Expenses, Fees and Tax" of Uber?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

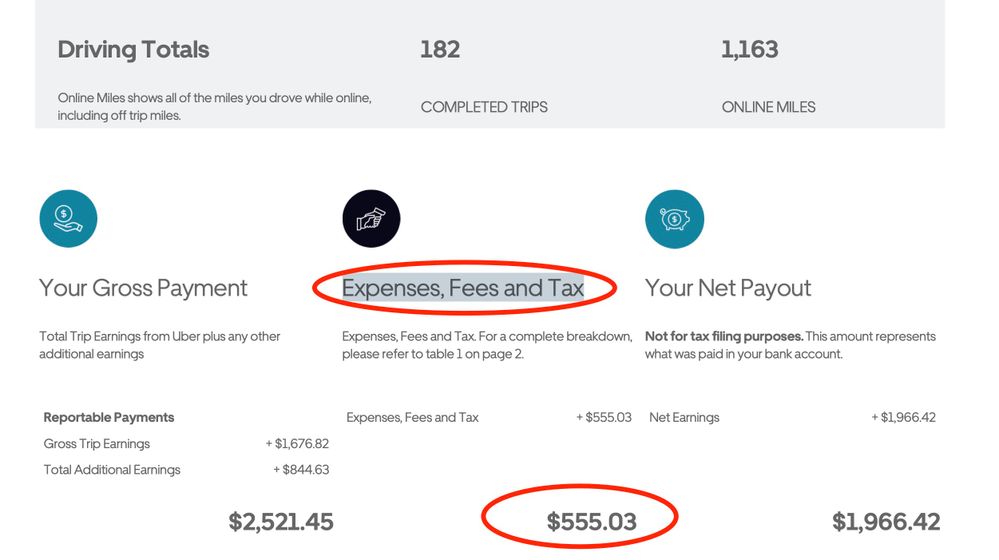

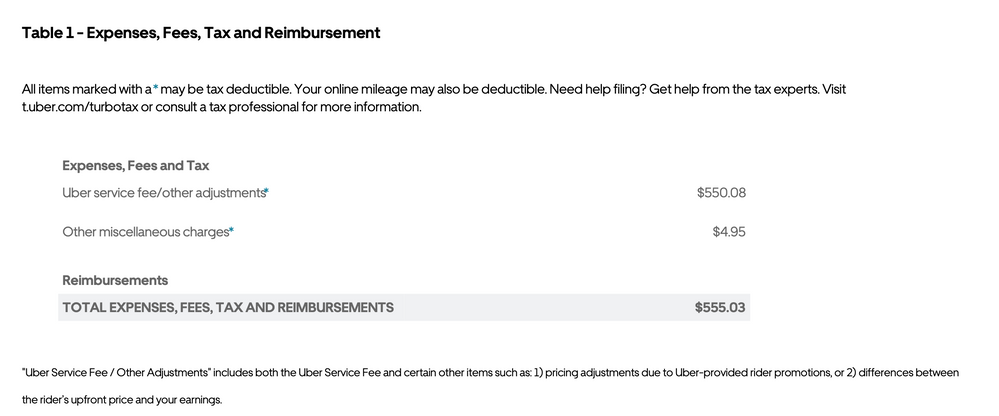

Where can I file the "Expenses, Fees and Tax" of Uber?

Hi

I do not know where I may file the "Expenses, Fees, and Tax" from the tax file from Uber. Because this ¥555.03 is not all the tax, I do not know how to fill this amount.

Thank you so much!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I file the "Expenses, Fees and Tax" of Uber?

Which TurboTax version are you using? Did you mean "not all the expenses" (instead of "not all the tax").

You should be keeping track of your deductible expenses separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I file the "Expenses, Fees and Tax" of Uber?

Thanks for your reply. I use the Home & Business version.

So that is all the information Uber gives me. How to fill?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I file the "Expenses, Fees and Tax" of Uber?

Where do I enter my self-employment business expenses, like home office, vehicle mileage, and supplies?

To enter your home office, vehicle mileage, supplies and other common business expenses:

- Type “Schedule C” in the Search box.

- Select the “Jump to” link.

- If this is your first time working in this section: You’ll be asked some questions about your self-employment work, and then have a chance to enter your expenses.

- If you have already entered some information about your self-employment work:

- Select Edit next to your business, and confirm your general business info if asked.

- Select Add expenses for this work OR, if this your first time entering expenses, select Continue on the Let's get the deductions...screen.

- Follow the screens to enter your expenses.

TurboTax CD/Download Home & Business - Follow these instructions to enter your expenses.

If you are new to being self employed, are not incorporated or in a partnership and are acting as your own bookkeeper and tax preparer you need to get educated ....

If you have net self employment income of $400 or more you have to file a schedule C in your personal 1040 return for self employment business income. You may get a 1099-NEC for some of your income but you need to report all your income. So you need to keep your own good records. Here is some reading material……

IRS information on Self Employment….

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Publication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

http://www.irs.gov/pub/irs-pdf/p535.pdf

Home Office Expenses … Business Use of the Home

https://www.irs.gov/businesses/small-businesses-self-employed/home-office-deduction

https://www.irs.gov/pub/irs-pdf/p587.pdf

Publication 463 Travel, Gift, and Car Expenses

https://www.irs.gov/pub/irs-pdf/p463.pdf

Publication 946 … Depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I file the "Expenses, Fees and Tax" of Uber?

Here's a bunch of links I've collected for Uber. Hope they still work......

Tax Tips for Uber, Lyft, Sidecar and other Car Sharing Drivers FAQ

What do I need from Uber

How to import from Uber

And

https://ttlc.intuit.com/community/entering-importing/help/how-does-importing-from-uber-work/00/27149

Where to enter Uber Income

https://ttlc.intuit.com/community/uber-or-lyft/help/where-do-i-enter-my-lyft-uber-income/00/26804

How to enter expenses from the Uber Summary

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Letty7

Level 1

jocelyn-limmer

New Member

basketballgirl

New Member

jonathancote92

New Member

Raph

Community Manager

in Events