- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

HOW?

Maryland code, i.,e. ww, vv, zz, etc?

Other?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

Not sure, must be a glitch because I was able to amend my federal and state. The information from Federal transferred to my state for the unemployment subtraction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

Software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

That is NOT true stop spreading LIES. MD updated their forms on April 15th, Turbo Tax has done nothing with it yet, most likely will not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

TurboTax Maryland update is ready!!!

The official page says so :

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

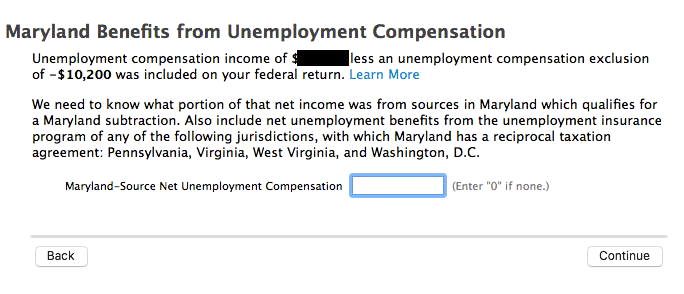

I'm confused…I filled out my updated TurboTax Home & Business (macOS) today, May 9, and in the state review section (Maryland) there's a part here:

What do I enter, the total amount (blacked out) or the total amount minus 10,200?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

YOU SHOULD NOW HAVE ACCESS TO MARYLAND FORM 502 L U.

THIS SHOULD SOLVE THE MARYLAND UNEMPLOYMENT ISSUE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

@johnnytucats We are not able to accurately answer your question without knowing what was blacked out.

It appears you received more than $10,200 in unemployment and the difference was included on your federal income tax return because it was not exempt.

Maryland's unemployment rules are different from federal. Any amount of unemployment compensation in excess of $10,200 that is included at the federal level is eligible for the subtraction at the Maryland level, subject to Maryland’s income caps for the subtraction.

Taxpayers who qualify for the federal exclusion, but do not qualify for the Maryland subtraction, need not add back the amount excluded from FAGI; the exclusion flows to the Maryland return.

Qualifying unemployment includes unemployment compensation from Maryland or from a jurisdiction with which the State has a reciprocal taxation agreement may be subtracted. Maryland has reciprocal agreements with Pennsylvania, Virginia, West Virginia, and the District of Columbia.

See: Maryland RELIEF Act 04-20-21

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

So, my problem is that I subtracted the $10,200 from my total 2020 unemployment compensation and put in that resulting figure of $7,692 fine when doing the MD unemployment section on TurboTax. However, when I did the final MD check, it says that I should put in 0 instead as "Form 502LU: Amount of Maryland benefits received from unemployment compensation Federal Adjust Gross Income of $79805.00 exceeds the limit. This field should be blank". But, the only reason my **bleep**I is above $75K is because of the unemployment I received above $10,200 not excluded on the federal side that is supposed to be completely excluded on the MD state side. So shouldn't I get to exclude the additional $7,692 as opposed to $0? My total unemployment compensation was $17,892 for 2020. Should I override Turbotax's suggestion and put $7,692?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

The federal allows the subtraction if it puts your income under the level, using your modified AGI. The state of MD does not have the same wording. See page 2 at Maryland Unemployment Assistance FAQs Final - Comptroller. Whereas IRS clearly states modified AGI in New Exclusion of up to $10,200 of Unemployment

The program subtracts the federal- if qualified, handles the MD state and does the work for you. You do not qualify for MD subtraction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

No me forgave all unemployment tax so u renter whatever amount your unemployment was

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

Maryland TurboTax calculations are correct and up-to date for your state. You can go ahead and finish and file your state return.

The tax deadlines of the Maryland Tax filing has extended to July 15, 2021.

For more information, click here: Maryland

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

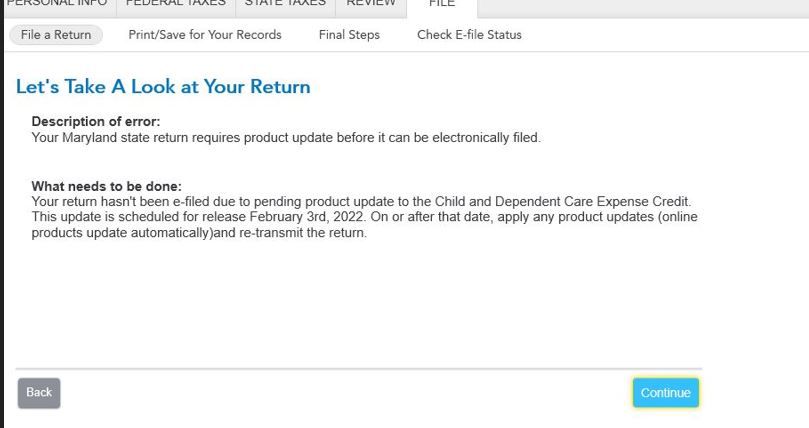

When can we expect an update to Maryland State Tax forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbotax put Maryland's RELIEF act into effect and remove unemployment income from filers' FAGIs?

What about the 8582 form when will y'all fix this glitch ? It keeps saying me abs my friend need it to file but neither of us have had rental properties ever I can't file till y'all fix this Ans am about to go ti another preparer

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wilsonbrokl

New Member

nstuhr

Returning Member

UnderpaidinIndiana

New Member

mwolfson63

New Member

lwolbrueck

New Member