- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

With the tax law change, effective 2018, most dependents will get the same refund whether they claim themselves or not (depending on the source of their income). The personal exemption has been eliminated and the standard deduction increased. However, you only qualify for an education credit or deduction, if you are not a dependent.

The big downside for 2020 is the $1800 stimulus/ rebate credit. Under the CARES Act, if he is claimed, or qualify to be claimed, as a dependent on someone else’s 2019 return he did not receive a stimulus check, in 2020. If he qualified as a dependent for 2019, but will not be for 2020, he will most likely get it in 2021, when you file a 2020 tax return.

Note that the requirement is not just whether he is actually claimed as a dependent, it's whether he qualifies to be claimed as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

My daughter claimed me can I still file for taxes and how would I do it. I been having problems with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

How much income did you have? If you had over 4,300 (not including Social Security) she can't claim you.

You don't have to file if you only have W2 income under 12,400 but you can file to get back any withholding taken out in boxes 2 or 17. But you don't get boxes 4 or 6 back. If you got a 1099Misc or 1099NEC you have to file it as self employment income no matter how small the amount.

To file a separate return as a dependent you need to set up a new account separate from your parents. Online is only good for one return per account. You can use the same email address for 5 accounts. You can probably use the Free Edition or the Free File website

Https://ttlc.intuit.com/questions/1894512-how-do-i-start-another-return-in-turbotax-online

Be sure on your return you check the box that says you can be claimed on someone else’s return. If your only income is W2 and under 12,400 you do not have to file a return except to get back any withholding taken out.

Filing requirements for a dependent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

YES. You can file as a dependent.

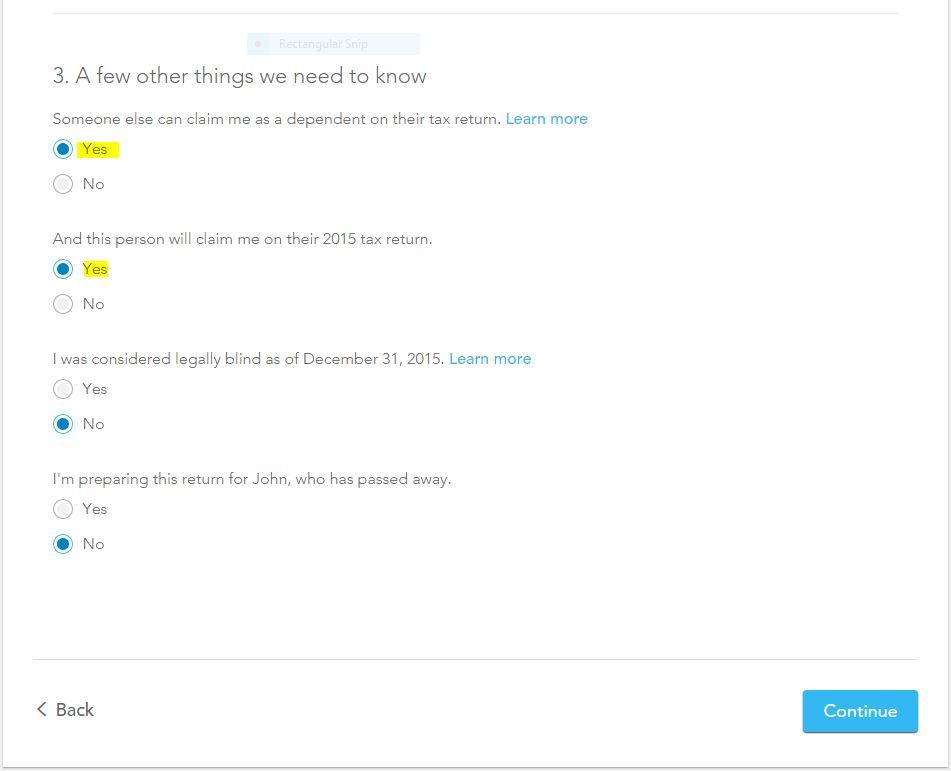

When you enter your information in the "Personal Information" section, be sure to carefully answer the interview questions.

The TurboTax program will ask if someone else CAN claim you, Select YES

The TurboTax program will then ask if someone else WILL claim you, Select YES

Continue through the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

@Nettiepooh what prompted your question???

did it have to do with stimulus? since you are a dependent of someone else, you wouldn't be eligible to receive any stimulus payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

My parents can claim me. But the Turbotax FREE version doesn't let me say that. It's trying to have me claim myself. Where can I input that I'm claimed on another return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

In the personal info section, click edit next to your name. The 2nd screen in will ask "Do any of these apply to (your name)"? Check "Someone else can claim (your name) on their tax return"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

@heyautumn324 wrote:

My parents can claim me. But the Turbotax FREE version doesn't let me say that. It's trying to have me claim myself. Where can I input that I'm claimed on another return?

You enter that you are a dependent in the My Info section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

@xmasbaby0 can you follow up this one please? I've been looking so hard in the Free File version for a place where this question is asked, and I can't find it. It's behaving as if I claimed myself. I've gone through the program several times, and have also called Turbotax. They weren't able to find it, but gave me a phone number to call. That number turned out to be the one I had already called!

Please help Turbotax!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

Wheh. Thanks @Hal_Al !!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

Do you know what section it is that you fix this problem? My parents claimed me as a dependent and I can’t figure out which form it is on my return that I need to fix

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

@Emilypalma17 The question about whether you can be claimed as someone else's dependent is in My Info. Scroll up in this same thread and you will see a screen shot of the screen where it asks the question.

What are you trying to "fix?" Did you answer incorrectly because you CAN be claimed? What are you trying to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

Can I claim my daughter if I’m being claimed by my mother?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

for this to be possible your mother would have to provide over 1/2 of your support while you provide over 1/2 the support for your child. this seems highly unlikely. there are also other tests.

here are the tests for QC and QR - 2021 tax year

You could be claimed as a qualifying child if all these tests are met

• You have the same principal abode as your mother for more than ½ the year. Temporary absences like for school are ignored

• If not a full-time student, you’re under 19 at the end of the tax year. If a full-time student, you're under 24 at end of the year

• you haven't provided over ½ your own support

• you didn't file a joint return unless there was no tax liability but merely filing jointly to facilitate refund of taxes withheld or estimates paid

Or as you could be a qualifying relative if all these tests are met

You’re related to the other person or, if not, lived with the other party for the entire year and

• your gross income for 2021 is less than $4,350

• your mother provided over ½ your support

• you aren't a qualifying child of another taxpayer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: If someone claims me as a dependent can i still file taxes

but it is the situation. would I be able to claim her, if i am being claimed? to clarify my question, it is allowed?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lewholt2

New Member

andrader05

New Member

vicki1955vic

New Member

robbinslin23

New Member

ehloughlin

New Member