- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax overpayment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

I filed a 2021 federal extension and made a payment at that time via TurboTax. The amount I paid is reflected in the tool, but when I now go to file my return, it is not reflecting the amount I already paid.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

When you requested your extension you were supposed to pay your estimated tax due. Did you enter the payment you made into your tax return? Go to Federal>Deductions and Credits>Estimates and Other Taxes Paid>Other Income Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

Yes, the amount I paid is reflected in TurboTax in the other taxes section. When i now go to finalize my return, it doesn't appear to be deducting that amount I already paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

@Mwatson89765 wrote:

Yes, the amount I paid is reflected in TurboTax in the other taxes section. When i now go to finalize my return, it doesn't appear to be deducting that amount I already paid.

If you entered the tax payment made with the extension request correctly in the TurboTax program -

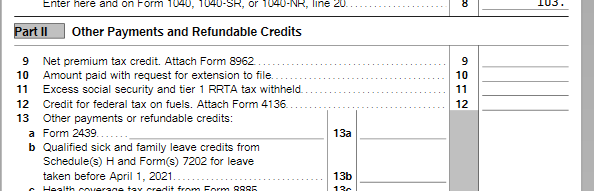

The federal extension payment will be shown on Schedule 3 Line 10. The amount from Schedule 3 Part II Line 15 flows to Form 1040 Line 31

Is there an amount entered on the Form 1040 Line 31?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

ok - Schedule 3 line 10 is blank. but my extension payment is recorded in the other taxes section you noted. Do I just manually enter it in the schedule 3?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

@Mwatson89765 wrote:

ok - Schedule 3 line 10 is blank. but my extension payment is recorded in the other taxes section you noted. Do I just manually enter it in the schedule 3?

Where in the Other Income Taxes section is the amount paid shown?

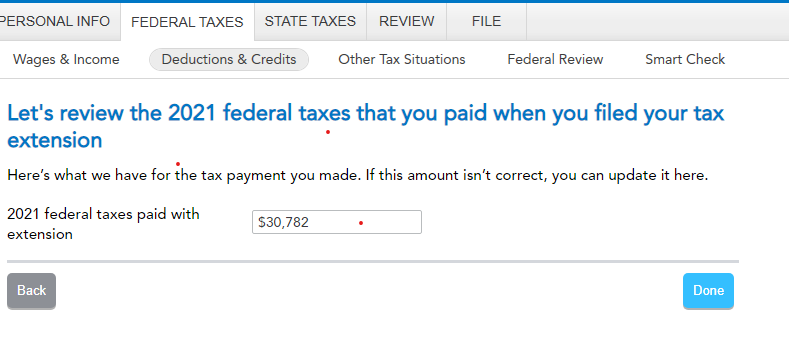

It should have been entered in the section Payments with Extension and specifically in Payment with 2021 federal extension -

Screenshots

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

Yes, i did the extension via TurboTax and it is reflecting in the step by step as you mention, but it is not pulling into the 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

as you can see, it is not pulling over

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax overpayment

Ok...Have you updated your TurboTax software to the latest release?

Click on Online at the top of the desktop program screen and then click on Check for Updates.

Current version for the 2021 TurboTax for Windows editions is 021.000.0738 (Click on Help>About TurboTax>Version)

If correct, then delete the amount paid with the extension and click on Done. Return back to Extension Payment and re-enter the amount.

If this does not correct the problem, then in Forms mode click on the Tax Payments Worksheet (Tax Payments) on the left side of the screen. Enter the extension payment on Line 9 of the Worksheet on Federal. This should transfer the payment to Schedule 3 Line 10.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rickgarcia2003

New Member

dw4181

New Member

LB200

Returning Member

Priscilla-nuwash

New Member

mdh337

New Member