- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

I click "no, none of these situations apply to me" for the limitations on mortgage interest...I click "continue" to the next step...and the software reverts back to the standard deduction.

I refinanced this year, so I don't know if it thinks I have a higher average loan balance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

It might be that your interest is limited because of the refinance. This situation sometimes comes up when entering your home mortgage interest. The following steps should resolve your issue:

1. Log into TurboTax and choose Deductions & Credits.

2. On the page “Your tax breaks”, select Mortgage Interest and Refinancing (Form 1098) and Start.

3. Delete any Forms 1098-MTGE you have already entered in the program. Then choose the button “Add a 1098”.

4. Enter the details from your FIRST Form 1098 – the one from your old mortgage company or before the refinancing occurred. Be certain to enter all the information, including the amount in Box 2 of your 1098. According to the updated 2019 instructions for Form 1098, Box 2 should show an amount. For a loan prior to 01/01/19, the amount should be the balance of your loan as of 01/01/19. For the loan taken out in 2019 (including refinance loan or when the loan is sold to another mortgage company), the balance should be as of the date of the loan origination.

5. Continue through the interview until you reach the screen “Was this loan paid off or refinanced with a different lender in 2019?” If you’re entering the original loan, say No.

6. On the screen “Is this loan a home equity line of credit or a loan you’ve ever refinanced”, say No.

7. Continue to complete the first 1098.

8. Add your next 1098. Be certain to enter all the information, including the amount in Box 2 of your 1098. If there is not an amount in this box, please contact your mortgage lender for the amount. It is required for an accurate calculation.

9. When you reach the screen “Is this loan a home equity line of credit or a loan you've ever refinanced?” say Yes. Select the correct radio buttons and Continue to complete the interview.

10. Click Done. If presented with a followup question about the interest limitation and your loan balance is under $750,000 then your deduction is not limited - say No. If your loan is over $750,000 then the deduction is limited. Say Yes. You will need to manually calculate the adjustment. Please see Page 12 of IRS Pub. 936 for a worksheet that will help you calculate the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

I'm having this same issue. When I follow the steps, I don't get a screen that asks

5. Continue through the interview until you reach the screen “Was this loan paid off or refinanced with a different lender in 2019?” If you’re entering the original loan, say No.

I've tried going to the forms and checking box #9, but it still won't re-calc my taxes due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

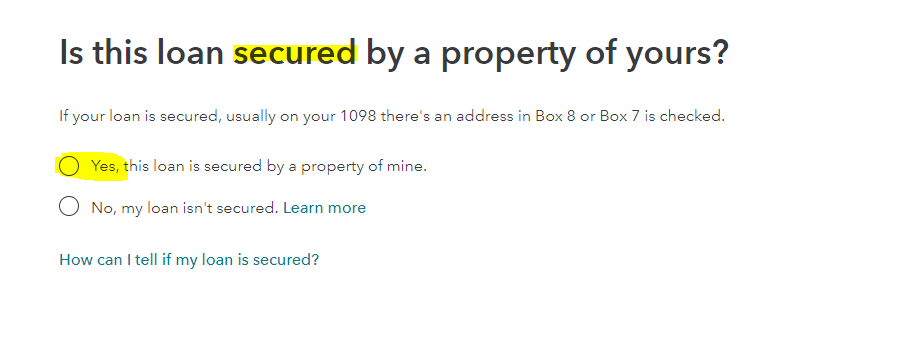

Are you sure you have enough itemized deductions to itemize? Did you mark that box that says the loan is secured by the property? If you didn't answer YES to the question below, the deduction will not show up. It is a requirement for taking a mortgage interest deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software Keeps Changing Deduction to Standard Because It Isn't' Recognizing My Interest Deduction

I finally figured it out from another forum post. There's a bug in the software if you refinance. So much time wasted on this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17724743702

New Member

user17724669799

New Member

roberts298

New Member

roberts298

New Member

boldrock1330

New Member