- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Are you claiming a qualified dependent?

Am I Head of Household?

https://ttlc.intuit.com/questions/1894553-do-i-qualify-for-head-of-household

https://ttlc.intuit.com/questions/2900097-what-is-a-qualifying-person-for-head-of-household

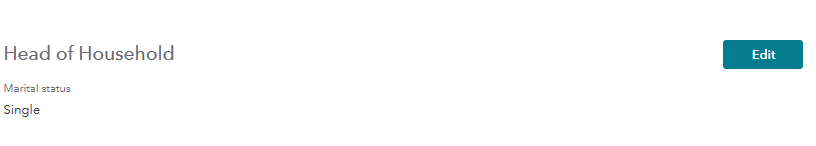

If you qualify as Head of Household, when you enter your marital status (single or married filing separately) into MyInfo, and then enter your qualifying dependent, TurboTax will offer HOH as your filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Did it say specifically that you did not pay more than half the cost of running your home, or did it show you a list of several possible reasons that you cannot file as head of household?

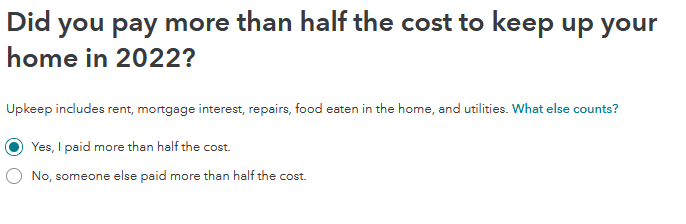

The only way that TurboTax knows whether you paid more than half the cost of running your home is that it asks you. One of the screens asked if you paid more than half the cost to run your home. If you mistakenly answered No, go back through the filing status questions in the Your Info section and change your answer. Read the screens carefully. The first screen will show your current filing status, and there is a box you can check to change it. But you have to meet all the requirements for head of household. Paying more than half the cost of running your home is only one of the requirements. See the first link in xmasbaby0's reply above for more information about the requirements.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

I am experiencing this exact same issue. I read every word of every question carefully and can't figure out why it's denying me this right without any option to manually select.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

In the My Info section of your return, at the beginning, in the Filing Status section, it will ask if you paid more than half the cost to keep up your home.

You will also need to answer the questions in the dependent section so that they qualify you for Head of Household.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

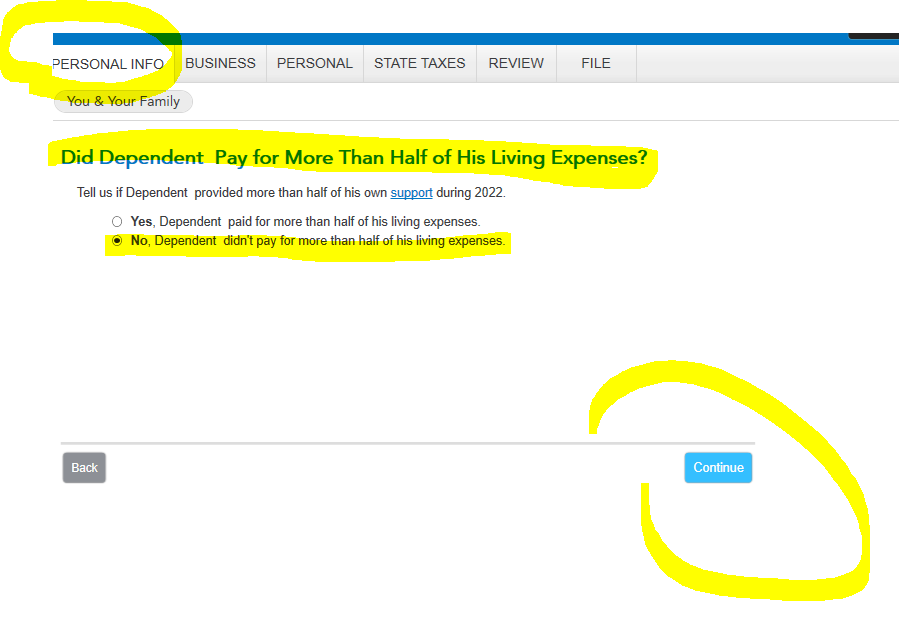

Go back and edit your dependent ... there is an oddly worded question about the DEPENDENT providing more than 1/2 of their own support ... you may have answered that question incorrectly and as such you don't have a qualifying dependent for HOH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

I've looked through the questions multiple times and I was never asked this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Go back to personal information section and go through every question again. It’s in there .

Im assuming you have a qualified dependent, if not that’s the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

In the Personal Info Section

You would need to go and select Edit for the dependent listed

there will be a screen that reads "Did they pay more than half of their living expenses?"

IF YOU PAID MORE THAN HALF SUPPORT FOR THE CHILD/DEPENDENT you need to select NO

"No Dependent didn't pay more than half of his living expenses" BECAUSE you did.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

I'm having the exact same problem and none of the above answers help. Here's all the questions I am asked under My Info aside from name, date of birth, and occupation:

I am a member or former member of the U.S. Armed Forces (active, reserve or National Guard).

(Yes / No)

State of Residence (On December 31st 2022)

(Dropdown list of states)

I lived in another state in 2022

(Yes / No)

Another taxpayer can claim me as a dependent on their tax return.

( Yes / No)

I was considered legally blind as of December 31, 2022.

( Yes / No)

I'm preparing this return for [My Name], who has passed away.

( Yes / No)

I want to change the language the IRS uses to send me written communications.

( Yes / No)

Then on the next page is asked for my SSN. Then on the next page it asks:

Were you afull-time student in 2022?

Some full-time students can get education-related tax breaks, so we want to check if you went to

school full-time for at least 5 months during the year.

(Yes / No)

Then it asks to confirm marital status. I say "Single".

Then it asks about dependents. Note that none of the questions above ask if I paid more than 50% of household expenses!

So, in dependents I am asked the following:

If you support more than one person, we'll help you enter them one at a time.

(My Child / Another Person)

Then after entering their information I am asked:

Was [Name] married as of December 31, 2022?

(Yes / No)

Then I am asked if they were disabled or passed away.

Did [Name] live with you for the whole year?

(I answered Yes)

Did [Name] live with anotehr relative for more than six months in 2022?

(I answered No)

Was [Name}'s gross income $4,400.00 or more in 2022?

(I answered No)

Did you pay for more than half of [Name]'s living expenses in 2022

(I answered YES)

Then it checks to see if they qualify as my dependent. It says they do, I continue, I enter their SSN, continue again, then click continue when done with dependents, then I enter my address and phone number, then click continue again, then I am asked about income in other states with a drop down, then I continue.

Then I am told:

"The IRS requires you to file this way if you weren't legally married as of Dec 31, 2022.

We checked, and even though you have a dependent, you don't qualify as Head of Household because you didn't pay for more than 50% of household expenses."

And THIS is the problem! Not asingle question actually ASKED ME if I paid for more than 50% (I paid 100%) neither on the page about my personal info nor on the page about the dependant. The closest question was to ask if I paid more than 50% of THEIR expenses (again, I paid 100%) so I really don't understand how to get it to list me as head of household.

To be clear, every other year I am head of household. The only thing that's changed is that this year they have this stupid "race mode" I had to turn off because the stupid graphics are distracting.

Just in case I proceed through the rest of the process to see if it would change. I get to the page where they try to trick me into the paid package (not falling for that again), enter my income by importing W-2, answered a variety of questions about assets, etc. Ended up at the end and it still wanted me to file as single rather than head of household.

When I got to the last page it listed me as single and stated I got the Earned Income Tax Credit for the dependent, but it was way lower than it should have been. Out of cuiosity I deleted the Dependent entirely from the return and... the final value was exactly the same! So it basically didn't even count their info at all and didn't provide me anything for them!

My guess is because the dependent is an unrelated disabled person, rather than a child, but per the IRS website they count as a dependent and TurboTax says they count as a Dependent, but adding them makes no difference on my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Better double check the question about paying more than half of dependents expense. It should be asking if THEY paid more than half, not you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Oh and at the end you said ".....the dependent is an unrelated disabled person" . That is why you aren't head of household. They have to be related to you.

Who is a qualifying person for Head of Household?

https://ttlc.intuit.com/community/family/help/what-is-a-qualifying-person-for-head-of-household/00/2...

But for getting the dependent credit you misread that question if THEY paid more than half. See the screen shot posted above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

That's not actually true, and INTUIT does not decide what a qualifying person is. The IRS does. Here's what the IRS says about it:

Head of Household status:

https://www.irs.gov/faqs/filing-requirements-status-dependents/filing-status

"Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. " This rule does not specifically say that the dependant must be related.

Now, the dependant rules are a bit more complex since most of the pages with rules are in specific reference to children, but the IRS has a tool you can go through to determine if you can claim someone as a dependant here:

https://www.irs.gov/help/ita/whom-may-i-claim-as-a-dependent

Of note, these are the rules on that form that matter:

- Who lived with you during 2022, or

- Who is your child, or

- For whom you provided any financial support during 2022.

Then, if they were not married, you were not married, and if they did NOT provide more than half of their own support, the form says you can claim them as a dependant provided that your relationship with them did not break any laws and no one else can claim them as a dependant. They even have an option in their dropdown,. "What is [name]'s relationship to you?" in which you can choose "Not related"

When I go through all the steps it clearly says I can claim the person as a Dependant even if they are not related to me, and since having a dependant is a requirement to be the head of household that means that Intuit is wrong. Unless you have a specific IRS reference that specifically defines what kind of Dependant is permitted.

And I didn't miss any question. I literally typed out ALL of the questions and your question was NOT one of them. I ended up having to file through a different service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

Try using the IRS interactive tool to see what the IRS says your filing status should be:

https://www.irs.gov/help/ita/what-is-my-filing-status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should qualify for head of household. It says I didn’t pay 50% of household when I paid 100% of household expenses

@Elliander --

It's possible for a person to be your tax dependent and yet not be a "qualifying person" for purposes of filing HOH. See the table on page 10 of IRS Publication 501. Also see the definition of Qualifying Child under "Relationship Test" on page 12.

2022 Publication 501 (irs.gov)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

srobinet1

Returning Member

aamandaxo03

New Member

elenaminter1

New Member

Questioner23

Level 1

lisaandchris4eva

New Member