- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why can't I input self-employment income that generated no 1099s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

I have my W2 filed correctly; that's the end, as far as my simultaneous part-time employment is concerned. I also have self-employment freelance income. That income is only a few hundred dollars so I did not receive 1099s. But I want to report that income as Schedule C income. I do not want to report is some vague "other" category that does not generate a Schedule C. I want to report the few hundred dollars I made in 2021 (yes my taxes are late) as self-employment income, even though I did not receive 1099s. I know exactly how much income I made freelance in 2021.

I am using the online/web version of TurboTax Self-Employment. Last year it let me report roughly the same amount of freelance income.

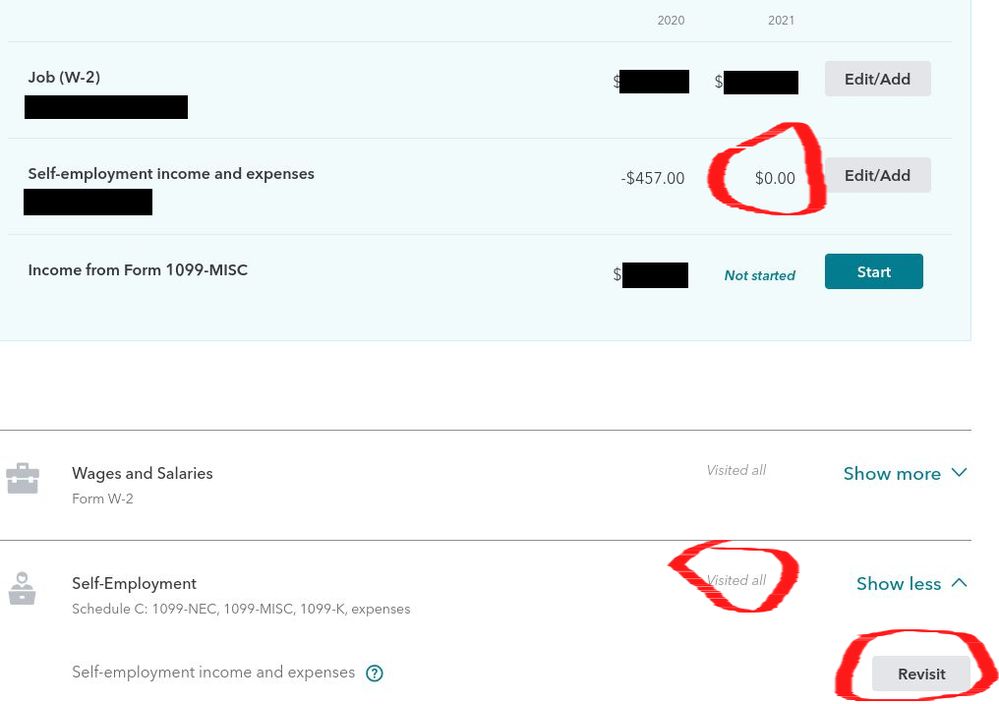

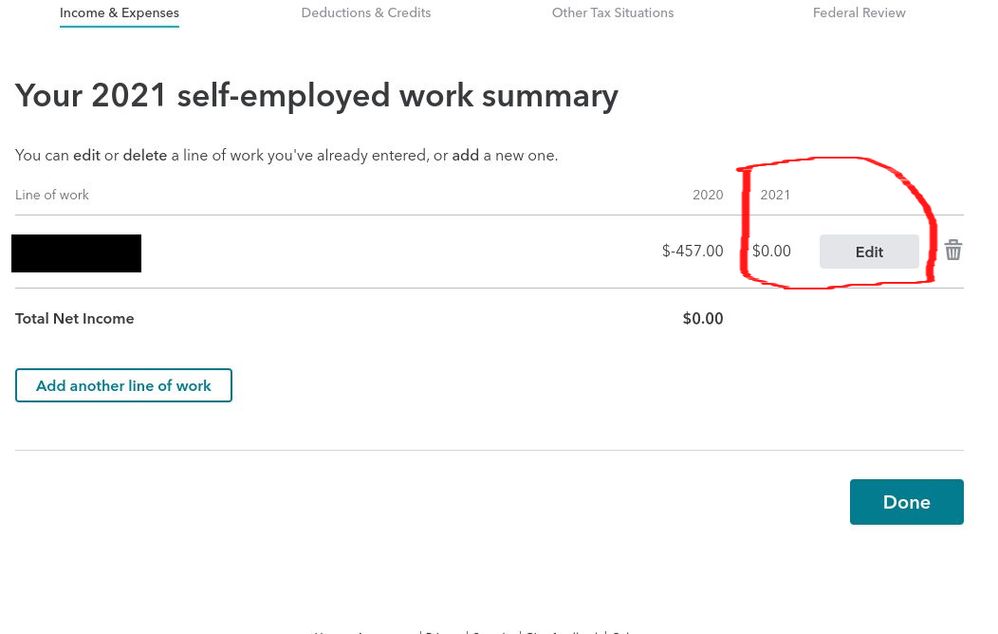

But now, Turbotax just boasts: 2021 equals $0.00 and when I click "Edit" from "Your 2021 self-employed work summary" under "Income & Expenses" I am taken to "Your [Self-Employment Occupation] Info" where I can adjust my mailing address and so on but not my income.

There's nothing wrong with self-employment income and it doesn't require a 1099 to be taxable and go on the Schedule C.

Why is Turbotax trying to force my 2021 income to be $0.00? What do I have to do? It worked last year. What's the deal? This is really upsetting.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

This is the original poster again - I just wanted to add, I did try switching browsers, clearing caches, and erasing my return and starting over. Even though I did all those things, TurboTax Self Employment Online still wouldn't let me input my self-employment income. When I use the search feature's "jump to schedule c" or "jump to self employment income", it's just not showing me any way to input 2021 self-employment income. As described in the original post, it lets me "edit" or "add" but such buttons don't lead me to any actual fields for adding income. And then main "Your 2021 self-employment work summary" keeps insisting 2021's is $0.00 even though 2020 it was like pretty similar amount and worked then. Thanks for any help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

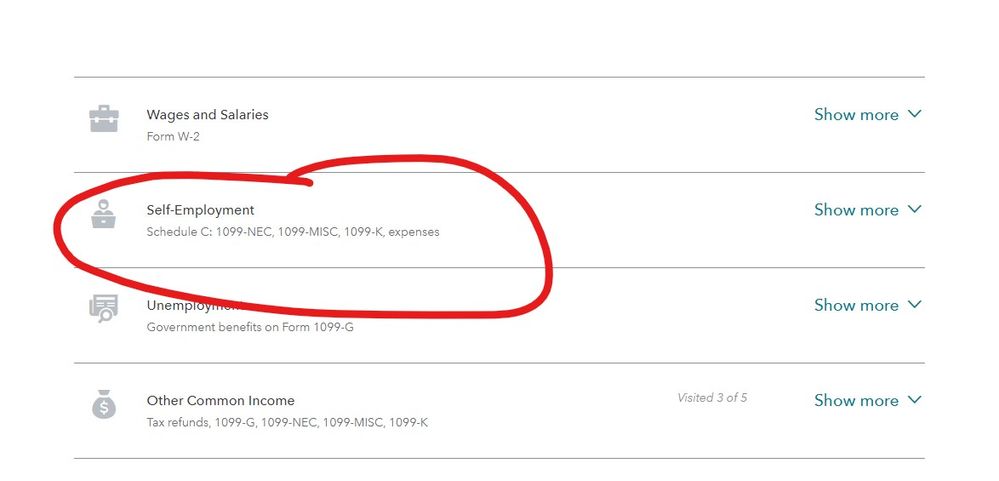

In the income section look for the Self employed section ... right after the W-2 income section ... then follow the screen instructions and skip the 1099 entry section ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

Thanks for your reply @Critter-3.

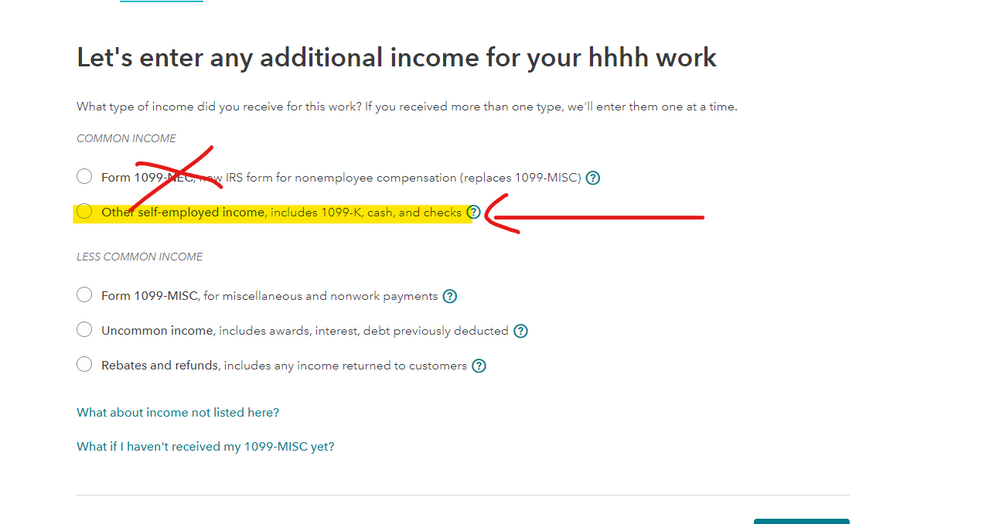

Unfortunately, despite following your advice (and that of Turbotax's help feature), I can't find my way to the instructions you mention, or the to-be-skipped 1099 entry section, or the "Let's enter any additional income for your [type of] work"

For whatever unknown reasons, Turbo Tax Self-Employed 2021 (online / web version) is preventing me from getting to that screen.

I'm embedding three screenshots that show me trying to navigate to "Let's enter any additional income" for non-1099 Schedule C freelance/self-employment income.

As the screenshots show, I start by clicking "Revisit," but I encounter the same problem if I start from clicking "Edit/Add." After clicking "Revisit," on the second secreen/screenshot, I click "Edit." This takes me to "Your [type of freelance work] Info" which lets me edit things like my snailmail address, nothing about income. Once I click "Looks good" at the bottom of that, it moves me directly to "Let's find all expenses for your [type of] work" with again, nothing about income.

Ideas? Thanks everyone

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

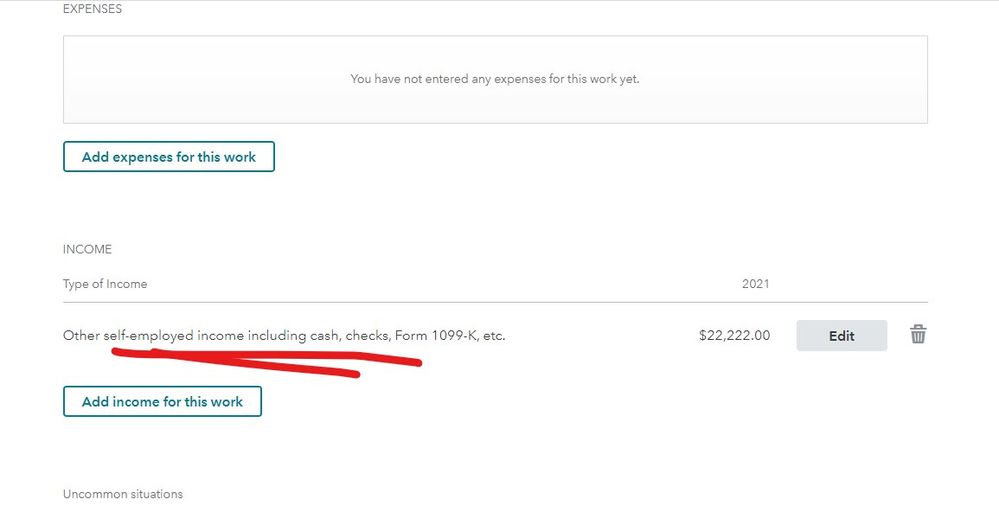

Keep going ... after completing all of the Sch C sections you will get this screen where you can edit the income... if you don't see it then try clearing your browser history and/or switching browsers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

@HumansVersusBureaucracy You do not have a box labeled Add Income for this work directly below the section of expenses on the General Info page for the type of work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

Hi @Critter-3 and @DoninGA,

I perservered through some of the expenses and now Turbotax is allowing me to enter "other self-employed income" such as, in my case, the under $600 did-not-generate-a-1099 income. I guess Turbotax will later put together the Schedule C.

If I remember correctly, this is a really frustrating change from 2020 to 2021. Lots of potential for problems. For example, what if someone made more than $600, but the client never sent them the 1099? I think Turbotax should revolve around fields for users to fill out, not documents for them to upload.

Anyway, thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input self-employment income that generated no 1099s?

I don't understand your problem or questions. You don't need to enter a 1099NEC at all even if you got one. I would just enter your total income as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

How to enter income from Self Employment

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dpa500

Level 2

RyanK

Level 2

dpa500

Level 2

velscricket2

New Member

mjtax20

Returning Member