- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When is 8915-f going to be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Did you review the response provided by DoninGA? @dfellen32, @edelatorre11.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

No - can you cut and paste please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Sure; DoninGA provided the following response:

Try this procedure so that you can file your 2021 tax return if you did not have a disaster distribution or you did not spread a 2020 distribution from a retirement account over three years.

If you did not take a disaster distribution from your pension funds between 2018 and 2020, there may be a question that needs to be reviewed. Follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

Now watch the headings under Federal closely.

- When you are in Deductions & Credits.

- Scroll down and click on Wrap up tax breaks.

- Then you are in Other Tax Situations.

- Scroll down and click on Let's keep going.

- Continue through to Federal Review.

If you've tried the previous steps and you did not resolve the question about the disaster distributions in 2020, then try the steps listed below

Go to Wages & Income

Scroll down to "Retirement Plans and Social Security

Select IRA, 401(K) Pension Plan Withdrawals(1099-R) = Continue (you don't need to add any income forms)

Have you ever taken a disaster distribution before 2021? = Yes (even if you didn't)

Did either of you take a disaster distribution at any time between 2018 and 2022? = No

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Hi,

I tried so much to get the 8915-F form to pay the tax for the second tax installment. took distribution in 2020 and paid tax for the 1/3rd last year. Now struggling to get the 8915 to pay the tax for the second part, I dont have 1099-R for 2021 as I did not take any distribution. I tried all the ways and still not able to reflect the correct taxable income.

Can anyone of you help with any latest information to resolve this 8915 issue?

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

I tried reaching out to customer support team and none of them resolved my issue. I dont have a 1099-r for 2021, but need to file 8915-F (as 8915-E is replaced) to pay the taxes for the 2nd -1/3rd of the covid disaster distribution that I took in 2020.

Any helps/leads please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Please follow these steps to report the 2nd portion of the COVID distribution or any repayment:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen

- Follow the instructions on the screen

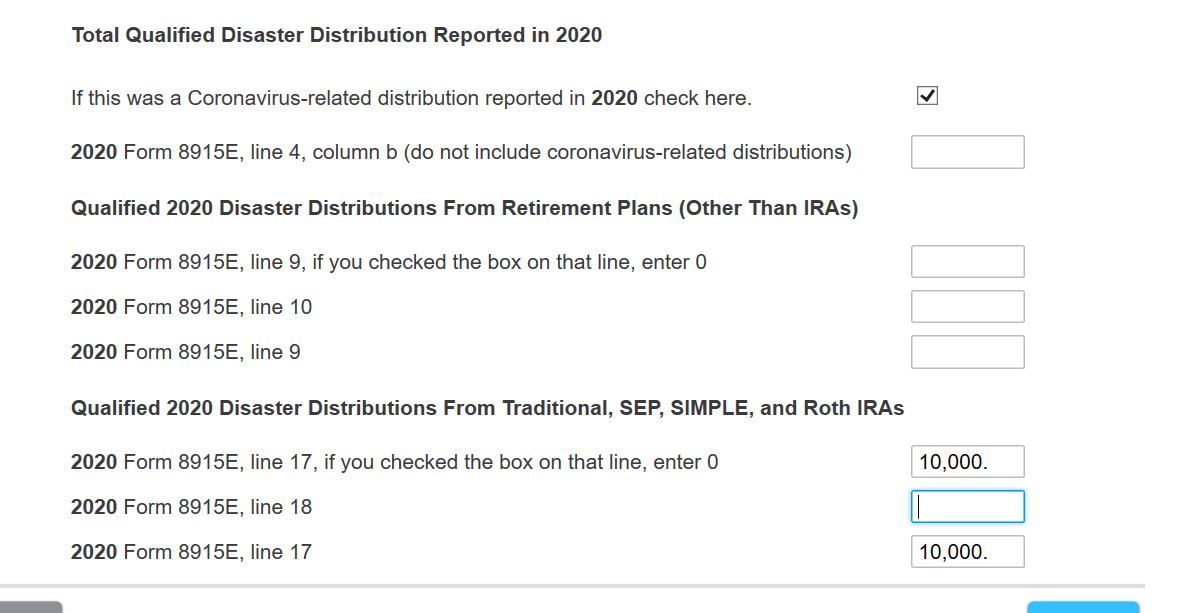

Please verify that you check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here". Also, make sure you enter the amount from Form 8915-E, line 9 twice (if it was not from an IRA) or enter the amount from Form 8915-E, line 17 twice (if it was from an IRA). This amount should be 1/3 of your 2020 COVID distribution.

For example, if you took a $30,000 distribution from an IRA and spread it over 3 years the screen should look like this:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

So i have the 1099-R info there from 20202... do i delete this for filing this year?.... Like this is the second expert i've seen say #4 "If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)" yet i have yet to see this question.

Also the part where you enter line 9 for example, twice, for the 1/3 part. When you move along it counts you as wanting to pay 2/3....

Lastly once you get to the end and it goes under review it wants a Disaster name, start and end date... i mean ffs its Coronavirus related which i clicked half a dozen times already. Looks like TT software not up to date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Thank you very much, it worked. Key here is to enter the 1/3 portion in both the fields (line 9). I was just doing in one field. very hard to catch that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Yes I found the section and entered all of my info. My portion this year is $20,000. I was getting a refund of $3,000 and once I put in my $20,000 portion it said I owe $6,000. I already paid 12,000 last year on the original $60,000. I was going to have a tax preparer double check it. I think it maybe counting it as income and popping us up into another bracket. I didn’t think it would do that since it was a disaster withdrawal that I already took out 20% taxes out on it last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

@dfellen32 wrote:

Yes I found the section and entered all of my info. My portion this year is $20,000. I was getting a refund of $3,000 and once I put in my $20,000 portion it said I owe $6,000. I already paid 12,000 last year on the original $60,000. I was going to have a tax preparer double check it. I think it maybe counting it as income and popping us up into another bracket. I didn’t think it would do that since it was a disaster withdrawal that I already took out 20% taxes out on it last year.

The 2nd year of the 2020 Coronavirus-related distribution is reported on the 2021 federal tax return Form 1040 on either Line 4b or Line 5b as ordinary income and taxed at your current tax rate.

All the federal taxes withheld from the 2020 distribution was entered on your 2020 Form 1040 as a tax payment on Line 25b. You received a 2020 tax refund for the overpayment of the taxes withheld on the 2020 return.

The taxes withheld are not spread over three years, only the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Yes that’s what I figured out. Thanks for clarifying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Can I amend last year’s return and choose to not break it out over 3 years. Would it have any effect on this years and lower my amount due. We already took the highest amount out of both of our paychecks for the year and didn’t owe anything until I put in the $20,000 on both lines.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

@Darth_racer wrote:

I tried reaching out to customer support team and none of them resolved my issue. I dont have a 1099-r for 2021, but need to file 8915-F (as 8915-E is replaced) to pay the taxes for the 2nd -1/3rd of the covid disaster distribution that I took in 2020.

Any helps/leads please.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty) or enter a 0

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

You should not receive the "Needs Review" in the Federal Review section if -

You Leave blank or enter a 0 in the box for 2020 Form 8915-E, line 4, column b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

IRS Form 8915-F information can be entered at the screen Did you take a 2020 Qualified Disaster Distribution? You are able to report Qualified 2020 Disaster Distributions from Part II and Part III from the 2020 8915-E by following these steps.

- Go to Federal / Wages & Income / Retirement Plans and Social Security / IRA, 401(k), Pension Plan Withdrawals (1099-R).

- Click Start / Revisit to the right.

- At the screen Did you receive any 1099-R forms? select No.

- At the screen Have you ever taken a disaster distribution before 2021?, Click Yes.

- At the screen Did you take a 2020 Qualified Disaster Distribution?, enter 8915F and 8915E information.

You may view the distributions on the 2021 Federal 1040 tax return at Tax Tools / Tools / View Tax Summary / Preview my 1040. You may view Form 8915-F at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

Form 8915-F Part II distributions may be found on line 5b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 5a. See entries for Part II of Form 8915-F on lines 12, 13 and 15.

Form 8915-F Part III distributions may be found on line 4b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 4a. See entries for Part III of Form 8915-F on lines 23, 24 and 26.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

How do I know whether or not I paid taxes on the distributions in 2020?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

news411chris

New Member

mikebones92182

New Member

CMcBeth59

New Member

rleboyd

New Member

qmmorr87

New Member