- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

This is on the desktop version:

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22.

What the heck?

Why isn't it let people e-file 2 days before the deadline which is on Monday?

Anyone from Intuit who can help please?

Or at least explain?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

Ok even though it said this, it allowed me to e-file. Weird.

With the conflicting message, I hope it really filed the return...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

I'm a fellow user and don't work for TurboTax. That message is obviously incorrect, since October 17 is the filing deadline this year for those who had extended deadlines. I've seen 2 users so far report this tonight, and both were using the desktop version. I don't know if Online TurboTax users are seeing a similar error message.

2021 Dates and Deadlines:

I suspect a lot of people will be posting on this issue in this forum in the coming hours.

You said it allowed you to efile anyway, so I guess there was a way to proceed beyond that message. Did you get an email that the efile had been transmitted, and when you check the efile status in your desktop software, does it show you the efile status?

Also, be aware that if an efiled return is rejected after it was timely efiled on or before October 17, one has until October 22 to make any corrections and either resubmit the efile or postmark and mail the rejected return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

Could TurboTax just decide to stop taking e-file requests? It seems to me that the return is now sitting at the TurboTax e-file center (like a server?). But it might just be sitting there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

@mesquitebean I posted about this issue to the moderators.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

__________________________________

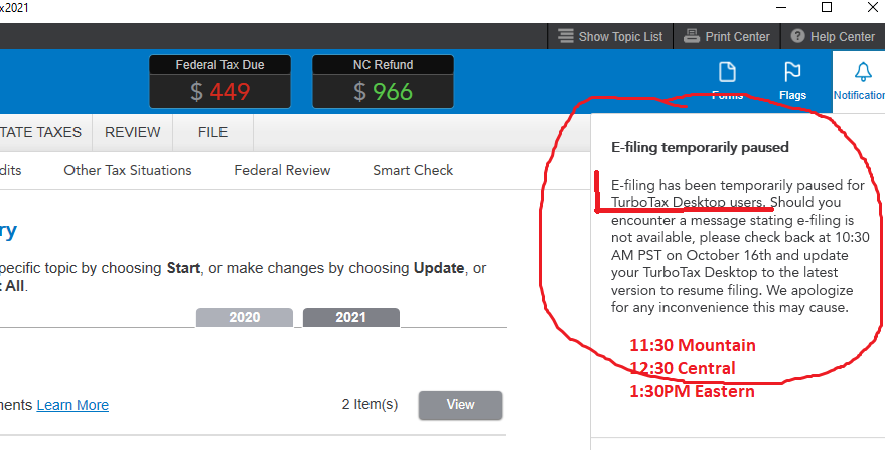

Looks like they are aware....here's a "Notification" I see in my Desktop Premier at 9:30AM Eastern, 16 Oct: (An actual "Pause" in Desktop e-filing??)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

Annnd..of course, the additional zone times I posted are assuming the notification is accidentally mis-using the term "PST" and really meant to say "PDT" (there's an hour difference between them).

________________

Been bugging TTX to stop doing that and just use the term "PT" or "Pacific" in the future...sighhh .

Yeah, perhaps I'm nit-picking

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

@Turbotax

Thank you all for responding!

So I didn't get any email confirming my e-filing.

In the desktop application it says the my status for e-filing is "pending", whatever that means in this situation.

Why doesn't a TT rep respond here precisely what is going on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

Why doesn't a TT rep respond here precisely what is going on?

This is the weekend. And....read that message in the screen shot.....it is not 1:30 pm Eastern time yet. So stay tuned for further information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

Sure, it's the weekend before tax filing day and they messed up the e-filing.

I've been called into work plenty of times on a weekend...don't see why they can't communicate better.

I filed at 1am last night ET, where there was a different message.

Of course I'll hang on till 130pm ET. No other choice except to just print and mail it as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax says I can't e-file my return after 10-15-2022 even though the tax deadline is 10-17-22

@Turbotax

Ok, follow up:

Went back to my TT desktop software and I was told my return as rejected because the AGI was wrong.

I was sure it was correct so...

went to IRS website and searched for last year's return, that I mailed, was not shown as received yet (!). Wow.

I'm assuming it was because it was mailed (extension deadline) and the IRS is still way behind from pandemic issues.

So I searched here and found this advice:

- Filed late last year after mid-November or your return was processed after that time—try entering 0.

https://ttlc.intuit.com/community/taxes/discussion/returns-rejected-2018-agi-incorrect/00/1139651

So, I entered "0" as recommended.

Just got confirmation that Federal return was accepted by IRS.

Waiting for State confirm and hope that this is all over with.

Thanks all for responses and help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilian

New Member

michael_s_peterson

Level 2

5LG8-6WT4-K8DY-KQQK

New Member

allancwatson

New Member

risman

Returning Member