- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: tax rate schedule, 2019, 22% bracket - error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

TurboTax shows 22% bracket for MFJ starting at $78,750. IRS documents show it starting at $78,950 - $200 difference. What's up?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

@akdancer wrote:

.....BUT - my question is about the threshold value for the 22% bracket. Your example shows it starts at $78,751. Per what I see in IRS docs, it starts at $78,951.

I am not certain whether or not we are looking at the same thing or talking around each other.

My screenshot shows taxable income of $78,751 and a tax bracket of 12%, not 22%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

Where, exactly, are you seeing this error? The screenshot below is from a test return and appears correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

Thank for the reply. As shown, it's ok. BUT - my question is about the threshold value for the 22% bracket. Your example shows it starts at $78,751. Per what I see in IRS docs, it starts at $78,951.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

My screenshot shows the bracket at 12% for $78,751.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

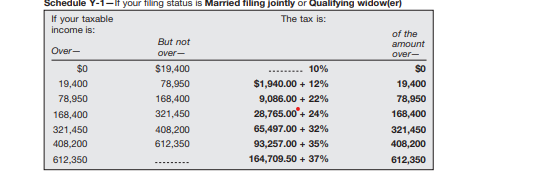

I didn't see your screenshot. I've added one, from Pub 17 (2019), p 257. 22% bracket starts at 78,950

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

Ah, the screenshot from the previous post.

And, my ref to Pub 17 should have said p. 255. (p. 257 was in the .pdf file).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

@akdancer wrote:

I didn't see your screenshot. I've added one, from Pub 17 (2019), p 257. 22% bracket starts at 78,950

Correct and that is where TurboTax starts the 22% bracket.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

Below is what you wrote, and $78,751 <> $78,951.

My screenshot shows the bracket at 12% for $78,751.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

@akdancer wrote:

.....BUT - my question is about the threshold value for the 22% bracket. Your example shows it starts at $78,751. Per what I see in IRS docs, it starts at $78,951.

I am not certain whether or not we are looking at the same thing or talking around each other.

My screenshot shows taxable income of $78,751 and a tax bracket of 12%, not 22%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

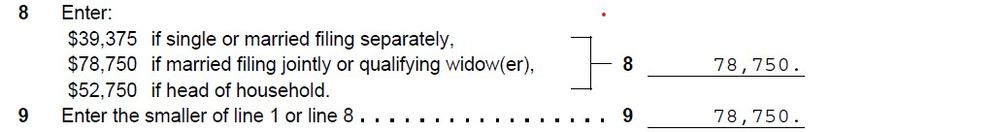

@akdancer Specifically why do you think TurboTax starts the 22% bracket at $78,751?

The screenshot posted by @Anonymous_ shows that if they create a fake return with income of $78,751, it is still taxed at 12%, which is correct. We all agree that the IRS documents show that the brackets starts at $78,951. Where exactly in the program do you believe you are seeing the 22% tax bracket start at $78,751?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

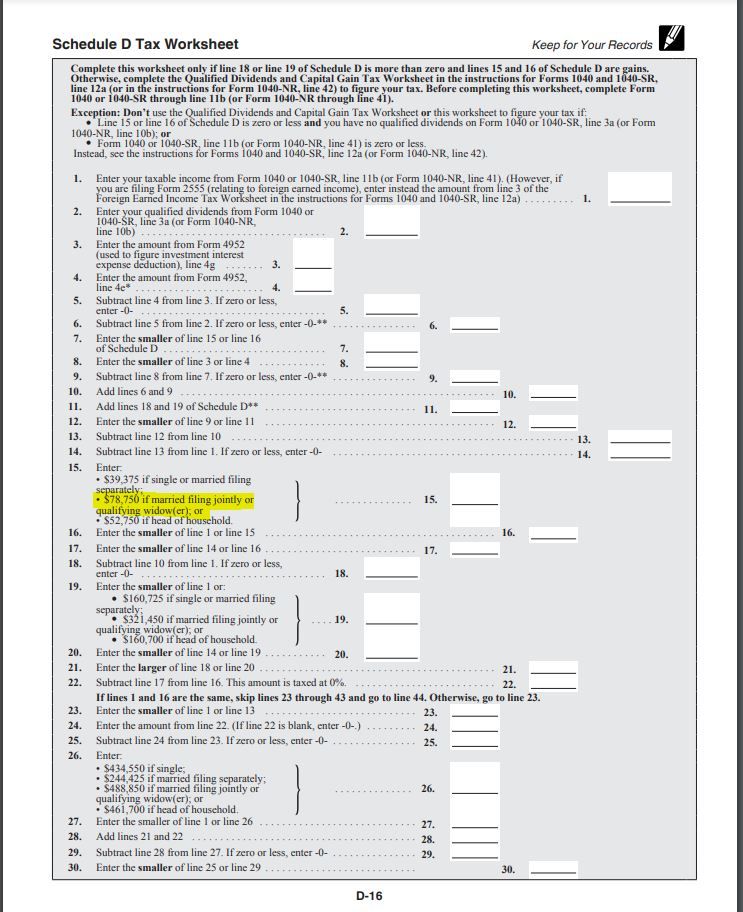

OK - I'm putting in a screenshot from Sch D worksheet. I expected the amounts there to correspond to the tax rate schedule. Obviously they do not. It's crazy to me, but that's the tax world.

Sorry to have bothered you about this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

TurboTax uses the same calculations on the Schedule D Worksheet as are in the IRS Schedule D Worksheet.

IRS Schedule D (2019) Instructions page 16 - https://www.irs.gov/pub/irs-pdf/i1040sd.pdf#page=16

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

How strange. At least for purposes of this specific worksheet, the IRS is using the wrong figure—or, it is the right figure but it is calculated differently than the tax brackets. I wonder why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

tax rate schedule, 2019, 22% bracket - error?

@Opus 17 wrote:

How strange. At least for purposes of this specific worksheet, the IRS is using the wrong figure—or, it is the right figure but it is calculated differently than the tax brackets. I wonder why.

Strange, indeed, but it is calculated differently based upon the table below.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dlevey4456

New Member

Ian B

New Member

terrierhodes

Level 2

johnnyt_909

New Member

rongtianyue

New Member