- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

A spouse is NEVER a dependent ... you file a JOINT return even if one person has no income. Your child can be your dependent if they qualify :

Who can I claim as my dependent?

You can claim a child, relative, friend, fiancé (etc.) as a dependent on your 2017 taxes as long as they meet the following requirements for either a Qualifying Child or a Qualifying Relative:

Qualifying child

- They are related to you.

- They aren't claimed as a dependent by someone else.

- They are a U.S. citizen, resident alien, national, or a Canadian or Mexican resident.

- They aren’t filing a joint return with their spouse.

- They are under the age of 19 (or 24 for full-time students).

- No age limit for permanently and totally disabled children.

- They live with you for more than half the year (exceptions apply).

Qualifying relative

- They don't have to be related to you (despite the name).

- They aren't claimed as a dependent by someone else.

- They are a U.S. citizen, resident alien, national, or a Canadian or Mexican resident.

- They aren’t filing a joint return with their spouse.

- They lived with you the entire year.

- They made less than $4,050 in 2017(not including SS benefits).

- You provided more than half of their financial support. More info

When you add someone as a dependent, we'll ask a series of questions to make sure you can claim them.

Related Information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

File a joint return that claims your child as a dependent. Your wife is NOT your dependent on a tax return.

If you were legally married at the end of 2019 your filing choices are married filing jointly or married filing separately.

Married Filing Jointly is usually better, even if one spouse had little or no income. When you file a joint return, you and your spouse will get the married filing jointly standard deduction of $24,400 (+$1300 for each spouse 65 or older) You are eligible for more credits including education credits, earned income credit, child and dependent care credit, and a larger income limit to receive the child tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

why isn't the advice to all these posts about whether someone can be claimed as a dependent. "simply respond to the questions asked in TT; it will determine whether you can claim someone as a dependent - in part, that is what you are paying for: that TT can answer your questions and guarantees the return is correct (as along as you respond correctly and honestly)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

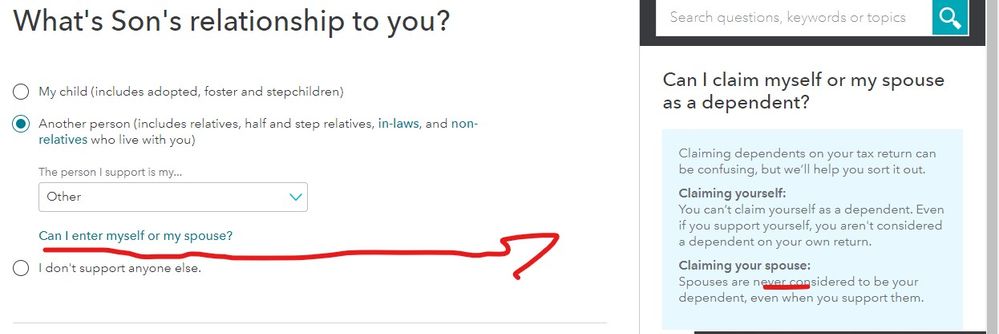

Sadly the program DOES tell you exactly this if the users would simply read the screens and the "more info" links ... but we all know that users ask questions before they use the program or fail to read the instructions as they go. 😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

Sorry ... missed screenshot on last post ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

I guess what I am suggesting is that the experts on this site, reinforce that this is why the taxpayer bought TT in the first place - as you are paying for the trust (and the guarantee is representative of that trust), that TT knows what it is doing and all TT is asking of you is to input the data correctly and honestly. That message doesn't resonate much on these boards.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

In the past I have posted "just read the interview screens" and I was told I was rude and snippy because so many folks post questions before they read the screens or even open the program.

When I worked for TT as a tax expert I would estimate that 90% of the calls/chats were resolved by simply bringing the caller to the appropriate screen(or form in the view mode) and asking them to follow along as I read the instruction (or form) with them. However in this forum I need to use more words, add screenshots, attach FAQs and links to answers by others to make the answer clearer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I file for my self but add my wife and daughter as dependents since she did not work for all off 2019?

Thanks man glad you did the lines and everything. They need to dumb it down... only have a hs diploma..

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gman98

Level 2

kristinacyr

New Member

elenaminter1

New Member

bs87840709

New Member

jaxsonsmommyy1624

New Member