- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Schedule K-1 Box 20 Code Z 199A Program Error Flag

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

I am getting an error upon final review of my federal taxes that I have been unable to resolve. I am entering information for a K-1 that has information in box 20 under both codes A & Z. I am getting an error message that states "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A." I have tried all of the steps of every solution that I have come across on the community boards and none of them have worked for me. I have tried deleting the K-1 and entering the information fresh and that did not solve the issue. I have deleted my entire return and re-entered all of the information again. This still did not clear the issue. I have tried every solution that I can think of but I cannot clear the error message. I used TurboTax last year for my return and did not run into any issues with the same K-1 & same codes last year. Is this a program issue or am I doing something wrong? I am at my wits end and any help from anyone who has experienced the same issue would be appreciated. Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

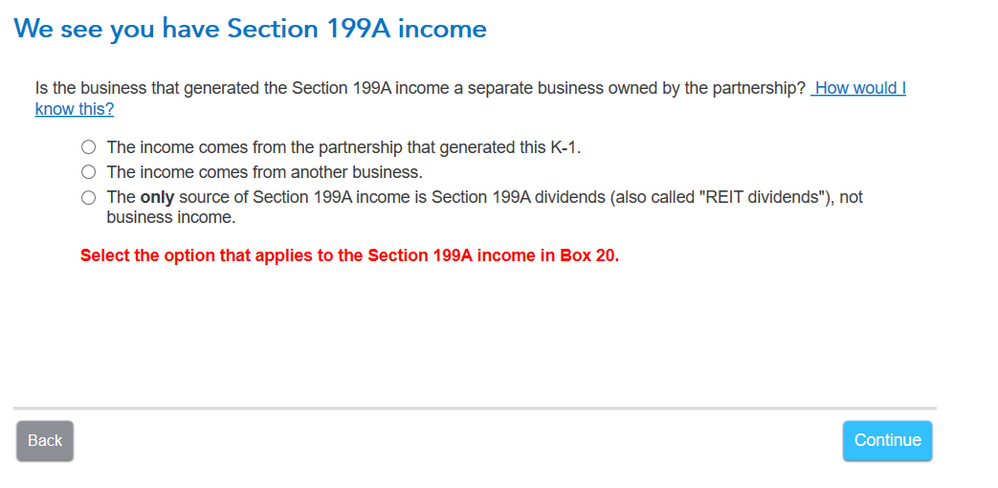

If your 20Z value is 0, don't enter it that line. Otherwise, entering a number for line 20Z triggers TT to ask about "Section 199A income" later in the interview. You have to complete these screens, particularly the one that says "We need some information about your 199A income" which asks for numbers off of "Statement A".

Note that not every K-1 is going to come with a Statement A. If you don't have one, the values you need (like Ordinary business income) will come from the K-1.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

Thanks for the response nexchap. The Box 20Z value is $16 listed on the Statement A as "Other Deductions" with a see attached which leads to another page for "QBI Statement A Other Deductions" and then lists the $16 as "Bank Charges." I have tried leaving the initial field blank when I select Code Z and then enter the $16 later and I have tried entering the $16 in the initial box. Neither has cleared the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

I don't know if you are using the online or the desktop version of TT. In the desktop version, see the very end of this message.

In either version be sure you have answered the 199A interview questions carefully. Have you?

199A is super confusing. Code Z is about getting the 199A QBI pass through deduction.

If the amount is small you could just leave it out. The max deduction is 20% of that amount.

But, of course, you should get every deduction you are entitled to. Here is screenshots for a test K-1 I did with box 20 code Z. Based on your answer to this screen it will ask for other info TT may need.

If you did this correctly then there may be another issue at play.

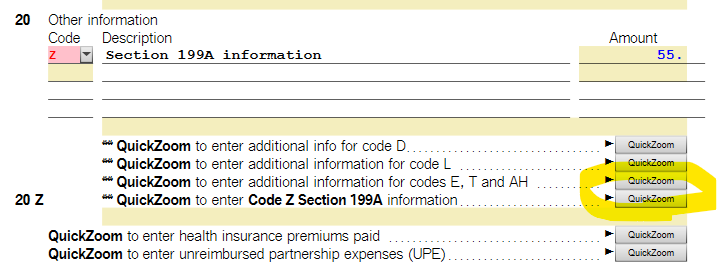

If you have TT Desktop then you can always take a look at the K-1 in forms mode and scroll down to line 20. There is a button Quickzoom to enter 1099A info.

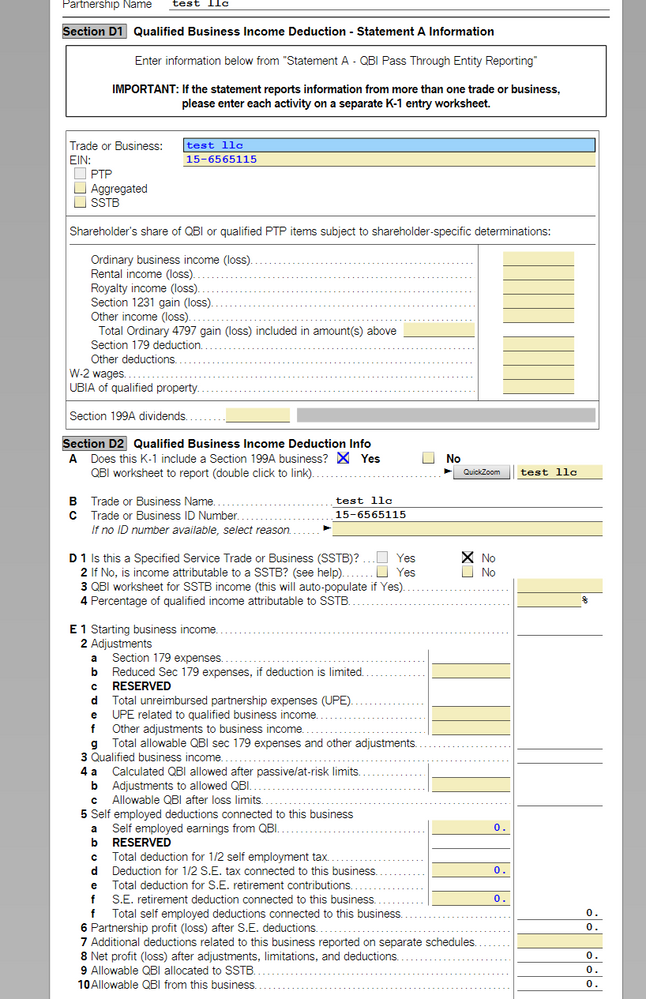

This is the worksheet for Code Z

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

You could just not enter Box 20 code Z. Tell TT it is blank (i.e. no code Z, enter any other box 20 items).

It is only a $16 deduction (and perhaps only 20% of that) that might not even apply to you. "Bank Charges" do not seem to me to be QBI (qualified business income eligible for the so complex 20% pass-through deduction). But QBI is so complicated I could easily be mis-understanding something.

But the point it is it a deduction. You can skip it and the IRS won't care. Don't skip income, but a small and complicated deduction who cares. Even though the word "income" is in QBI that income is already in the other boxes (e.g. box 1). A portion of that income is QBI, which in some circumstances may be partially deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

Make sure you're entering a positive number from your K-1 as a positive number and a negative number from your K-1 as a negative number in TurboTax. Normally, a single line item listed as "Bank Charges" would be negative, unless it's reporting a refund of the charges.

You should enter the amount in TurboTax Online with the Section 199A line then check the box and enter it under "Ordinary Income (loss)" on the "We need some information about your 199A income" screen.

@wgrady6553

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

jtax,

Thanks for the response. I am using the desktop version of the software on macOS. I have tried every combination of using the easy step or going directly into the forms & worksheets. No matter what combination of inputs I use based on the information on my K-1 has allowed me to clear the error. I deleted the K-1 and re-entered the data again, this time leaving out the Box 20 Code Z entry. I kept the other Box 20 entry. This time the final review cleared with no issues. I am going to keep trying to see if I can get it to clear with all of the entries but leaving out the Code Z entry seems to be the only way to solve the issue for my circumstances at the moment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

This was a very useful discussion because I am also at my wit's end with the Box 120 Z 199A. In my case, it's a negative number but I can't get past the error. The question is whether it's better to delete it, so I can get through the error check, or file anyway -- if such is possible! -- so to at least have that figure on the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

I have entered 20 Z STMT with a blank ____, and 199A entered UBIA of qualified property XXXX with a numerical value.

I get the error too.

Section D2 line A is checked Yes, line D1 is checkedNo,

line J1 and J3 have the numerical value for the UBIA of qualified property XXXX entered earlier.

Error check won't clear the error

In forms I have the 20 Z flagged and nothing in the jump to area flagged.

I've tried entering the XXXX value in line 20 Z and blank ____ ; nothing clears the error

I want the deduction; can I fix the error? where does my deduction flow to on the 1040?

Thanks so much… Robert

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

In the same boat! Sounds like if we have a positive number it is acceptable to not enter Box 20 data but welcome confirmation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

I encountered the same flag error on my K-1's... here's what I tried...

(I am in no way a tax professional and am not qualified to advise in any way - only sharing how I proceeded. Please consider only for informational use.)

On the entry page for Box 20 codes and amounts, I had two amounts shown in Column A - for New rental RE inc/loss and for Qualified Property. I added those two amounts together and entered it with the Code Z.

I then proceeded through the interview questions until it said "We need some information about your 199A income." I clicked on the box to the left of "XYZ Co. has business income", which drops down the options to enter the appropriate number for the New rental RE inc/loss. (It is not clearly indicated in TT that this box becomes a drop-down...its easy to miss.) Then I clicked on the box for Qualified Property and entered that corresponding number there.

After proceeding through the rest of the questions, it appeared to clear the prompt for the federal review.

I make no guarantees that this is correct in TurboTax's or the IRS's eyes, but it cleared the flag error for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

I did a similar process to JTPCL. I deleted the small amount of net section 1231 gain ($1) and deleted 13 (A) deduction ($3) and then ran the interview again and answered the questions and got no errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

YES! I have done the exact same things you have tried, called support she couldn’t help me and hung up, so frustrating I want to efile not paper, can anyone help us?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 20 Code Z 199A Program Error Flag

Enter IRS form K-1 (1065) information at the screen Enter Box 20 info,

- Select code Z Section 199A information. Do not enter a value to the right.

- Click Continue.

- At the screen We need some information about your 199A income, you will likely enter the following information:

- Ordinary business income (loss) from this business, and/or

- Rental income (loss).

Enter these values for the Qualified Business Income Deduction to be calculated.

Some preparers of the K-1 form will include the Section 199A information on a separate statement called a Statement A.

It is possible that additional information may need to be entered. Click the box to the left to open up entry boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

barbnich

Level 2

Dayabcdefg

New Member

Kyczy Hawk

New Member

user17726505797

New Member

extending

New Member