- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I don't know if you are using the online or the desktop version of TT. In the desktop version, see the very end of this message.

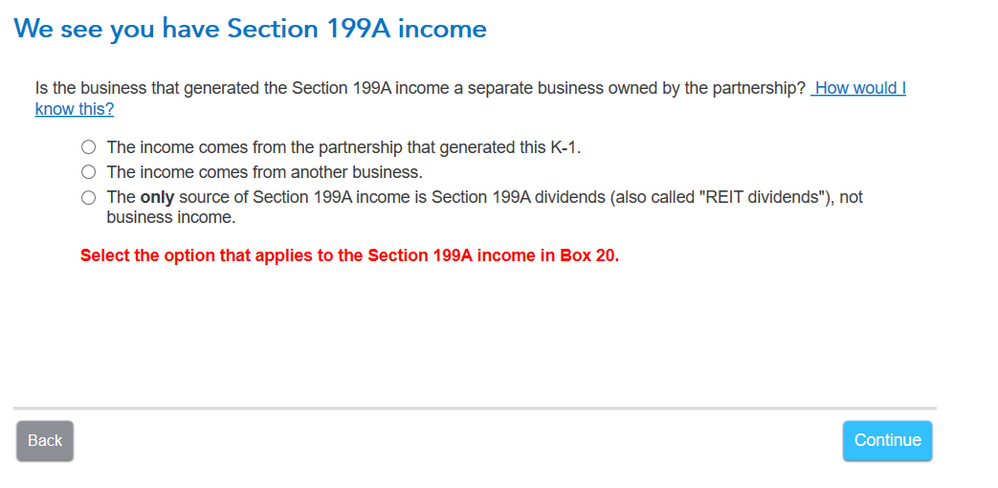

In either version be sure you have answered the 199A interview questions carefully. Have you?

199A is super confusing. Code Z is about getting the 199A QBI pass through deduction.

If the amount is small you could just leave it out. The max deduction is 20% of that amount.

But, of course, you should get every deduction you are entitled to. Here is screenshots for a test K-1 I did with box 20 code Z. Based on your answer to this screen it will ask for other info TT may need.

If you did this correctly then there may be another issue at play.

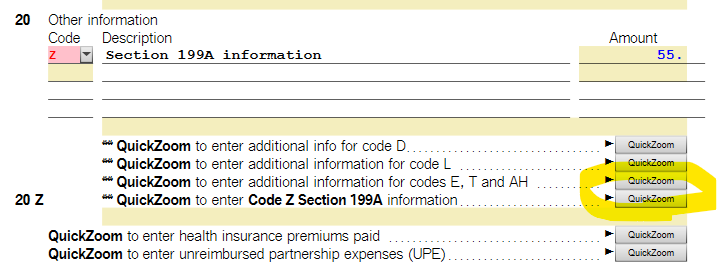

If you have TT Desktop then you can always take a look at the K-1 in forms mode and scroll down to line 20. There is a button Quickzoom to enter 1099A info.

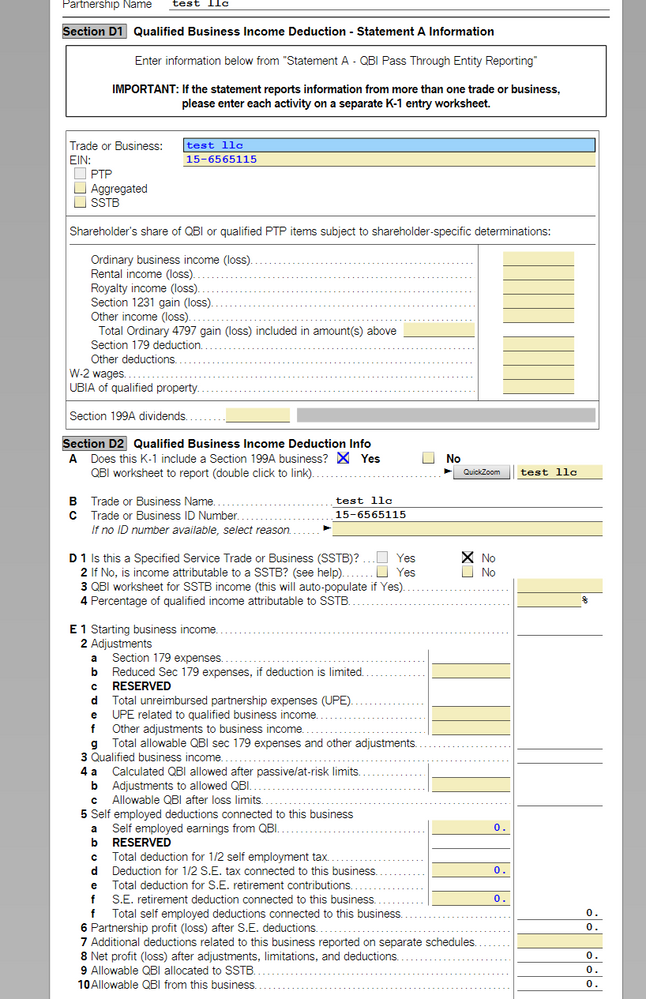

This is the worksheet for Code Z

**Mark the post that answers your question by clicking on "Mark as Best Answer"