- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Sale of my home to a related party

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

I do not see any question about selling to a related party in the section where I report a sale of home.

There is a such question for rental property that was sold but not for the main residence.

How do I report a sale of my main residence to a related party?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

You do not report that for the sale of your main residence. The question is not relevant when a home sale is involved. The reason is because a personal residence sale that results in a loss is not allowed at all. For this reason the question is not needed for the sale of your main residence.

A rental home sale is important because if you sell it to a relative and it results in a loss, you would not be allowed to claim the loss against other income, whereas if you sold it to an unrelated part at a loss, you would be allowed to offset that loss against other income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

The thing is that I get 1099-S, so I have to report the sale, and if it is to a related party, the gain is taxed as an ordinary income. In my case the gain will be less than $250K.

So, how Turbotax will know that it should be taxed as ordinary income, and how will it apply the $250K exclusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

You report the sale of your main home as a regular home sale. Related party rules are put in place to eliminate the ability to sustain and report a loss on a sale, that would affect and reduce other income categories.

There will not be ordinary gain, rather capital gain and if you meet the qualifications you will be allowed to exclude the gain.

In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if:

- you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale.

Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. Refer to Publication 523 for the complete eligibility requirements, limitations on the exclusion amount, and exceptions to the two-year rule.

If you are saying you are retaining a 'remainder interest' in the property then other rules may apply.

Remainder interest. (usually involves a gift and not a sale)

The sale of a remainder interest in your home is eligible for the exclusion only if both of the following conditions are met.

-

The buyer isn’t a “related party.” A related party can be a related person or a related corporation, trust, partnership, or other entity that you control or in which you have an interest.

-

You haven't previously sold an interest in the home for which you took the exclusion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

Thanks. I also did not see any reference to this becoming ordinary income on publication 523, my information came from an article here: https://www.taxlawforchb.com/2013/12/rel[product key removed]/

see under rule #1:

"The Internal Revenue Code provides that in a sale of property between “related persons,” any gain recognized to the transferor shall be treated as ordinary income"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

Although your link is not working, you can check out this link for related party sales. This may not be referring to your home, but rather other business property such as a rental property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

Sorry, the link was modified by Turbotax.

I am selling to a related party corporation that will use it as a rental. So, it will be a depreciable. I read somewhere that this rule applies when either transferor or transferee is using is as depreciable property.

So I think the link you sent does apply. In that case how will I report it in Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

The link (law) you reference only pertains to business property being sold to a related person/entity. If a rental property is sold to a related person/entity, then the portion of the gain to the transferor that is allocated to depreciable property is taxed at ordinary rates. So the rental property is sold to a related entity, the portion of the gain for the buildings (depreciable) is ordinary but the land (not depreciable) is not.

If the property is not business to begin with this law does not apply.

You will enter the sale of your home and claim the exclusion in the "sale of home topic" as a personal/capital asset.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

The thing is that I am selling to a related corporation that will be eligible for depreciation. Please see below.

(a) Treatment of gain as ordinary income

In the case of a sale or exchange of property, directly or indirectly, between related persons, any gain recognized to the transferor shall be treated as ordinary income if such property is, in the hands of the transferee, of a character which is subject to the allowance for depreciation provided in section 167.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

The law that you reference is only for a business property that is sold. Since the property is not business property this law does not apply.

What this law refers to is if you sell a business property to a related entity then the part of gain for the transferor that is attributable to a depreciable property received by the transferee is taxed as ordinary income.

Example, you have a rental property you sell to a related entity, the part of the gain attributable to the building (depreciable) is taxed at ordinary rates. The land (not depreciable) is not.

If the property is not a business property this law does not apply. It is not a business property just because someone buys it and turns it into a rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

Thanks.

Where does it say that "The law that you reference is only for a business property that is sold"

I did not find any mention in that law that restrict the law to a business property. to the contrary, "if such property is, in the hands of the transferee, of a character which is subject to the allowance for depreciation".

in my case it will be depreciable in the hands of the transferee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

As a personal residence the home "in the hand of the transferee" is NOT "subject to the allowance for depreciation" since personal residences are not depreciated.

Although doing your own returns is ok in most instances there are sometimes when getting a professional involved would be fiscally wise. If the party to whom you are selling is using professional then please ask them to help you understand your situation and/or assist you with the return.

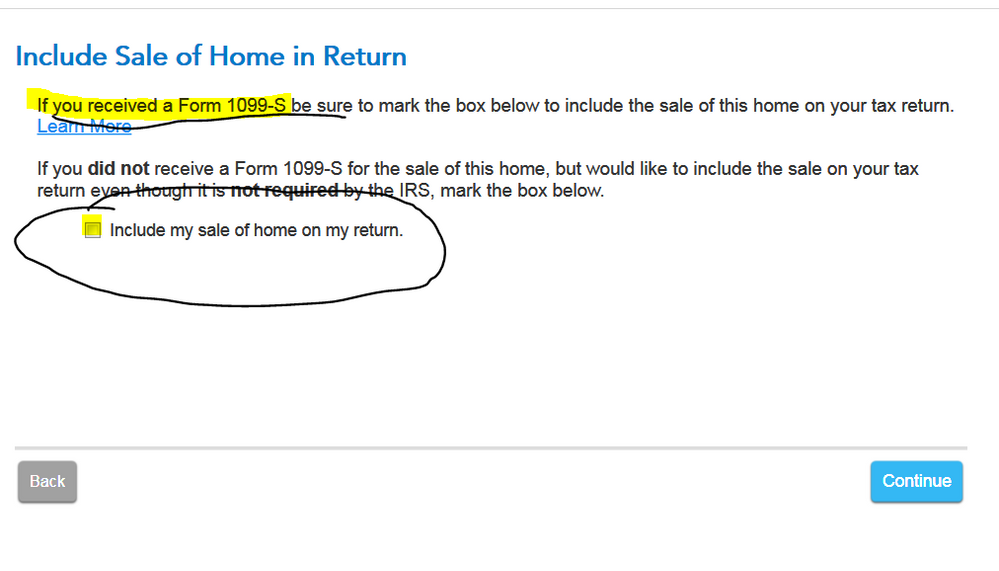

If a 1099-S was issued for this sale then you must report the sale on the Sch D ... remember to check the 1099-S box so it forces the sale to the Sch D even if you owe no taxes ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

The transferee is a corporation and the house will be rented out. So, it will be "subject to the allowance for depreciation"

Also, marking 1099-S on the "Sale of home" in Turbotax will put it on Schedule D as a capital gain while based on the 26 U.S.C. § 1239 - U.S. Code, it is ordinary income:

" (a) Treatment of gain as ordinary income. --In the case of a sale or exchange of property, directly or indirectly, between related persons, any gain recognized to the transferor shall be treated as ordinary income if such property is, in the hands of the transferee, of a character which is subject to the allowance for depreciation provided in section 167."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

You said you would be SELLING the home to the company not transferring it ... PLEASE seek local professional assistance in this matter. A faceless public internet forum is not the best place to discuss such an issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of my home to a related party

Yes, I am selling.

26 U.S.C. § 1239 is about selling. "In the case of a sale or exchange of property...."

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17523314011

Returning Member

Jeff-W

Level 1

VJR-M

Level 1

wa45burnette

Level 1

atn888

Level 2