- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

As a personal residence the home "in the hand of the transferee" is NOT "subject to the allowance for depreciation" since personal residences are not depreciated.

Although doing your own returns is ok in most instances there are sometimes when getting a professional involved would be fiscally wise. If the party to whom you are selling is using professional then please ask them to help you understand your situation and/or assist you with the return.

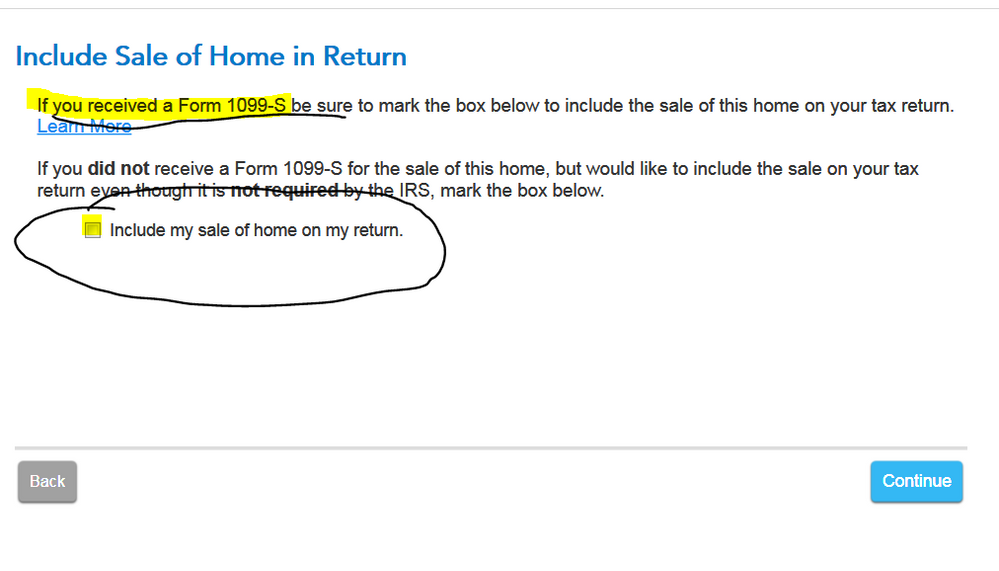

If a 1099-S was issued for this sale then you must report the sale on the Sch D ... remember to check the 1099-S box so it forces the sale to the Sch D even if you owe no taxes ....

April 1, 2021

10:58 AM