- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Refund Processing Fee - Federal Return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I downloaded TurboTax to my desktop. Completed my federal and state taxes. When I efiled my taxes I expected a filing fee for my state, but I was blindsided by the $40 fee for e-filing my federal taxes! I will be searching for a different product next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

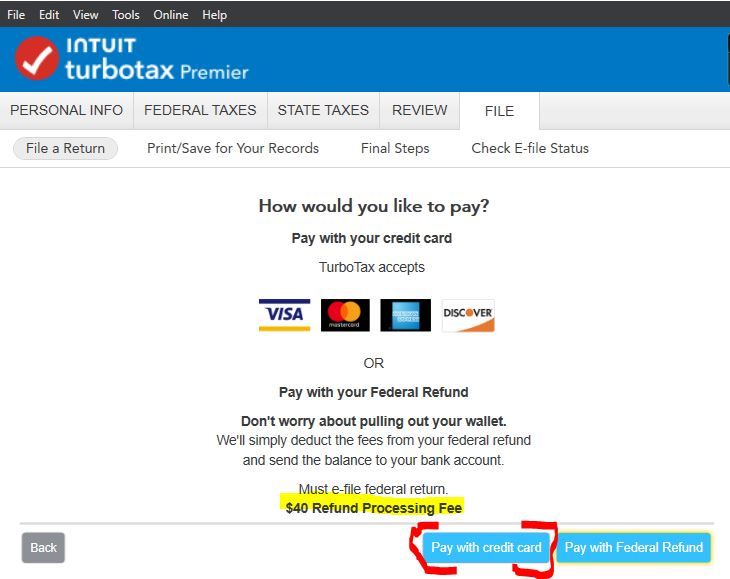

@lashleyd1 Did you read this whole thread? If you read it you would recognize that you did not pay $40 to file your federal return. You paid an extra $40 to have the $25 state e-file fee deducted from your federal refund by a third party bank. Please scroll up and read through everything that is here--including a screen shot of the page where you could have chosen to pay using your own credit card. If you already e-filed, it is cold comfort now, since it is too late. If you are ever taken aback by fees----ask questions here in the user forum before you e-file so we can help you avoid that unnecessary refund processing fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I bought Turbo Tax Premier. I am on my second of two returns I have worked on. I successfully filed my return, no problem. On my daughters return the software is trying to charge me a $40 Federal e-file fee, when the panel before said $0 for the Federal e-file and my software package clearly says 5 free Federal e-files. How do I get around this clear software bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Look very closely at those screens. One of them --on the left-- gives you the option to pay using a credit or debit card. The other box -- the one on the right-- gives the option to pay using your federal refund. Do NOT choose to pay using your refund. If you choose to pay the $25 state e-file fee using your refund, you add an EXTRA $40 fee to the $25!

Pay the state e-file fee using a credit or debit card before you e-file. Or...even better----choose to print and mail the state return and avoid the $25 state e-file fee and just pay for a stamp to mail it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I purchased Turbo Tax Premier, it clearly says 5 free Federal e-files on the package. This is not the state e-file charge for a second state, which I expect to see a $25 charge for that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I went back to the state that 2nd state we were e-filing too. I changed that to will mail a check and it gave me an address to mail too. I then got back to the panel that says $0 for the Federal e-file, and it still has the state e-file charge listed, so even worse. Moving on from there is is again trying to charge me 40 for the federal e-file, that is supposed to be free.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Read your packaging. I have Turbo Tax Premier and it says 5 free e-files. I suspect your package does too. This seems to be a software bug. I also found a couple of others, one of which was that I un-checked e-file for my second state, and it still wants to charge me for that. TurboTax needs to fix this ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

The $40 is to have the $25 state efile fee deducted from your federal refund. So it will be $65 total. Go back though the FILE tab slowly. There is one screen people miss and click on the wrong box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@phdelessio I'm trying to decipher what is happening. Did you already file your federal and state returns? Did you pay the $25 to efile your state return?

You mention a 2nd state. Is that a 2nd state in the same state as the first one OR do you need to file state return for a different state? You get 1 free state PROGRAM (not efile) to prepare returns for the same state. Then if you need to file in a different state you have to buy another state program for $45.

If you only changed to mail a check then you are still efiling the state return. You need to select NOT to efile the state.

Just go back though the FILE tab again slowly and check all your selections.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I'm soooo glad I found this post. Initially I went through the drill for doing the efile and came to a screen that said my cost for doing Federal was $0.00 and state was $15 ($25 - 10 (Amazon credit when I purchased). On the next screen I selected 'take from my refund' - no cost shown for this selection. At the end I was presented with a $60 cost. I called tech support and got a song and dance that the forms that I was using negated the free Federal efiling. I was totally POed and was about to chop down trees and print many pages and mail the returns until I read these posts. Common sense would dictate that Turbotax would show the $45 cost nest to the box where you select pay from the Federal refund. I wouldn't have a problem with that if it was disclosed as it involved more effor by Turbotax to get their money. However someone came up with the brilliant idea of trying to slip it through without people understanding why they were being charged an additional $45. SHAME ON YOU TURBOTAX.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@nitramxxx Didn’t you get a screen like the one I posted above showing the amount? You must be in California. In California it is $45 (not 40) to have the $15 fee deducted from your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Yes I received that screen but there is nothing on the page that explicitly says that the $45 fee only occurs if you have Turbotax take the state fee from a refund of the Federal return. Probably every person that complained on this thread didn't realize where the additional $40 or $45 came from. There is nothing on this page that addresses how to avoid the fee. I think this was a direct ploy that some wizard at Turbotax came up with to smeak an additional $40 (or $45) past the customers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

There is no warning anywhere that when it comes down to filing you have to pay $45 to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@Fedup Bill Using the desktop editions you had to see the following screen to pay for the $25 e-file charge for the state tax return. The additional charge of $40 ($45 in California) was clearly shown when choosing the pay with the federal tax refund option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Are you in the Desktop program? The fee to efile state is only $20 or 25. There is no $45 fee to efile. You can pay the $25 with a credit card or print and mail state for free.

But if you want the efile fee deducted from your refund there is an Extra $40 Refund Processing Service charge (45 in California). So pay with a credit card to avoid the extra charge. Go back through the File tab slowly and read all the screens and watch what button you click on. People get going too fast and click on the wrong button to continue to the next screen.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jamdeuce

Level 1

woodtah

Level 1

carterrd

New Member

snoocher

New Member

jackleonard2468

New Member