- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Refund Processing Fee - Federal Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I have looked at the other posts and I still don't understand. I purchased the software - Home and business version. Now I have to pay a fee to efile my federal return? $40.00? I don't recall this last year. Everything I have read about this fee references using the Free Turbo Tax. What am I missing?

Am I better to consider another product to avoid the $40.00 fee to efile?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

No-----if you are using the CD/download there is a $20 fee to e-file the state return. Do NOT choose to pay that $20 fee by having it taken out of your federal refund or you get that EXTRA $40 "refund processing fee." You do not have to do that. Pay the state e-file fee upfront with a credit or debit card before you e-file. Or avoid the state e-file fee altogether by printing and mailing the state return.

What is Refund Processing Service?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

E-filing fee in desktop software

Did you purchase desktop software with state software included? They sell Deluxe both with and without state software--so you have to be careful which one you choose. And even if it does have the state software download included, that is for preparing the state. There is an extra fee to e-file the state. Before March 1 that fee is $20; after March 1 it increases to $25. You can avoid the state e-file fee if you print and mail the state instead of e-filing it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I have not e filed anything yet. Is there someplace I can look to see where i may have answered that incorrectly on the state or should i delete state and start over? Thanks - appreciate the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

i bought home and business. But not sure at this point about the state. Will live with paying that, but NOT federal return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Yes, Xmasbaby is right. When you buy TurboTax Home and Business, the cost of the software includes five federal e-files and one state download.

You may be charged extra to e-file the state.

It sounds like you may have done your return in the Online product rather than using the software you purchased. When you start, do you open a software program, or do you sign in online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Those 5 federal returns are not free anymore, $40 buck refund processing fee now for each return, This will be my last Turbo Tax filing. After several calls finally got to talk to a real person and she confirmed this ripoff tactic.

BYE TURBO TAX!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Nope, its $40 buck REfund filing fee. No more free 5 fed efiles

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

Not FREE anymore $40 filing fee for Fed refunds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@jchale3331 wrote:

Those 5 federal returns are not free anymore, $40 buck refund processing fee now for each return, This will be my last Turbo Tax filing. After several calls finally got to talk to a real person and she confirmed this ripoff tactic.

BYE TURBO TAX!!!

The TurboTax desktop editions come with 5 free federal tax return e-files. There is a state tax return e-file fee that is currently $20. That charge can be avoided by printing and mailing the state tax return.

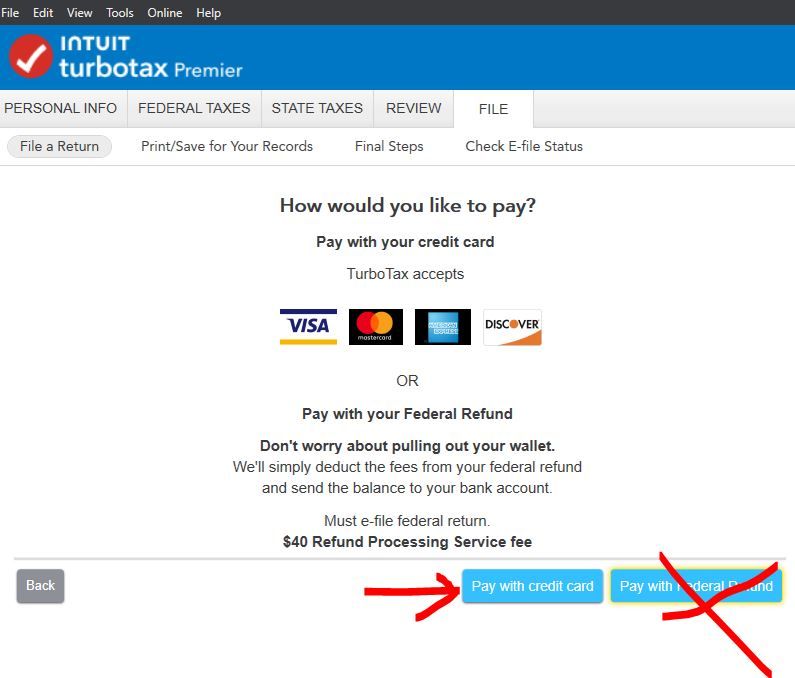

In the File section of the program if you are e-filing the state tax return, there is an option to have the $20 state e-file fee paid from the federal tax refund. The charge for this totally optional service is $40 and DOES NOT have to be used. You can pay the $20 state e-file fee with your credit for no further charge.

All you needed to do is select Pay with Credit Card on the screen presented to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@jchale3331 No one can see what software you used. If you used the CD/download then your only extra fee would have been a $20 state e-file fee, which you could avoid if you mailed the state return instead of e-filing it.

If you used online TurboTax, you pay for every federal and every state return that you prepare and file---unless you have very simple returns and use the Free Edition.

There are no "five free federal e-files" with online----if you are using Deluxe or higher.

So.....what software did you use?

We see people get confused and they keep logging in to online software which will require them to pay at the end. You need to use the desktop software. One way to tell if you are using the right software---your tool bar. Online software has the toolbar in a black vertical column on the left side of the screen. Desktop software has the tools up on the top of your TT screen.

How can I see my TurboTax fees?

https://ttlc.intuit.com/questions/2565973-how-do-i-review-my-fees-in-turbotax-online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

No you misunderstand. In the Desktop program it is $20 to efile each State return. THEN if you want to have the state efile fee (or any extra services you bought) deducted from your federal refund there is an Extra $40 Refund Processing Service charge (45 in California). Which you can avoid by paying the state efile fee with a credit card.

You have to go through the File tab SLOWLY. People get going to fast and clicking on the right corner box to continue. But you have to click on the left box to pay with a credit card to avoid the fee. See the screenshot on this one

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I paid just under $60.00 for the software, Then had to pay another $60 just to file my federal return.

Total scam, will never use it again.

So saying E-File is included is a total false hood.

I have left a negative review on Amazon where I purchased the software.

Oh and contacting support is a total waste of time, you wind up in chat land spinning in circles with some AI Generated Bot.

So I really don’t expect a reply,

I will never use another Intuit product again. The IRS.GOV web page says my e-file should be free of charge BTW.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

I was charged a filing fee for the federal return which was filed by mail

Please process credit to Carl Williams debit card

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee - Federal Return

@6269 Did you use the Online version? The Online fees are to prepare the return whether you efile or print and mail. Sorry.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joe22mango22

New Member

dc5grl

Level 3

user17712587958

New Member

user17712587958

New Member

kaylapopplewell19

New Member