- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Please help! Accidentally submitted a Non-Filer form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

As am I. Very sorry for your misfortune. It happens to best and brightest of us. Dont feel bad.

Overlook the "you're dumb" comments and the "you screwed up so now you get to suffer" comments and the "hahahahhahaah, goddy goody goody" comments that some people who lack empathy may post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I have a suggestion....

It won't help you get the money you are owed but it might be a way to get any new updates from the IRS more quickly and reliably than you'll likely get in this forum.

The IRS has an email / text Alert Mechanism that you can subscribe to.

You can check an assortment of boxes for the category of Alerts that you would like to be alerted about from the IRS. I signed up for a few of these alerts a while back and I don't recall the URL. But if you search the IRS.gov web site for... "news alerts" or "email alerts", you should be able to find the page fairly quickly

Here is an example of one of the email alerts I got last week from the IRS on the topic of Economic Impact Payments. They have maybe, 10-15 different topics you can sign up for.

Isn't it interesting - or disturbing - that even within the Administration, they refer to this program by different names. Depending on who and where, it could be "Economic Impact Payments" or "Economic Stimulus Payment". They can't even agree on the name of the program, or get the name of the program coordinated. Oh well.

I figure that, if and when, there are any new developments, tools, or resources available to help you with your predicament, these email alerts are likely to be the very first way you'll find out about them.

Good luck.

UPDATE: I see that right there on the screen shot, it says "IRS Newswire". Try searching the site with that keyword and see what you get.

Bahda-bing-bahda-boom... Shazaam... there it is...

https://www.irs.gov/newsroom/subscribe-to-irs-newswire

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Where do you think many of us get this info for this forum from ? I am on several of these alerts and when I post the info directly from them others say I don't know what I am talking about ... they would rather believe the rumor mill instead because they like those answers better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I filed my non filer weeks ago. Went and deleted the information from the form and nothing happened. Still getting a rejection.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

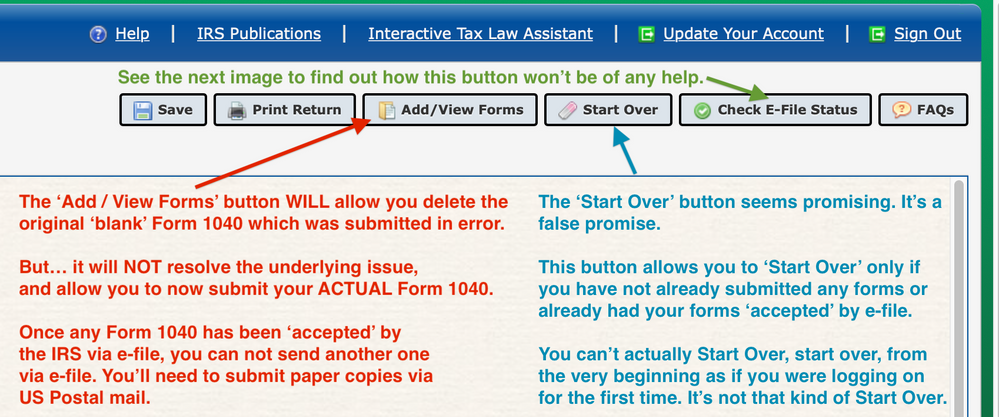

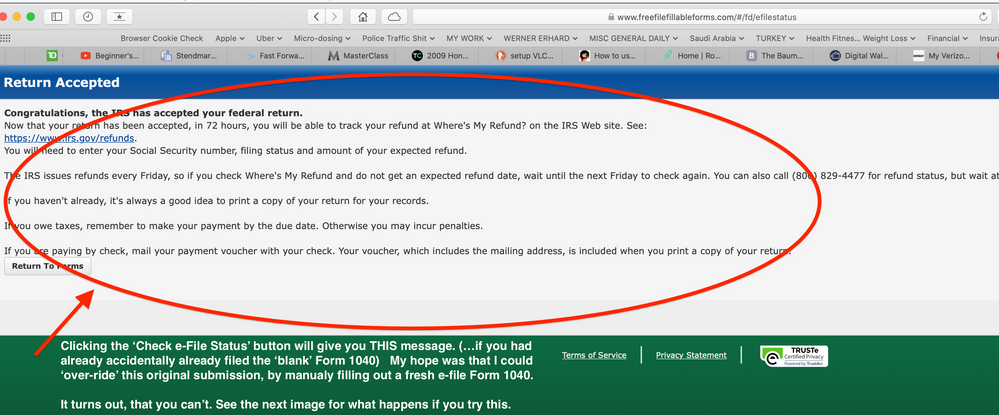

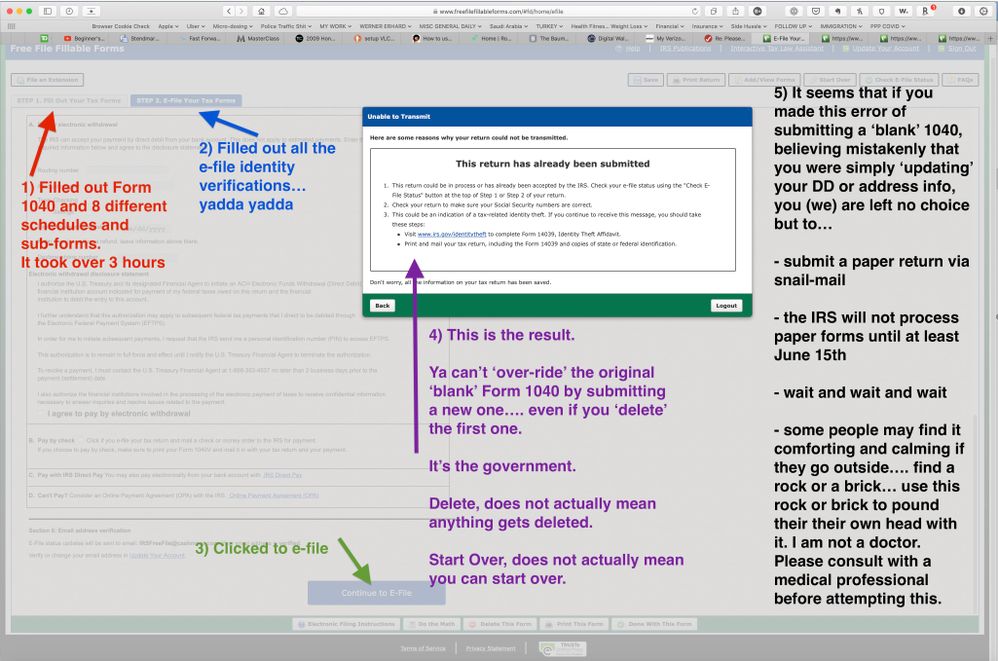

The only complete remedy at this point, is to file a paper return via US Postal snail-mail and wait until at least June / July 15th for the IRS to process it.....

These are screen shots which explain in detail why this is your only option remaining.

You DO NOT file a 1040X Amended Return.

A 1040X is for FINANCIAL changes. It is NOT for this purpose of changing your filing status.

To be factual.... nobody... not the IRS, not Turbo Tax, not a CPA.... nobody knows exactly what the best remedy for this situation is because the IRS has not published anything, which advises what to do, or what is the best course of action. But collectively, ..... mostly through trial and error..... the group in this thread has come up with these work-arounds, which hopefully will produce good results... eventually.

But know, that ALL of these work arounds require human interaction from the IRS. They aren't automated or electronic solutions. So all of these work-arounds will delay receiving tax-return monies, and Economic Stimulus monies, longer than would be the case had the non-filers 'blank' Form 1040 been sent in the first place.

Just file your ACTUAL Form 1040 with either a cover letter explaining why you are submitting a paper return after having already filed a 'blank' erroneous initial e-file return.

OR

You can send a Form 14039 (as shown in the final image above) and attach it to the back of your paper Form 1040, as per the ACTUAL IRS instructions for the Form 14039.

Be sure to....

- include a color copy of your Drivers License or State issued ID card.

- sign and date the form

- attach it to the back of your 1040

- send it to the correct IRS address assigned to your ZipCode (available on the IRS web site)

This is critical because there are many IRS addresses. There are different addresses for different geographic locations, AND there are different addresses for people sending their return in with a PAYMENT enclosed, vs returns NOT with payments enclosed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Not filing will not stop your stimulus.

Stimulus has nothing to do with your taxes.

But, since you used that form, when you do file either use 1040x..an amended form...or simply use a cover letter saying it's amended cuz you used that form for stimulus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

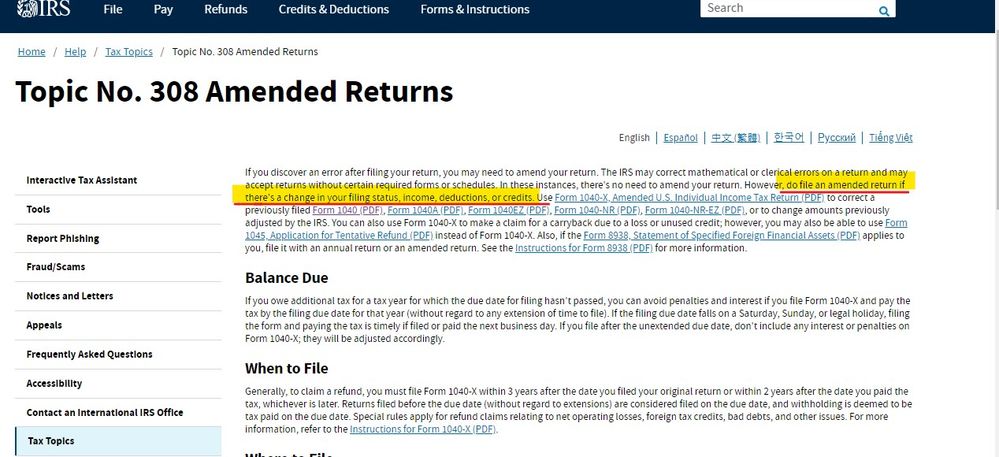

From the IRS : https://www.irs.gov/taxtopics/tc308

If you discover an error after filing your return, you may need to amend your return. The IRS may correct mathematical or clerical errors on a return and may accept returns without certain required forms or schedules. In these instances, there's no need to amend your return.

However, do file an amended return if there's a change in your filing status, income, deductions, or credits.

Don't forget that when you mail a paper return to the IRS, you must include copies of your W-2s and 1099s, plus you need to sign and date the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

You wrote: "Not filing will not stop your stimulus."

Yes... it COULD, depending upon what your 2018 AGI was.

If your 2018 AGI was over $150,000 (joint) and that is the most recent data the IRS has for you, then you will not qualify for a stimulus, UNLESS, you file a 2019 return which has a lower (thus qualifying) AGI.

This is the exact case a person reported to have previously in this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

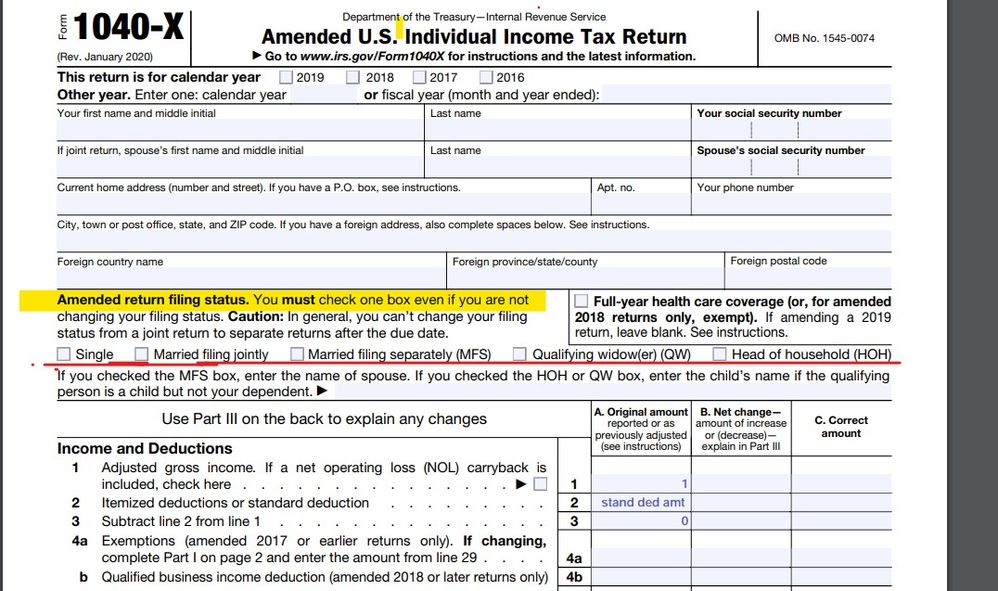

Critter... you are in love with making annotated screen shots for everyone.

How about you use your love of annotated screen shots, to make one of a Form 1040X, and show everyone, exactly how they should fill out that form in order to amend their STATUS, from non-filer to filer.

I read, the same IRS text that you highlighted. The trouble is that the Form 1040X has no provision on it to "amend" a STATUS... even though the IRS instructions say that this form CAN be used for this purpose. As a practical matter, it can not.

But please... you have posted this same post many many times in multiple posts, denigrating and insulting TT users who made this "non-filer" filing error.

So please... use your screen shot annotating skills and enthusiasm and show everyone here exactly how they would go about doing what you ... and the IRS are professing is the right way to go about this.

Show us a sample Form 1040X filled out the way you would submit this form if you were in the situation that all these people are in. And see if you can do it without insulting people. The other readers aren't responding to your insults very favorably.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

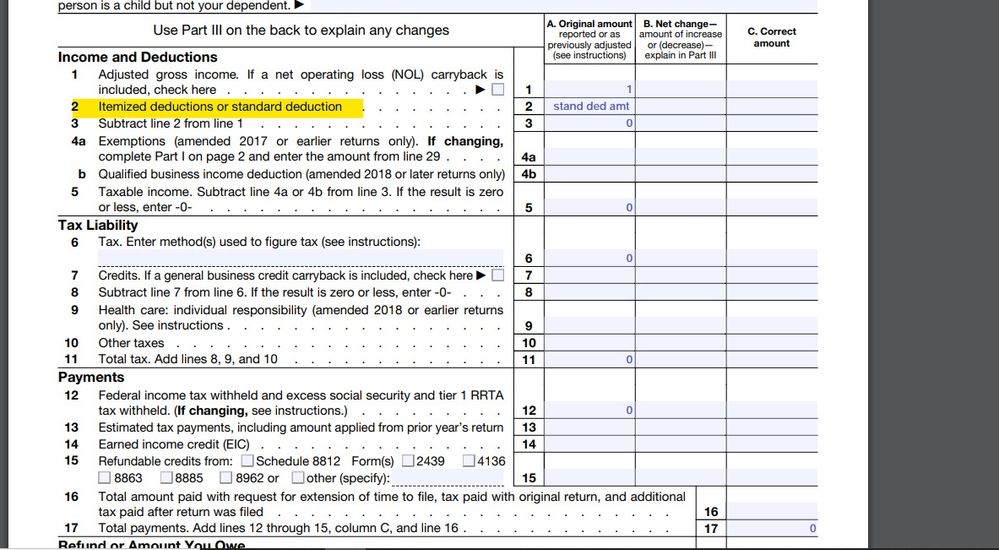

Not sure what you are talking about ... "NON FILER" is not a status of any kind ... on the form 1040X the column A must match what is on the original return and this is what it would look like ...

Column A should have the figures from the original return, Column C the corrected figures and Column B the differences between the other 2 which needs an explanation on page 2 of the form 1040X.

If you completed it correctly you will see an entry on either line 16 OR 18:

On line 16 should be the amount you paid with your original return.

On line 18 should be the amount of your original refund you received.

Then you will see your extra refund on line 22 OR the new balance due you need to pay on line 20.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

You will usually not change your FILING STATUS unless you had to file SINGLE instead of MFS for the stimulus check ... and the 1040X allows that as well ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

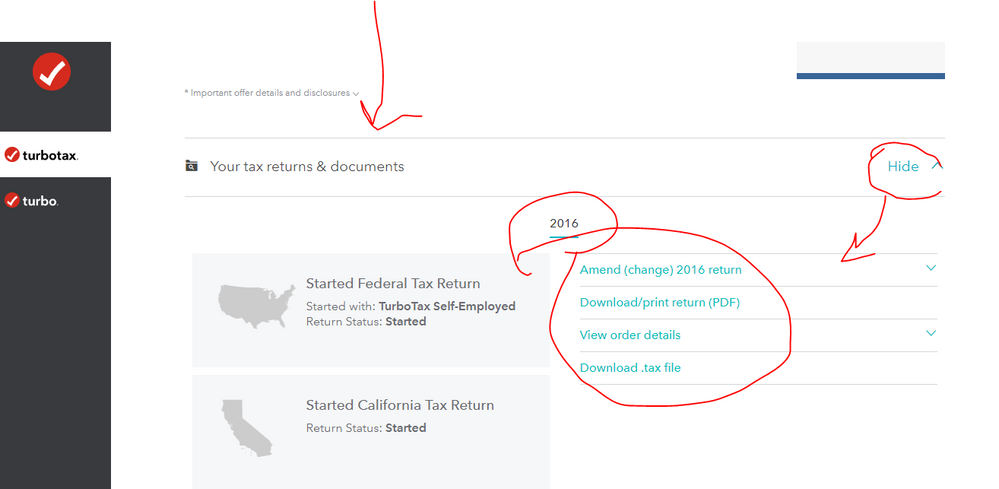

And if you used the TT registration program all you have to do is log back in and click on AMEND then follow the screen instructions. You can even save a PDF of the return you filed before you start ... log in ... scroll down ... pick the year ... choose the PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

You wrote: "Not sure what you are talking about ..."

This is true and correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

@Critter You're wasting your time on this thread.

here's the latest IRS Warning:

Do NOT use this tool if you will be filing a 2019 return. Using the tool instead of filing your 2019 return will slow down processing of your tax return and receiving any tax refund.

At this point the slow down is self-imposed by those waiting for some IRS action to turn them from "non-filers" into "filers".

I repeat my solution, file a paper return.

Write "Filed after using the IRS non-filers portal" plainly on the top of Form 1040.

IRS will figure it out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

You wrote:

"Do NOT use this tool if you will be filing a 2019 return. Using the tool instead of filing your 2019 return will slow down processing of your tax return and receiving any tax refund.

The facts:

This entire thread is to help those people who already made the error.

Reminding them to "not use the tool", after they already did, is.... is... is ? Pointless maybe?

You wrote:

"At this point the slow down is self-imposed by those waiting for some IRS action to turn them from "non-filers" into "filers"."

The facts:

Everybody here already acknowledges that the error is "self-imposed." Everyone here admits that they used the tool unnecessarily. I haven't seen anyone here claim that aliens threatened them with an **bleep**-probe, and forced them to use the non-filers tool against their will. People here are looking for a remedy to their mistake. They are seeking help and guidance.

Has shaming people for their mistakes, after-the-fact, ever worked effectively to help people, in your life experience?

You wrote:

"I repeat my solution, file a paper return.

Write "Filed after using the IRS non-filers portal" plainly on the top of Form 1040.

IRS will figure it out."

The facts:

HUH? This is a convenient historic re-write.

You have posted in this and other threads 8? 10? 12? times .... that "your solution" is to file a Form 1040X.

Not once... not ever... has "your solution" been to "write a note on the top of your 1040 and let the IRS figure it out." What the _____ are you talking about? (rhetorical) This has NEVER been your posted "solution"... until this moment just now.

It's probably the best remedy... and probably enough of a remedy to get the job done... but it's never been your position in this thread until just now.

Bah-bye

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

adriyana-allen2000

New Member

229hawk

New Member

229hawk

New Member

user17684639366

New Member

jannettj79

New Member