- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

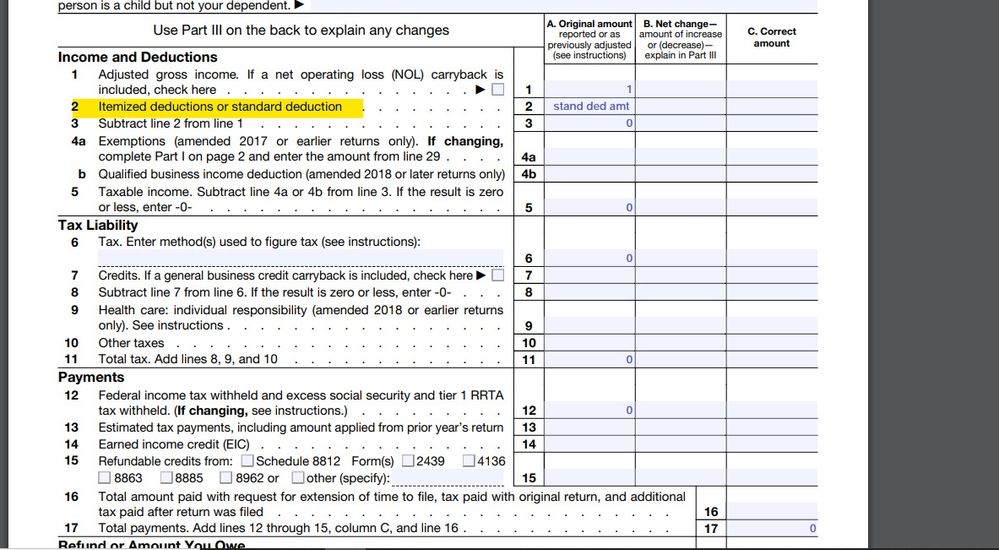

Not sure what you are talking about ... "NON FILER" is not a status of any kind ... on the form 1040X the column A must match what is on the original return and this is what it would look like ...

Column A should have the figures from the original return, Column C the corrected figures and Column B the differences between the other 2 which needs an explanation on page 2 of the form 1040X.

If you completed it correctly you will see an entry on either line 16 OR 18:

On line 16 should be the amount you paid with your original return.

On line 18 should be the amount of your original refund you received.

Then you will see your extra refund on line 22 OR the new balance due you need to pay on line 20.

May 7, 2020

2:35 PM