- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

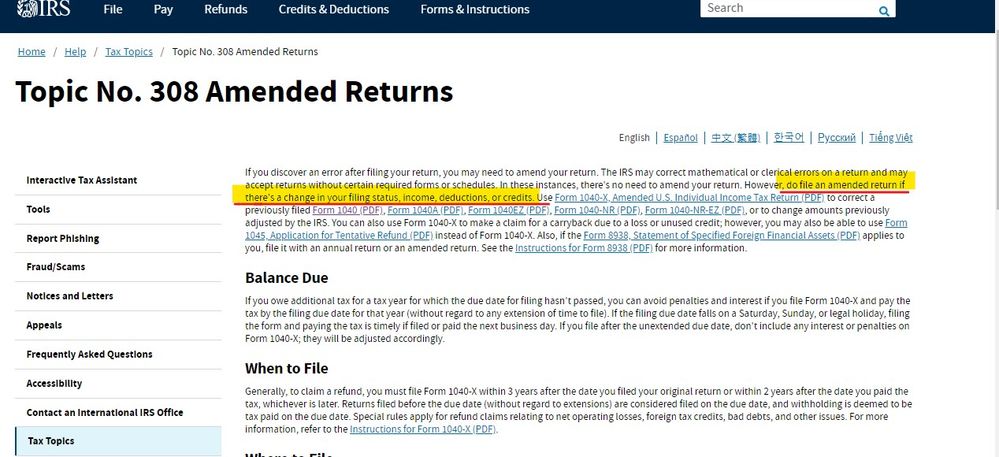

From the IRS : https://www.irs.gov/taxtopics/tc308

If you discover an error after filing your return, you may need to amend your return. The IRS may correct mathematical or clerical errors on a return and may accept returns without certain required forms or schedules. In these instances, there's no need to amend your return.

However, do file an amended return if there's a change in your filing status, income, deductions, or credits.

Don't forget that when you mail a paper return to the IRS, you must include copies of your W-2s and 1099s, plus you need to sign and date the return.

May 7, 2020

1:18 PM