- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Opening 2 TurboTax desktop applications simultaneously

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

I cannot open TurboTax 2023 Desktop & then open also TurboTax 2022 Desktop. I am able to do so in reverse, since TurboTax 2022 doesn't have yet the connection to a specific account. This tells me that by next year, I won't be able to open 2023 & 2024 simultaneously. Can you fix it in time for next year, testing that it works already for this year?

Why is this important? Every year, I open TurboTax desktop for the 2 recent years, and use my answers for last year in answering this year. If I can't open them simultaneously, there isn't a useful workaround. Opening the PDF only gives me the final result, but not useful for answering the questions. I can open the old one and take photos for questions one by one, but it would be extremely tough to compare this way. In addition, I often copy and paste between the TurboTaxes and that wouldn't work.

I hope that after reading this description, you will realize that it's a really big deal to keep allowing for a single user on a single computer to have multiple TurboTax desktops open.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Yours is the only post reporting this. I can open 2 years. Are you trying to open the program first or by clicking on the data file .tax2022 etc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

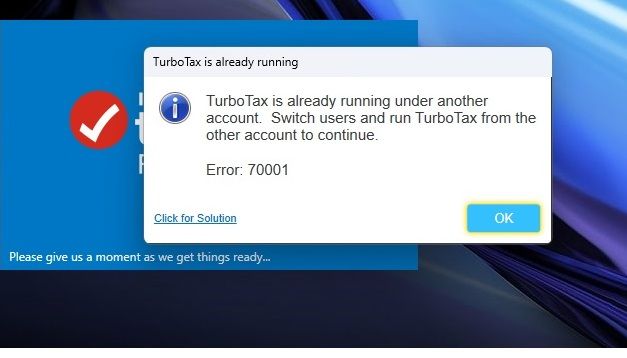

1. I opened the program "TurboTax 2023"

2. Then, the recent 2023 tax return within the program

3. Then "TurboTax 2022"

and it gave me the error disallowing opening 2022. I am not sure about this specific order, but that's my memory.

I just tried recreating it and couldn't - now I'm able to open both in either order. I know I am not imagining the error message, something about the account being used elsewhere, but can't recreate it now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Thanks for the quick reply. I tried to reply to you quickly, but now see that the reply doesn't show, so I'll try again.

I opened TurboTax 2023 using an icon, then TurboTax 2022, and it failed. In between the 2, I may have opened a tax return in 2023.

Thanks!

Gil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Yeah...it's something new I've been ignoring...but then I have two new Windows 11 Computers and didn't install 2023 on my older Windows 10.

1) Two different Windows 11 Computers, One a laptop and one a desktop All-in-one

2) Desktop 2020, 2021,2022, and 2023 Premier installed in both during January of 2024, and all work by themselves.

Symptoms:

3) If Premier 2023 is open, I can open 2022, but not 2020 or 2021 at the same time. (picture below).

4) IF Premier 2023 is shut down, I can open all 2022, 2021, 2020 to run at the same time.

5) If I open 2020, 2021, 2022 first and then open 2023, I can then run them all at the same time.

So opening 2023 Premier first seems to lock out the startup of two of the prior years for desktop Premier, at least in my setup.

I can live with it, but it is a bit strange.

________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Thanks SteamTrain for giving much more useful information than I did. I agree that we have an easy workaround right now - open 2023 last. But, I suspect that all new versions will have this issue given the tying of the software to an account. So opening 2024 & 2023 simultaneously may not work, no matter the order.

I really feel that this is a bug/limitation that has to be fixed. After paying for multiple versions of TurboTax, I would expect to be able to open any combination of them simultaneously. And this is not a random desire. It's a basic need of making sure I use the knowledge of prior years in the new year, and don't reinvent the wheel.

Can someone from Intuit confirm that you will fix this, hopefully soon, but definitely in time for next year?

Thanks!

Gil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Yep...would be great if they fixed by next year.

But...we do also have the option to just look at any of the prior year PDF files too.......which everyone should be creating after filing and acceptance.

One PDF as just the filing copy, and a second PDF with all the forms AND worksheets. Those PDFs can be opened at any time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Yes, comparing PDFs is some type of workaround without a fix, but far inferior to comparing answers to questions. It requires completing the questionnaire blindly, then seeing differences in the PDFs, and figuring out the source of the problem in the questionnaire.

If it's not fixed, my workaround may be creating a document with the questions and answers, by running through them again for the prior year. It's an unbelievable amount of work, but the most conservative way to do it. I would guess that fixing the restriction would take less time than a single taxpayer (out of millions) going through my process.

Thanks,

Gil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

I just wanted to pipe in and also say that having 2 sessions of TT open (current + past) is something I have been doing for 20+ years. And this is not an OS issue, it is clearly an Intuit issue. Yes, I can open PDF's and/or look at printed copies of stuff but why? Particularly as many times I am opening last years return to get info that is being asked for in this years return; be nice if this was also fixed as this has been a 'forever problem.'

Your words below are very accurate!

'ghanoch wrote:

I would expect to be able to open any combination of them simultaneously. And this is not a random desire. It's a basic need of making sure I use the knowledge of prior years in the new year, and don't reinvent the wheel.

Can someone from Intuit confirm that you will fix this, hopefully soon, but definitely in time for next year?'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Regarding this problem: Turbotax Premier Desktop. Can't open my 2022 software, while running my 2023 software. I own both and need both running simultaneously.

************************************************************************************

I agree with all of the messages above. This is a basic need and if we purchased the software every year, then we should be able to open one simultaneous previous year while working on the current year. pdf files definitely do not solve the problem. It is about being consistent in answering the interview questions without having to rethink each one every year. The workaround of opening last year's software first, works for now, but given the new account login requirement going forward... this is the last year that will work. I have been loyally using TurboTax for 30 years and respectfully request that this problem be fixed for next year.

***************************************************************

Ps. The following 2 automated solutions do not work...

***************************************************************

- Try restarting your computer and then opening both programs again.

- If that doesn't work, try opening the 2022 software first and then opening the 2023 software.

- If you're still having trouble, you may need to uninstall and reinstall the 2022 software.

Please note that it's not recommended to run multiple versions of TurboTax simultaneously, as it can cause conflicts and errors. If you need further assistance, please don't hesitate to contact TurboTax support.

1. Close all TurboTax windows that are currently open.

2. Open the 2022 program and sign in to your account.

3. Once the program is open, right-click on the TurboTax icon in your taskbar and select "TurboTax 2022" to open a new window.

4. Sign in to your account again in the new window.

5. Repeat steps 3-4 for the 2023 program.

This will allow you to have both programs open at the same time in separate windows.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

I use two computers. Or I also use my phone and a laptop. Copy the file on to the second computer and open it up. Mine is in Documents/TurboTax/Individual/2023. The file is a ".Tax2023" type.

"2023 lastname firstnameinitial Form [phone number removed]4 Individual Tax Return.Tax2023"

maestrowlf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

Dear maestrowlf, thank you for the suggestion, which I also thought of as a backup idea. However, using 2 computers would not facilitate copy and paste of certain complex descriptions from my last year's entries (other posts also mentioned the need to copy / paste ). It would be greatly appreciated if Intuit could fix this problem. Opening 2 versions of TurboTax simultaneously has worked for the past 30 years and there is no reason it shouldn't work now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

I'm chiming in to say that being able to have two years (at least) of TurboTax running at the same time on my computer is a huge issue for me as well. I have used TurboTax Home and Business (or some prior version) for over 20 years, ever since I opened my small business. I *always* open the past year while I'm working on the current year, for exactly the reasons people have identified above, and because it allows me to make sure I'm being consistent in how I answer and fill in the information from year to year. If I have already figured out how to answer questions, I do not want to be slowed down by having to figure it out again. Being able to check on details from prior years, and to cut and paste answers to questions. I don't have two computers, so that won't work for me.

I've perfected a system of doing my taxes over the past several years to make it go as smoothly as possible for me, and I need this. The PDFs don't lay out everything in the program in the way I need to see it done.

I hope that Intuit will fix this problem for next year and beyond.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

I am also running into this right now and am not happy. Any tax software I use, I need multiple years open at the same time to do the current year properly. This is fundamental tax preparation methodology. Having the final PDF from a prior year is inadequate and not a substitute for the software. Starting this year, having 2023 Home & Business open prevents the 2022 version from opening which is ridiculous. I paid for 2022 so I should be able to open the software however and whenever I want, regardless of what other programs are currently running, including those from Intuit.

Not allowing more than one year of TurboTax Desktop open at the same time is a serious flaw that I hope is fixed soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opening 2 TurboTax desktop applications simultaneously

@rob4226 Yeah, they need to get on that, and get it fixed.

But the workaround solution that has worked for most everyone, is to open the oldest software you "might" need to see first, and work your way forward to the 2023 year. Then don't shut any year down until you are sure you won't need it for your current session. (Takes up memory and resources...so it is far-far from an ideal situation).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

heritierchamona

New Member

m936tt

New Member

krafii

New Member

suill

Level 1

suill

Level 1