in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My state tax return went down when I added my stimulus payments. It is not taxable. I cant fi...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

Your state return gets updated with all information in your return when completing the "Federal Review". Your state refund changed due to all the entries made to that point in the interview. It is coincidentally, just after entering the stimulus payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

You are correct the stimulus payments are not taxable income since tax credits are not taxable. Be sure you are entering the stimulus payments only in the "Federal Review" interview section. Which state program are you working in?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

It was for Oregon. I did enter it in the federal review section. It was at the end where it asks if I received the stimulus and I input the amounts (I did enter the correct amounts) which then lowered my state return directly after I entered it. Just confused how it had affected that. It did not affect my federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

Your state return gets updated with all information in your return when completing the "Federal Review". Your state refund changed due to all the entries made to that point in the interview. It is coincidentally, just after entering the stimulus payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

More Info for Oregon:

Oregon allows an OR income deduction for the Federal tax liability. Certain Federal tax credits are either allowed, or are not allowed to be used to adjust that Federal tax liability total that is eventually used to reduce OR taxable income.

From what I gather by reading their actual instructions, Oregon does use the Federal stimulus payment you get, as reducing the Federal tax liability...thus a smaller OR income deduction (and more OR tax) when you enter the stimulus payments in the Federal section.

_______________________________________

The calculations that TTX "supposedly" uses are on pages 65 and 66 of the OR instructions...a series of calculations under "Federal tax worksheet" in the rt-column on page 65 and continuing to page 66. Step #8 in that series of calculations uses your stimulus payment to reduce the eventual (adjusted) Federal tax liability that OR allows you to deduct from OR income :

https://www.oregon.gov/dor/forms/FormsPubs/publication-or-17_101-431_2020.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

I am from Texas and my taxes did the exact same thing...crazy..I went from getting $649 back to owing $2,000...crazy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My state tax return went down when I added my stimulus payments. It is not taxable. I cant figure out why this happened. Is this a bug?

You are absolutely correct. Stimulus payments are not taxable. They are not part of the calculation to determine Federal or State taxes. The recovery rebate tax credit and stimulus checks are two parts of the same thing. The way the law is written, both the first ($1,200) and second ($600) stimulus checks were simply advance payments of the credit. So, if the combined total of your two stimulus checks (i.e., advance payments) is less than the recovery rebate credit amount, you may be able to get the difference back on your 2020 tax return in the form of a larger tax refund or a lower tax bill. If your stimulus checks exceeded the amount of the credit, you don't have to repay the difference.

To check why your refund changed to an arrear

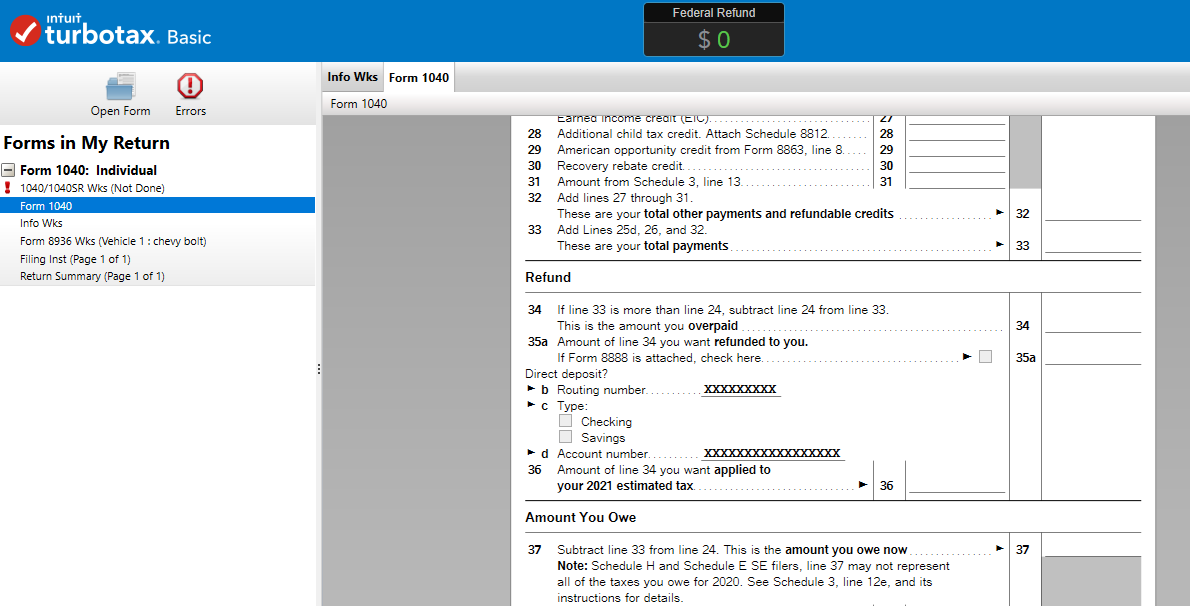

- Navigate over to Forms View and look at your 1040, line 30. This is where you can see the recovery rebate credit.

- Then check the Refund and Amount You Owe fields to see what the software has calculated. These are boxes 34-37.

Here is a screenshot:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dliotta

Level 1

waynelandry1

Returning Member

rodiy2k21

Returning Member

pchicke

Returning Member

CWP2023

Level 1