- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You are absolutely correct. Stimulus payments are not taxable. They are not part of the calculation to determine Federal or State taxes. The recovery rebate tax credit and stimulus checks are two parts of the same thing. The way the law is written, both the first ($1,200) and second ($600) stimulus checks were simply advance payments of the credit. So, if the combined total of your two stimulus checks (i.e., advance payments) is less than the recovery rebate credit amount, you may be able to get the difference back on your 2020 tax return in the form of a larger tax refund or a lower tax bill. If your stimulus checks exceeded the amount of the credit, you don't have to repay the difference.

To check why your refund changed to an arrear

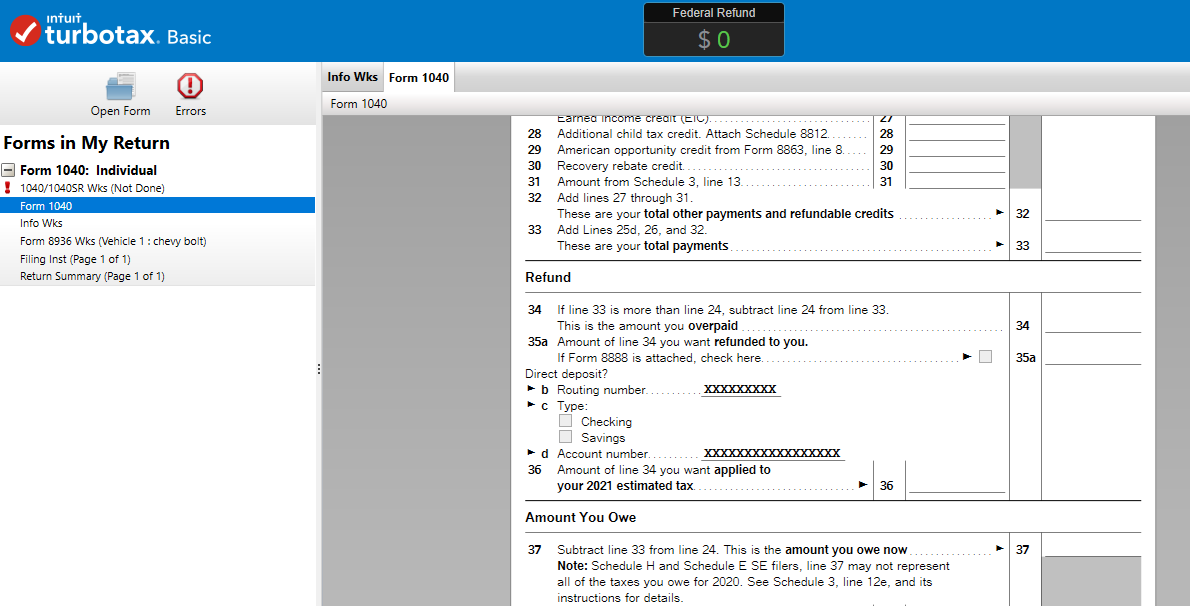

- Navigate over to Forms View and look at your 1040, line 30. This is where you can see the recovery rebate credit.

- Then check the Refund and Amount You Owe fields to see what the software has calculated. These are boxes 34-37.

Here is a screenshot: