- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My estimated tax refund for next year is $10.000 same numbers used as this year and I only re...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

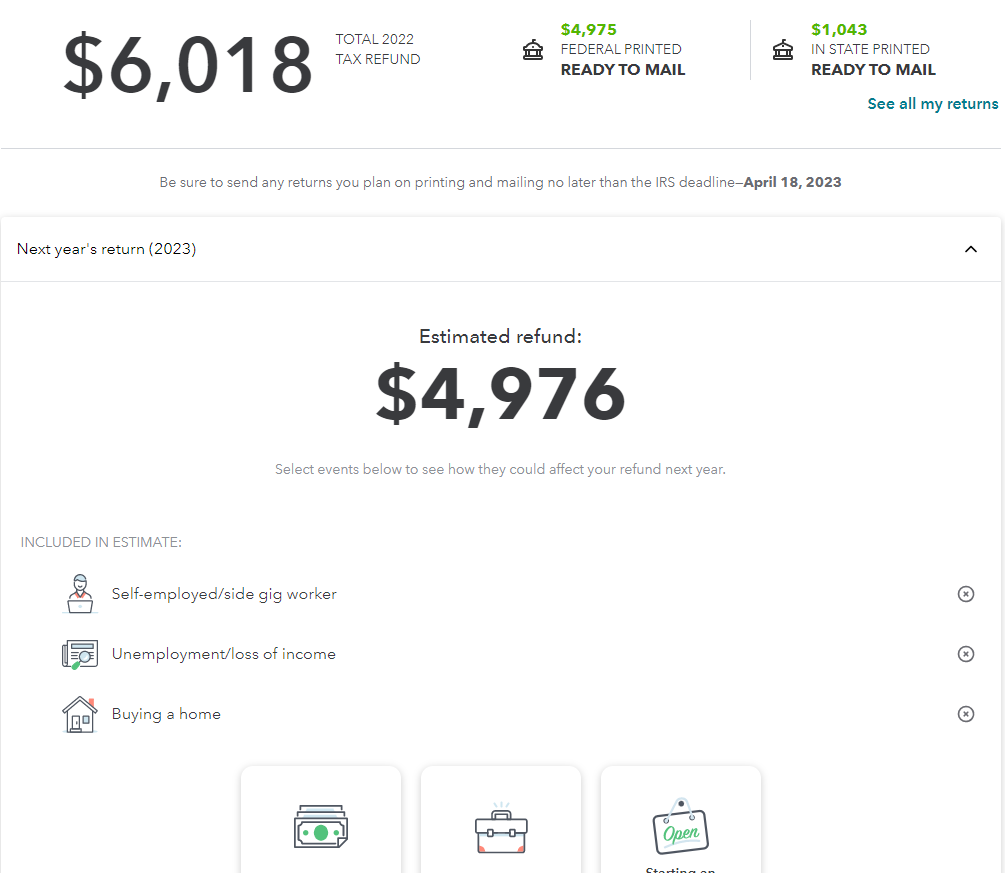

My estimated tax refund for next year is $10.000 same numbers used as this year and I only recieved 6000 ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My estimated tax refund for next year is $10.000 same numbers used as this year and I only recieved 6000 ?

Estimates are based on the numbers you enter and the number of dependents you have entered on your return and the changes you say will or will not happen.

If you, for instance, enter that you will have $15,000 withheld and end up only have $10,000 withheld, then you will end up getting less in a refund. If you say you will make $38,000 and you have 3 kids but end up making $60,000, the calculation of EIC would be totally different.

Estimates are only as good as the data and assumptions entered. If your taxes are simple, you can always use your tax rates throughout the year to compare what you are having withheld vs what you are liable for to see what your refund or amount due should end up being.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My estimated tax refund for next year is $10.000 same numbers used as this year and I only recieved 6000 ?

Yes I do know, and understand that. That is not what I'm asking. Turbo tax has posted on my home page that they have have estimated my tax refund for "next" year to be over $10,000. It shows that they have estimated this amount using the same income, dependents, etc. that I used this year to do my taxes. But this year my tax refund amount came out to be over $6,000. Did I miss something possibly? Why or how did they get that amount for next year with the same input of numbers that I used thisbyear and I am receiving half of that amount this year? What did I do wromg.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My estimated tax refund for next year is $10.000 same numbers used as this year and I only recieved 6000 ?

I would not presume that you made an error.

The estimated tax refund tool allows you to select life events and see how those changes will change your tax return from 2022 to 2023.

The difference that you are seeing is likely:

- a difference in tax rates, and

- the presumptions that are built into the life events that you may click at the bottom of the page.

Click the life events to see what presumptions are built into the calculations for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ronscott2003

New Member

pivotresidential

New Member

sakilee0209

Level 2

douglasjia

Level 3

johntheretiree

Level 2