- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: MN property tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

I filed MN state tax and when I entered Property tax statement I was told I am will not get refund on my property tax

I checked on instruction for filing form M1PR and it looks to me I am eligible for refund?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

It depends. When you entered your property tax statement, what was the reason given for disqualification for a refund?

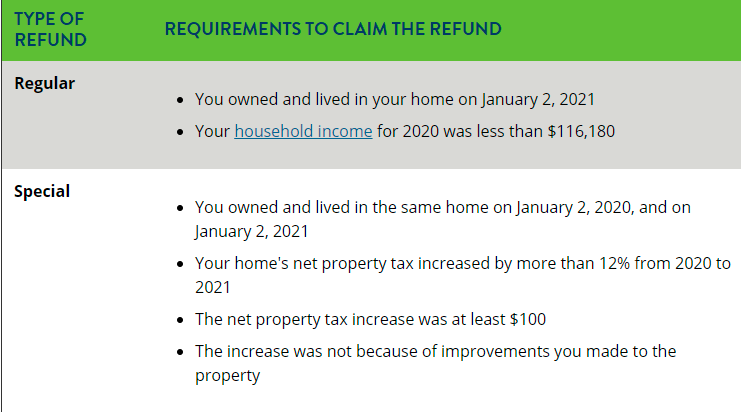

There are two types of Homestead Credit Refund:

- Regular - based on your income and property taxes

- Special - based on how much your property tax increased

You may qualify for either or both of these refund. I have attached the requirements below for each type of refund.

If you believe you are eligible based on the requirements listed above, then you can amend your return to revisit this area in TurboTax or file this form online through the State of Minnesota. Please see Online Services to file your M1PR.

You can use this service if you:

- Owned a home in Minnesota

- Are filing an original Property Tax Refund return

- Are filing a refund for 2019 or later

- Did not rent out your home

- Did not use your home for business

You can also file this return with a paper form. Please see Filing for a Property Tax Refund for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

I can get REGULAR Property tax only.

How I can filed thru Turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

My state tax are pending on turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

I just got email that my state tax are accepted

Now I need to file MN property tax instead of Turbo tax did it as I paid for it.

I thing I should get credit on my payment for services

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

If you paid for TurboTax to prepare your Minnesota M1PR and you prepared the form, the return can be found in your TurboTax software. This TurboTax Help states:

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form which you can print and mail.

As you're preparing your Minnesota taxes, look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics).

Check the first box and follow the onscreen instructions.

After the State Elections Campaign Fund and Nongame Wildlife Fund screens, you'll come to the Filing instructions screen. Select Print Form M1PR and mail the printout by August 15 to:

Minnesota Property Tax Refund

St. Paul, MN 55145-0020

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

Seems to be a glitch in the software for filling out the Minnesota Property tax refund form. It skips right over the regular refund and only asks about the special refund. You have to go to the form within TurboTax and fill it out manually. This also requires you to go to the Minnesota Revenue website to look up the tables for the numbers you need to enter. Very annoying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

The MN property tax refund should autofill once you select the type of property, 1a is a residential homestead. To get there continue through the state until you arrive at the Other Forms You May Need screen. Confirm the Property Tax Refund (Form M1PR) box is checked, then continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

It was confusing and now I have to filed an amended form! Very annoying and frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

Please see this Turbo Tax FAQ on when to amend.

https://ttlc.intuit.com/community/amending/help/do-i-need-to-amend/00/27607

Can I file my M1PR (Minnesota Property Tax Refund) through TurboTax?

https://ttlc.intuit.com/community/filing-and-paying-taxes/help/can-i-file-my-m1pr-minnesota-property...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN property tax refund

I was very satisfied with my federal & state tax preparation BUT disappointed that the software would not correctly compute the MN Property Tax Refund. Since I did not qualify for the "Special Refund" it said I did not qualify for a Property Tax Refund at all. I have done this form for years & I know for a fact that this is WRONG. Further, I see when I Google the question that this has been a problem in years past & has gone unfixed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noodles8843

New Member

Kiwi

Returning Member

tlathram

New Member

josephmarcieadam

Level 2

unlimited_reality_designs

New Member