- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It depends. When you entered your property tax statement, what was the reason given for disqualification for a refund?

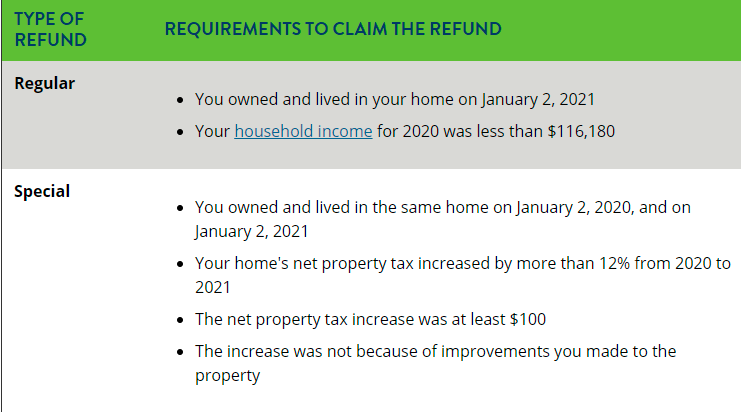

There are two types of Homestead Credit Refund:

- Regular - based on your income and property taxes

- Special - based on how much your property tax increased

You may qualify for either or both of these refund. I have attached the requirements below for each type of refund.

If you believe you are eligible based on the requirements listed above, then you can amend your return to revisit this area in TurboTax or file this form online through the State of Minnesota. Please see Online Services to file your M1PR.

You can use this service if you:

- Owned a home in Minnesota

- Are filing an original Property Tax Refund return

- Are filing a refund for 2019 or later

- Did not rent out your home

- Did not use your home for business

You can also file this return with a paper form. Please see Filing for a Property Tax Refund for more information.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 31, 2021

11:00 AM