- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

My family situation: Married Filing Jointly, 1 dependent (born 2019, so on the full year 2020)

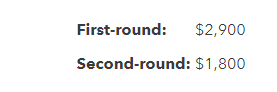

When I entered in the amount of stimulus my family received in 2020, I put in the following information

First-round: $2,900

Second-round: $1,800

(screenshot from today)

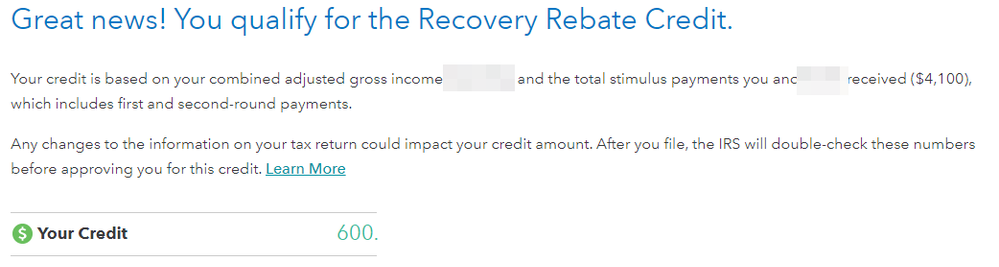

After clicking "Continue" I see the following message:

Note that TurboTax says I received $4,100 in payments, thus giving me a credit of $600. Simply adding my first and second round payments, though, gives me $4,700 in payments (which would result correctly in no credits). There is clearly something wrong with the calculation of this credit; my question is what is TurboTax going to do to make this right? My refund (which luckily I still get a refund instead of an unexpected tax bill) has been in limbo for 4 months (and counting) because of this calculation issue. At the very least I'd like to request a refund of my filing fee for the delay and inconvenience this has caused me and I'm sure countless others.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

This is a user community forum and not a direct link to TurboTax support.

You will have to contact TurboTax support for this issue.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or -

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

Or -

On every TurboTax web page, including this one, scroll down to the bottom of the page and click on Contact Us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

With respect, this is an issue that the community should be aware of as it likely affects more users than just me. I have already talked to someone in support about this, but will try again to see if there is anything further which can be done, but the reason for the post still stands and it may help someone who finds themselves in the same boat as me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

This happened to me as well. I filed on 5/2/21 and I just received a letter from the IRS saying I owed $500 instead of receiving an $1800 refund like Turbo Tax said. The reason said it was due to "Recovery Rebate Credit"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

I just finished my joint return and was happy to be getting a refund due to the recovery rebate credit.

I sent it off to the IRS but this morning, woke up thinking something was wrong.

We received the full stimulus amount in 2020 but $0 in 2021.

Turbotax said our recovery rebate credit was $1,400 which I accepted as being correct and I e-filed yesterday.

This morning, I decided to try the TaxSlayer online system just to see.

TaxSlayer calculated it at $2,800 ($1,400 EACH).

Now, I have to contact TurboTax to find out why this happened and suspect that I will have to send an amended return (which I cannot do until mid March because the 1040x is not available yet) which by the way, with the way the IRS is operating, will mean our higher refund amount will likely sit in a queue somewhere.

If I don't get a satisfactory response (incl a refund of the fees paid to Turbotax), next year might be a year to try TaxSlayer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

You and your spouse would be eligible for $1,400 each from the stimulus payment if you both were U.S. citizens with valid social security numbers and neither of you was claimed as a dependent on someone else's return. You also would not get the full amount if your combined income was above $150,000.

If it does not sound like any of the requirements would affect you or reduce your stimulus payment, an amount may have been inadvertently entered on your return. If you review your Form 1040, the amount of stimulus you are receiving will be on Line 30 Recovery rebate credit.

If that amount is incorrect, you can look at the Recovery Rebate Credit Worksheet to determine the source of the error. Line 12 should be $2,800 for your situation and Line 13 should be $0. If Line 12 is incorrect, that means either you or your spouse did not have valid social security numbers. If either of you has an ITIN that begins with a 9, that person would not be eligible for the third stimulus payment.

If Line 13 is incorrect, that means you entered that you already received some amount for your stimulus back when they issued the payments in March through May of 2021. If you did receive any stimulus, the IRS should have sent you Letter 6475 which says the amount of payment you received.

If the amount of stimulus you claim to have received does not match the IRS's records, then they may automatically adjust your refund to match their records. In that case, no amended return would be necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

Hello and thanks for the quick reply.

Line 30 shows $1,400 but as I am using the online version, it seems that I am unable to view the worksheets.

Download/Print does not give the option for worksheets and none are in the resulting PDF.

To answer your other questions, we are < $150k and both of us have valid social security numbers.

Of course it is possible that I entered the wrong numbers but I don't think I did because I recall entering that we received $0 in 2021. And because the return was e-filed, I can't even go back and look at my entries.

I tried to use the "amend" option but TT says that won't be available until mid March.

So, I think I am going to have to wait until then and look to amend the return.

At that time, I can double check everything I entered and correct as needed.

As you noted, it is also possible that the IRS will "fix" this without me amending the return.

In truth, I don't even know why I even have to file a return. The IRS already knows everything about me from documents sent to them (eg 1099-INT, 1099-DIV, 1099-B, etc) and it's very hard to beat the standard deduction.

Best Regards...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

@robbyja You should be able to view/print/download your complete tax return including worksheets using this procedure -

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2021 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

Just wait and see what the IRS does. They should automatically adjust Line 30. It will delay your return.

How to get a copy after filing

How to download all forms and worksheets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

Thanks for the tip to "add a state."

Doing so allowed me to get into the print center where I was able to choose all of the worksheets.

With the worksheet, I was able to follow the worksheet and see this was my error.

TT added $1,400 for a dependent (our son) but I answered the question about how much we received incorrectly thinking it was just my wife and I.

LY, our son filed as an independent (and received all of his stimulus) but this year was back on our return because he went back to school full time and wasn't working.

As he has already received his $1,400 stimulus (March 2021), I should have entered $4,200 total received for all 3 of us combined which would have made line 30 $0 (no credit due).

I suspect the IRS will catch this but if they don't, I will file an amended return and repay them.

Thank you for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

All good. Thanks for the assistance.

This experience renewed my faith in TT!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

No you only enter what you yourself actually got. Not what he got. You can get his now again.

If you are claiming them this year then you DO get it now. It is really based on 2021. And they don't have to pay theirs back. The IRS just used 2020 returns to send the checks out fast.

See Question 15 here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

Wow. Didn't know that. Seems weird (like a double payment) but OK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Miscalculation of 2020 Recovery Rebate Credit - TurboTax Make it Right

Just received a letter from the IRS saying that I miss-calculated this item after using Turbo Tax for my 2020 taxes. Very frustrated that I put in my data correctly, paid $200+ to Intuit for filing and then get a letter from the IRS that I underpaid. I would suspect that many others are receiving letters due to this error.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sebastiengrrr

New Member

overdrive31

Level 1

edmarqu

Level 2

LLCHERMOSA

New Member

SethSev

Level 2