- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: IT-558, A-011

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

Trying to finish my taxes and this form came up for New York State. The federal side already has 10,200 filled in. What value am I suppose to put in for New York? I made over 10,200 in unemployment so am I supposed to just use that value? Please help this is the last step before I can submit my taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

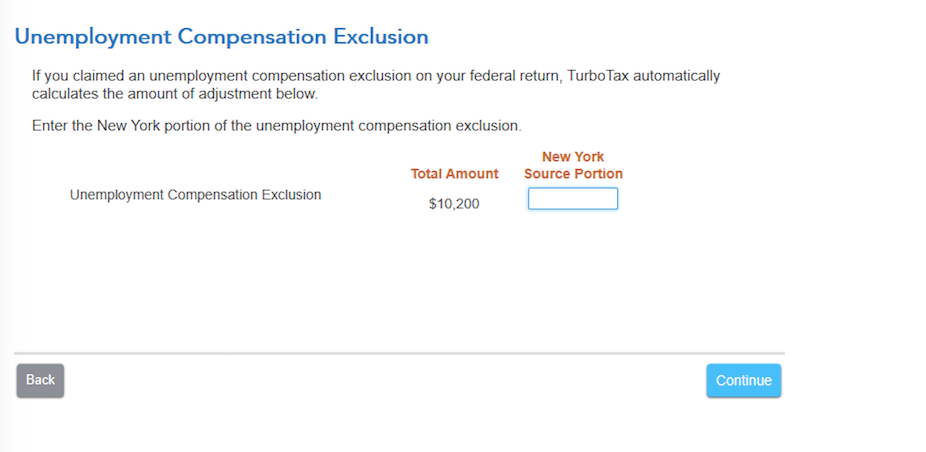

You would enter $10,200 on your IT-558.

Form IT-558 is new NYS form which adjusts your federal adjusted gross income. Certain items this year are being added back and subtracted from your federal adjusted gross income. It is similar to previous year Form IT-225, except that it includes items that cover the CARES Act and the American Rescue Plan.

Since only $10,200 of your unemployment was deducted from your federal adjusted gross income, then that is the amount that must be added back for your New York return on Form IT-558. NYS has decided not to waive taxes on state unemployment benefits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

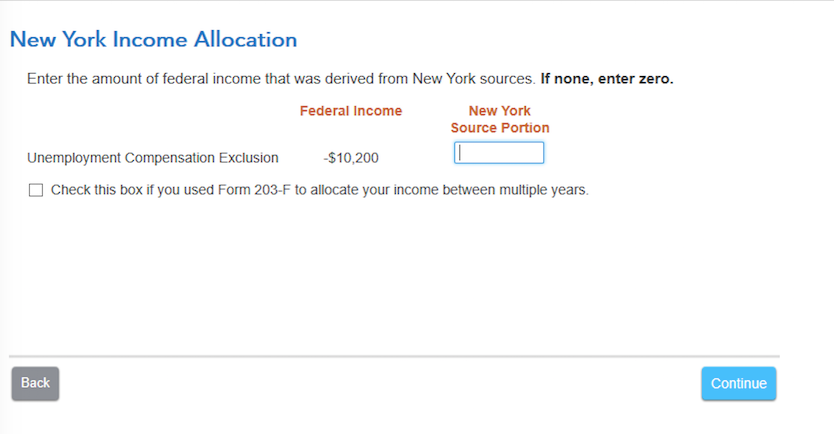

Having the same problem, but finding the turbotax update to be a bit confusing. I've already completed the federal portion of my taxes. I'm a NJ resident but made over 10,200 in unemployment from NY.

When I start filling out the NY portion, it asks for the NY source portion for the federal income allocation. Should I be putting a -10,200 here or a +10,200...or 0? Because then a few pages later, it asks almost the exact same question, which I'm assuming its this second question that add back the 10,200 into my state taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

I’m having the same issue. I entered 10,200 for the first question and then 10,200 for the second question again. It made the amount I owe NY increase by about $900 which makes no sense to me. Would be nice to have this streamlined a bit or some help figuring it out. Thankfully I haven’t submitted them yet so there’s still time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

So I did what you said but then a second question comes up after that asking almost the exact same thing. Unsure what to do I entered 10,200 again and the amount I owe NY increased by $900. I feel like there shouldn’t be any increase since nothings changing for them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

Same here. Thank goodness for the May 17th extension. But turbotax should still give guidance on what to do here. I did the same thing of putting 10,200 for both questions which raised my NY tax due to 900. Yes, the tax credit increased my federal refund about 1,000 but if I have to pay it all back in NY taxes, I fail to see the point of the credit at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

I still haven't filed, just waiting to resolve this one last issue. Going to wait a couple of more days to see if there are any answers. @clm11160, have you learned anything new? I'm also trying to search other threads about this topic and seems like other people have been having the same problem, but the answers from the tax experts are still a bit confusing.

This thread below is the closest answer I found, but still can't make a lot of sense of what to do.

Maybe its just putting 0 for the first question and then 10,200 for the second?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

@Norm85 I may have figured it out. So I viewed my NY state return to take a look at it and found that putting 10,200 for both was incorrect. This added an additional 10,200 to my NY taxable income. When I looked at my NY W-2 I now had my NY taxable income, Unemployment from NY, and now an additional 10,200.

So I went back and decided to put 0 in for NY for whichever question corresponded with the negative federal amount -10,200. I kept the 10,200 for whichever question had the positive 10,200. I then saved the new entry for my NY W-2 and went back to take a look at it now that it was updated. The NY W-2 now had only my NY taxable income and my NY unemployment. The additional 10,200 was no longer there and now said 0. This added value (which is now 0) was also right next the -10,200 on the federal side which I read as...Federal was forgiving -10,200 and NY was forgiving 0. Which I believe is the answer we're looking for...hopefully.

Haven't been able to submit my taxes yet because IRS is rejecting my return because of my previous year's AGI. Gonna try and just set my AGI to 0 and resubmit this weekend but that's a whole different issue. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IT-558, A-011

Please follow the instructions and screenshots for the NYS unemployment add-back here.

If your return is getting rejected for your prior year adjusted gross income (AGI), please follow the instructions on the page What if I entered the correct AGI and I’m still getting an e-file reject?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

david-stachurski

New Member

srpagnotta

Level 1

suect1987

Level 3

mikiandmark

New Member