- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I sold a primary residence that includes a rental. How do I get the passive activity loss rel...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

I had a primary residence in California that included a room that I rented out. I sold the home in TY2023. I'm reporting capital gains correctly in TurboTax. My tax accountant advises me that I can report passive activity loss on Schedule E via Form 8582. However, I'm not seeing a way to report this loss in TurboTax.

Any suggestions? TIA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

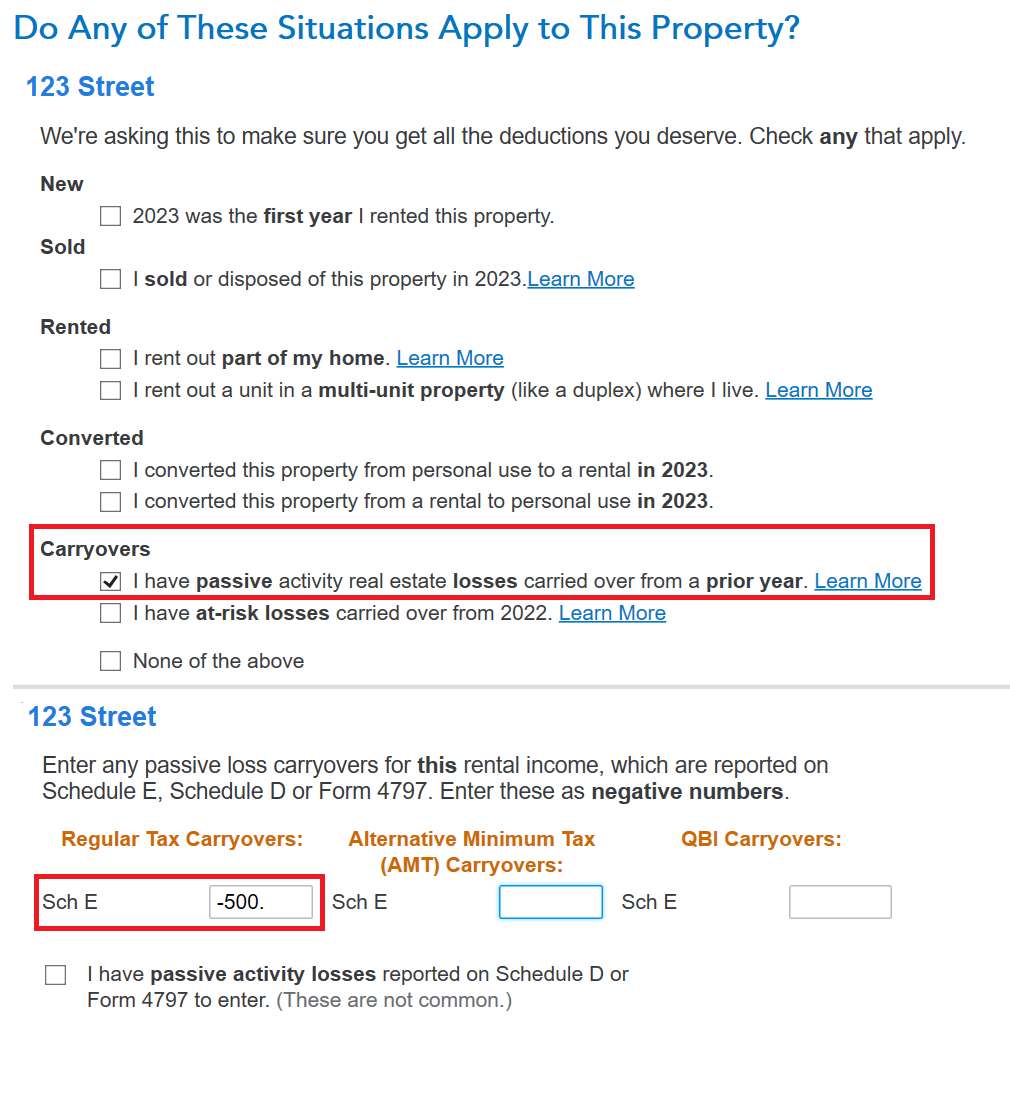

Let's approach it another way.

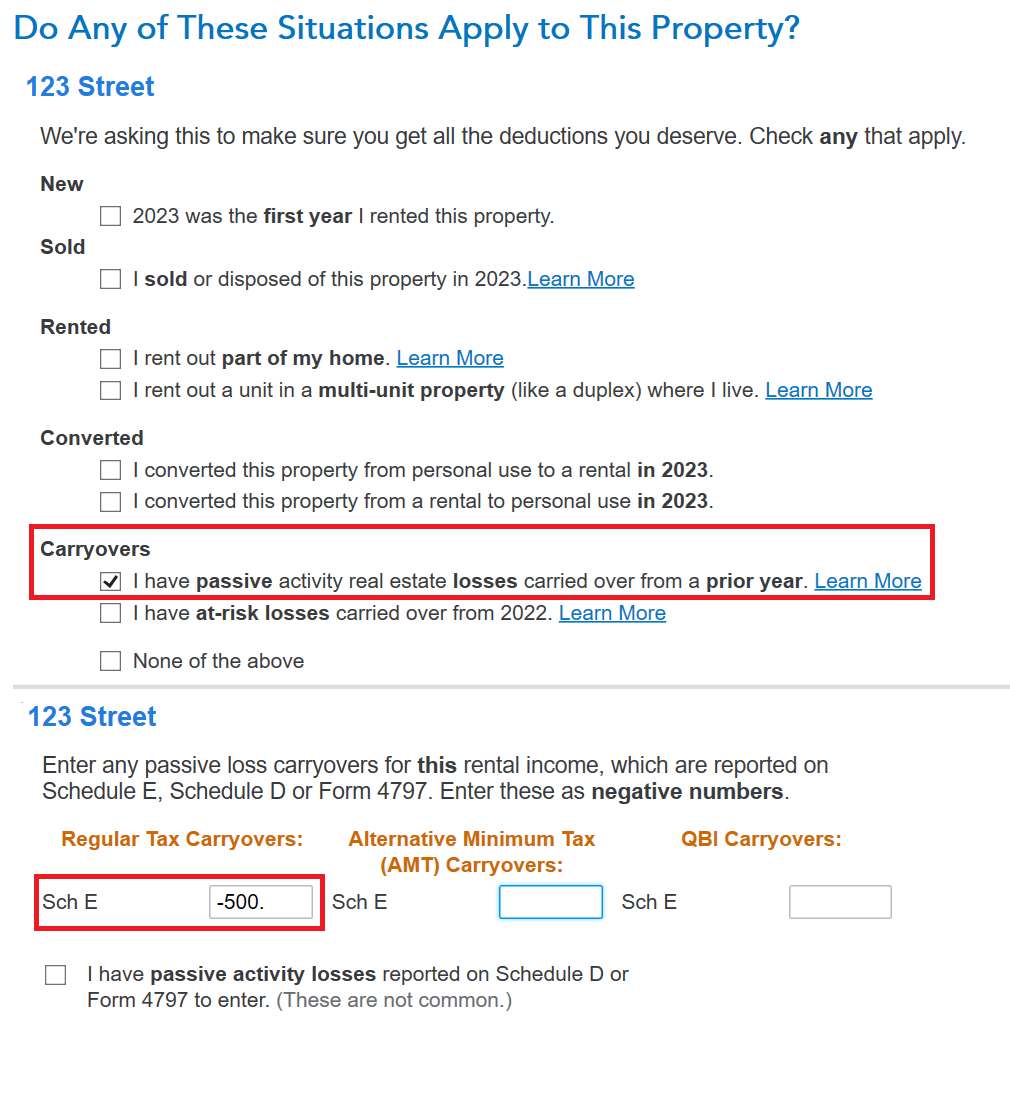

- Go to Income and scroll to Rental Properties and Royalties > Edit beside your property > Select Update beside Property Profile

- Continue until your reach the screen 'Do any of these Situations Apply...?'

- Check the box next to 'I have passive activity real estate losses carried over from a prior year'

- View the image below. It will look slightly different because it's not a Mac,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

You will first need to enter the rental property into TurboTax. And then enter that it has been sold. You will need to enter all the prior depreciation in order to calculate your gain or loss.

Then follow the steps listed here in order to enter your prior year passive losses which are triggered by this sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Thanks @RobertB4444 - I appreciate you taking the time.

I have entered all the sale information, prior depreciation, and this years rental information for TY2023. However, when I try to follow the instructions in the linked message (editing the rental information), I don't see the "Do any of these situations apply to this property" or "I have passive activity real estate losses carried over from a prior year" dialogs. I think I saw them earlier, but I can't find any way to get back to them. I also can't find the worksheets shown in the screenshots. Parenthetically, this is one thing I find extremely frustrating in TurboTax: the difficulty in finding screens and information I've entered earlier.

Nonetheless, the attachments gave me some ideas for worksheets to check. I'll try entering the passive losses there and see if I can get them to flow correctly to Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Specifically, Turbo Tax throws me into a loop:

- Your Property Assets Screen

- Clicked Edit, clicked through too ...

- Special Handling Required?

- Select Yes if any of the following ...

This asset was a rental ... within a home.

Clicked Yes. - Depreciation amount deducted screen.

- Clicked Continue.

- Back to Property Assets Screen.

There's no opportunity here to enter passive activity loss.

If anyone can show me how and where to do that in TT, I'd be most grateful -- TIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Yes. The following instruction should help you with the location to enter your carryover loss. You must go into the rental property income section first, then follow the steps to enter your carryover loss.

- Any passive activity loss (PAL) carryforwards allowed would be listed on your Form 8582, Worksheet 5 or 6, in your 2022 tax return as 'unallowed loss'. If you have a PAL and it does not seem to be populated in your 2023 tax return you can take the following steps to enter it.

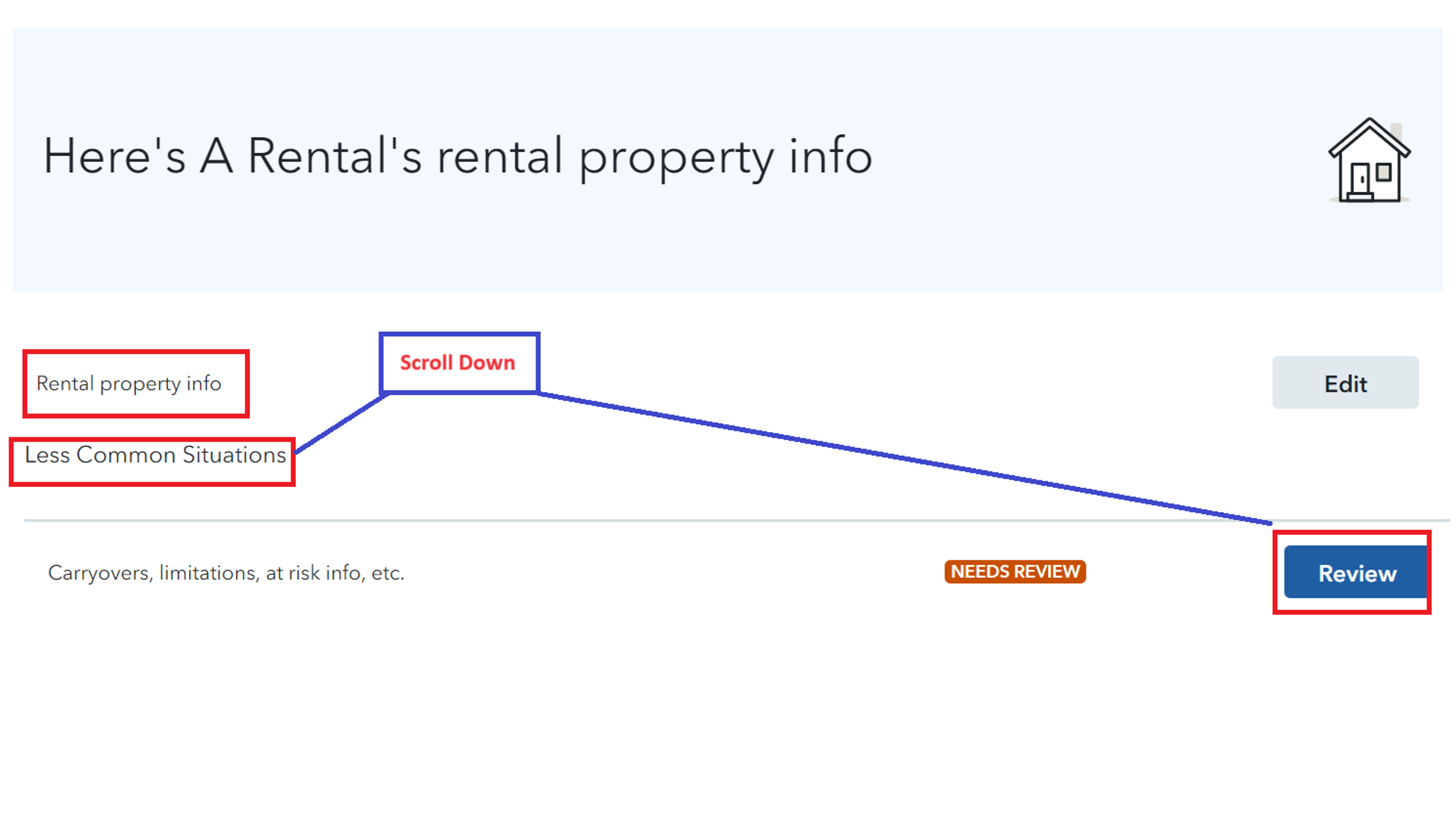

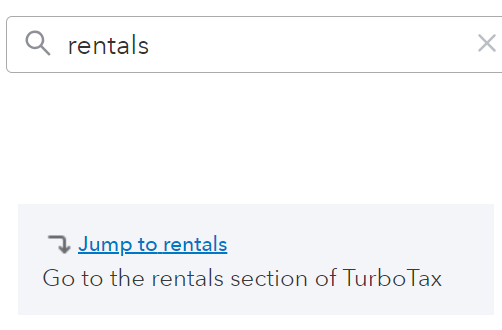

- Use the magnifying glass to Search (upper right) > Type rentals > Jump to Rentals > Select Edit beside your Rental Activity > Under Less Common Situations > Review Carryovers, limitations, at risk info, etc. > Continue to enter your passive loss carryover. See the image below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

@DianeW777 Thanks very much for replying - I appreciate your willingness to help!

First part is good: I have PAL on my 2022 return, it's not carried forward to 2023. I *think* this is what I need.

The search instructions don't work for me. I click Search and type rentals and get a series of unrelated help articles. I get nothing like the results you showed.

I have TurboTax Deluxe installed on a MacPro. Are perhaps your instructions oriented towards online users? I don't see anything like "Jump to" from Search or anything on the menu bar.

Suggestions very welcome - TIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

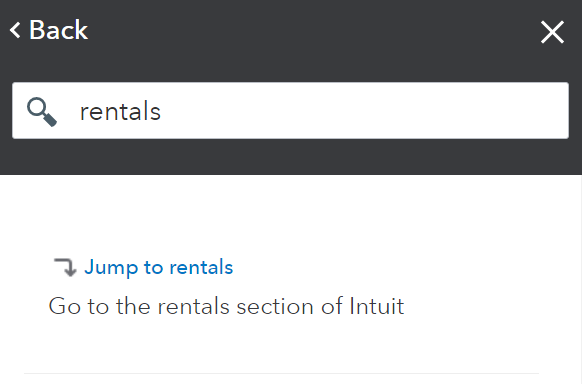

it's important to make sure you are in the federal section of the return, Wages & Income before you do the search. See the images below.

- TurboTax Online

- TurboTax Desktop

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

@DianeW777 Here's what's the TT screen is showing - I'm not seeing anything like Jump to in the Search results. Am I missing something totally obvious? TIA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Let's approach it another way.

- Go to Income and scroll to Rental Properties and Royalties > Edit beside your property > Select Update beside Property Profile

- Continue until your reach the screen 'Do any of these Situations Apply...?'

- Check the box next to 'I have passive activity real estate losses carried over from a prior year'

- View the image below. It will look slightly different because it's not a Mac,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Thank you, @DianeW777 -- that worked. I was not seeing the carryover checkboxes earlier, but that could well have been brain fade on my part. Schedule E line 22 is now populating and my tax is reduced. Good so far.

However, line 22 says "Deductible rental real estate loss after limitation, if any, on Form 8582", but Form 8582 lines 2a-d are blank. So it looks like TT is bypassing 8582, which I think I need to file, correct?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Yes, it should be filed with your return if you meet these conditions:

- Form 8582 is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). However, you don’t have to file Form 8582 if you meet the following exception.

- You have no prior year unallowed losses from these (or any other passive) activities.

Double check to see if the 8582 actually is with your file. The information may be on worksheets. Make sure to 'Review' your return first and check again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a primary residence that includes a rental. How do I get the passive activity loss release?

Thanks again @DianeW777.

I do have prior year unallowed losses, so I believe I will need to attach 8582, but it's currently blank.

Nonetheless, I think I've resolved my basic issue here, so I'll just wait for a few more updates from TT to see if they resolve this issue (some other forms I need still aren't ready).

Best regards -- MF

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

M_S2010

Level 1

Taxfused

New Member

Taxfused

New Member

droidboye

New Member

sgk00a

Level 1