- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Schedule SE is prepared automatically when you indicate that you had income that is subject to self-employment tax. This will usually be accompanied by a schedule C for a small business. Your net profit from your small business or independent contractor status flows to form 1040 where is combined with your other income and subject income tax, and the net profit from self-employment also flows to schedule SE to calculate self-employment tax.

It sounds like you had income from a 1099-MISC or a 1099-NEC and did not report it as self-employment income. You may need to file an amended tax return to report the income as self-employment but first, you must determine if the IRS is correct. Did you receive income on a 1099 and was it from a hobby or a business?

If the income was from a hobby, you don’t need to pay self-employment tax, but you may need to send an IRS a letter to convince them that this was a hobby rather than a business. If this was from a business, then you do owe self-employment tax, but, if you file a schedule C, you will be able to deduct your business expenses against the income. That would reduce the amount of self-employment tax that you owe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Hi,

Thanks for the response. This is all in regards to Tax Year 2019. Some employers did not send me a 1099 so I had to calculate it myself and file it as "Other Income". For one of income I forgot to add an amount so I filed an Amended Return. I also attached a Schedule C with the amended return since this was through my business.

Now, yesterday I received a letter from IRS saying that "We have received your amended income tax return Form 1040X but we don't have all the information we need to process it".

- Complete Schedule SE to support the changes you made with your amended return.

So, now I need to find out how to access Schedule SE form. Is there anyway I can access this form in Turbo Tax.

PS: If I log onto the IRS website I can see that I do not owe any balance apart from the late payment. I have already paid that balance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Is there a way to download Schedule SE form from Turbo Tax? In IRS Letter they are asking me to submit Schedule SE form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

@azamsharp wrote:

Is there a way to download Schedule SE form from Turbo Tax? In IRS Letter they are asking me to submit Schedule SE form.

If you prepared an amended return in any software and included a schedule C, you would also have included a schedule SE automatically. So I'm guessing you did this by hand and didn't follow the proper instructions?

Your Schedule C net income must be reported on schedule SE. This will calculate your self-employment tax. You can download schedule SE for 2019 from the IRS web site

https://www.irs.gov/forms-pubs/prior-year

However, adding self-employment tax calculated from schedule SE will also change your form 1040 and your form 1040-X, and you will need to send the IRS a check for the SE tax you owe. Expect the IRS to send you a bill for late payment fees and interest that will add up to about 1% per month. If you have never owed penalties before, you can request a first-time penalty abatement once you get the bill.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Hi,

I used Turbo Tax to prepare my amended return and it only created Schedule C form which I sent to IRS. I have already paid IRS the amount I owed $618. They have deducted the amount back in March 2021 (confirmed from my bank statements and even the IRS activity log on their website).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Hi,

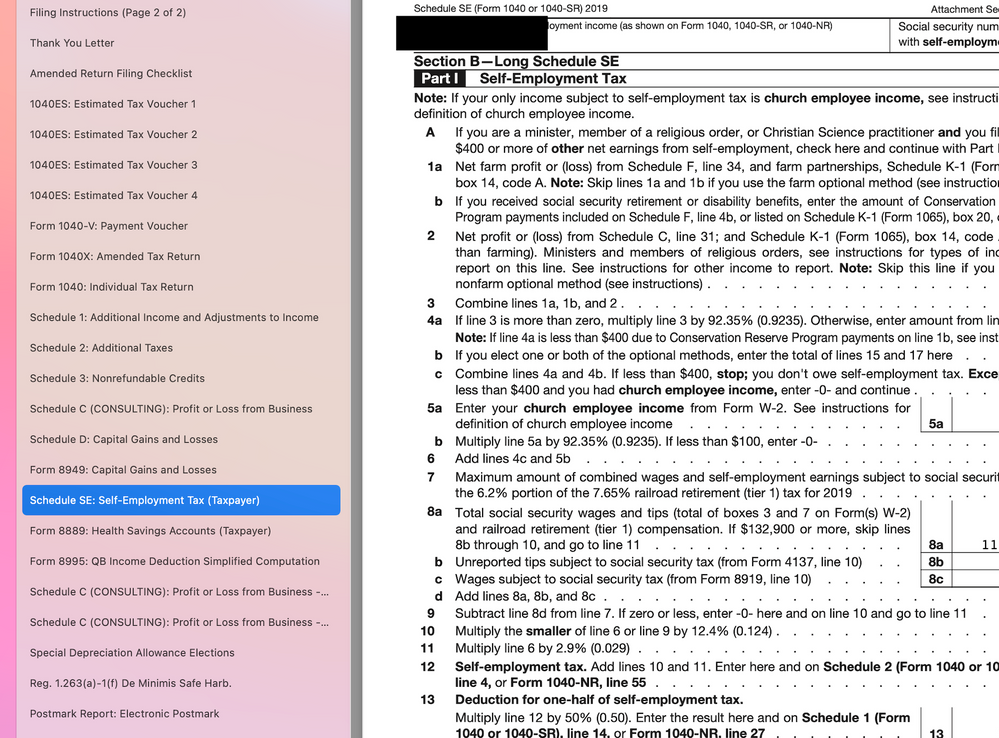

I went to Turbo Tax again and printed the forms again and now I am able to see Schedule SE form. The Schedule SE is written very small so it was hard to see. It says

"Schedule SE(Form 1040 or 1040-SR) 2019".

Section B - Long Schedule SE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

here's a link to the blank form. but if you use the SE edition of TT, it should have been included in your e-filed return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

I went to TT and prepared the amended return. Here are all the forms it has created. Is this the correct Schedule SE as shown in the screenshot. This is the only Schedule SE form in the generated amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

@azamsharp wrote:

Hi,

I went to Turbo Tax again and printed the forms again and now I am able to see Schedule SE form. The Schedule SE is written very small so it was hard to see. It says

"Schedule SE(Form 1040 or 1040-SR) 2019".

Section B - Long Schedule SE

I'm slightly confused. You prepared your amended 2019 return in Turbotax, mailed it to the IRS, but the IRS now wants you to send them schedule SE? Then you checked your Turbotax file and you didn't see schedule SE but now you do see it?

Hopefully, you kept a copy of the actual amended return you sent the IRS. If it had a schedule SE, maybe it was lost in the IRS office, or the pages stuck together. If you did not mail the SE but you have it now, and everything else matches your amended return, then you can just send the schedule SE. Maybe your printer skipped a page or there was a glitch between the program and the printer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Hi,

I will call IRS on Monday and see what is going on. Let's see if I can get through the phone hold, because current hold times are very very long.

I only sent IRS Schedule C and not Schedule SE.

- Turbo Tax amended return always had the Schedule SE form but since the letters was so small I could not see it. So it is safe to say that I forgot to send them SE form. I only send them Schedule C.

I have now prepared few things to sent to IRS. This includes:

- Schedule SE

- IRS Account Activity Report which shows that I have already paid the amount owed $618

- Bank statement screenshot showing that I already paid $618 to IRS

Hopefully, all this would be enough and hopefully they would be able to see that I have already paid the amount.

On IRS view account website, it asked me to pay $9.14, which was generated through penalty etc. I also paid that amount yesterday through their online server but it still says owe $9.14. Maybe it will take few days to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

@azamsharp wrote:

Hi,

I will call IRS on Monday and see what is going on. Let's see if I can get through the phone hold, because current hold times are very very long.

I only sent IRS Schedule C and not Schedule SE.

- Turbo Tax amended return always had the Schedule SE form but since the letters was so small I could not see it. So it is safe to say that I forgot to send them SE form. I only send them Schedule C.

I don't see why you would want to call. When you file an amended return, you must mail the 1040-X plus all the pages that have changes. Turbotax should have included the SE along with the C in your printout and you should have mailed both. If your amended return was correct but you just failed to mail one page, that may be all the IRS needs. I would mail a very brief letter, include a copy of their letter (so they can find your file faster) and your schedule SE. Use registered mail.

The filing deadline for a 2019 return was July 15, 2020. If you filed your amended tax return after that date and paid additional tax, you will owe some interest back dated to July 15, even if a penalty is not assessed. That sounds like the extra $9.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Thanks!

If I just send them Schedule SE and a copy of their letter then would they be able to find out that I have already paid $618 I owed them. Should I include IRS Account Activity and highlight the transaction of $618 which should made it clear for them that I already paid the amount I owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

@azamsharp wrote:

Thanks!

If I just send them Schedule SE and a copy of their letter then would they be able to find out that I have already paid $618 I owed them. Should I include IRS Account Activity and highlight the transaction of $618 which should made it clear for them that I already paid the amount I owed.

You can, it won't hurt. Are they asking for money or just the schedule SE?

If you sent a 1040-X that says you owe an additional $618 and you included a check, but you didn't include the SE, they aren't necessarily questioning your payment, they just don't have the documents to line everything up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find a copy of Schedule SE form so I can print it and send it to IRS. When I search I get no results? Where can I find this Schedule SE form?

Thanks again!

No they are just asking for the missing document, which is Schedule SE.

I will send them everything and hopefully, this will resolve the issue.

Thank you so much for your help! I really appreciate it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

saurabh-doctor1

New Member

pfAKaQYRwG

Level 2

maryherndon54

Level 2

AndrewA87

Level 4

GeneE

Level 2