- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have sole custody of my cousin, he has been living with me the entire year, and I pay the living expenses but I am not getting any child credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have sole custody of my cousin, he has been living with me the entire year, and I pay the living expenses but I am not getting any child credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have sole custody of my cousin, he has been living with me the entire year, and I pay the living expenses but I am not getting any child credit?

Go to this IRS website for information on who qualifies for the child tax credit - https://www.irs.gov/credits-deductions/individuals/child-tax-credit

- Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have sole custody of my cousin, he has been living with me the entire year, and I pay the living expenses but I am not getting any child credit?

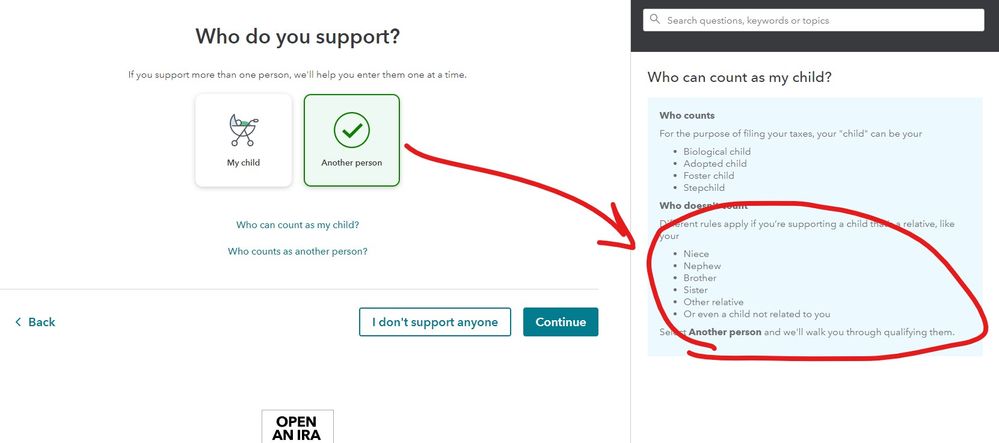

A cousin is usually considered ANOTHER PERSON which doesn't qualify for the CTC or EIC UNLESS they are your stepchild by marriage or fosterchild (placed by the courts) or you legally adopt them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have sole custody of my cousin, he has been living with me the entire year, and I pay the living expenses but I am not getting any child credit?

Thank you both. I read that its suppose to be certain family but I figured I was putting something in wrong. You would figure a child is a child and he's family.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rsherry8

Level 3

lou-chapko

New Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

anonymouse1

Level 5

in Education

bgoodreau01

Returning Member