- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I don't understand how to depreciate with the business safe harbor election for building material?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

Hi, I read the URL below and it confuses me even more. I don't know how to get to these screens while "add asset" for improvements. I have 11k of building materials I need to claim and I hope to find another way to depreciate rather than the 27.5 years.

Can someone please provide TT step instructions to get to the right spot? I appreciate any help. Note: I don't have much rental income for 2019 because i left vacant for a few months to renovate. So expense isn't my focal point although carry-forward is great.. but I guess adding to capital improvement is the proper way. I don't understand how to get to safe harbor for building improvements following the 27.5 SL method.. or if I qualify. (I don't understand how to use safe harbor for building improvements .) Please help if you can. Thank you!

https://ttlc.intuit.com/community/business-expenses/help/what-can-i-expense-or-depreciate-with-the-b... <not clear to me>

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

@rbyu wrote:Can someone please provide TT step instructions to get to the right spot?

You have to indicate that you made improvements to the property in the Rental Properties and Royalties section of the program.

The program will then ask whether or not you meet the criteria for the annual election for improvements (e.g., gross receipts, eligible building, cost).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

@rbyu wrote:Can someone please provide TT step instructions to get to the right spot?

You have to indicate that you made improvements to the property in the Rental Properties and Royalties section of the program.

The program will then ask whether or not you meet the criteria for the annual election for improvements (e.g., gross receipts, eligible building, cost).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

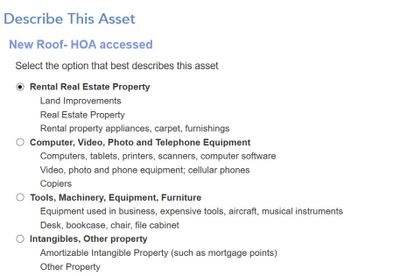

i thought I as there. I am in deduction and credit tab, YOUR PROPERTY ASSETS, I select ADD ASSET, and go though identifying, RENTAL REAL ESTATE... it gives me only three ways to categorize the asset...

From there, how can I access safe harbor? Thanks..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

You should have seen the safe harbor option before that screen to which you are referring.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

Tks for responding, I like to clarify what Im doing.. i don't think it is right.

in Add Asset, I choose RENTAL REAL ESTATE property..

then, next screen,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

You never came across the following screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

The improvements (over $2500) are depreciated like the property over 27.5 years so you ARE in the right place ... keep going.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

If it is $2500 or less and you want to expense it then do NOT enter anything in the asset section instead enter it in the EXPENSES section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

If you qualify for the Safe Harbor Election for Small Taxpayers, then check the appropriate box when you get to that screen (see screenshot below).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

sorry my message was incomplete...TT authentication failed b4 i can finish my message. :<

yes it did, but after .. it ask me to desc building i made improvements to .. I got confuse and went directly into add asset. I wasn't sure what to put here..

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

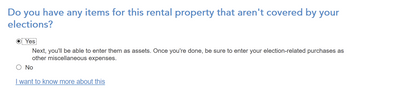

also after it asks, DESCRIBE THE BUILDING YOU ARE MAKING IMPROVEMENTS TO, I enter the improvements

it says continue and I get this scree,

Yes or No.. I am on the ADD ASSET screen. So mostly everything besides carpet, appliances etc, are the 27.5 depreciation method? so what is the URL https://ttlc.intuit.com/community/business-expenses/help/what-can-i-expense-or-depreciate-with-the-b... on safe harbor referring to? I am hoping to depreciate quicker than 27.5. For land improvements, can roof or build. materials be used under land improvements at 15yr deprec.?

Thanks a million for all the help everyone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

Did anyone ever explain this? I am at the same point. Answered yet to "did you make improvements to a building", , Next screen: I did qualify to claim them as expenses. Next screen: describe the building (????). Did that. Next screen: any items not covered by your elections? (it acts like I'm all finished with the building improvements! It never asked for dollar amount or description of improvement!) I answered yes to this question because I did have an asset to add but that took me to my list of assets and after I added the one new item to it, it went on to "other situations", carryovers, self-employment tax (which it couldn't have calculated accurately yet since I didn't enter this expense!!!) etc. and never back to entering those improvements as an expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

Whichever items you are claiming safe harbor for under $2500, you need to add as expenses. In the assets interview you are simply indicating that you are making the safe harbor election you will not be entering those in the assets section. If you have other improvements that do not meet the safe harbor criteria you would enter those as assets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

In the asset section it asks if you want to expense the item ... if you say yes YOU need to return to the expenses section to make the entry. The program will not take you back there automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand how to depreciate with the business safe harbor election for building material?

Improvements to rental property that become a physical part of the structure are classified as residential rental real estate and are depreciated over 27.5 years. Typically, these types of improvements are not eligible for safe harbor. Especially if the total cost was more than $2,500. Therefore you will not be offered that option.

Also, you're not depreciating the cost of the materials only. You are depreciating your total cost. This will include the cost of shipping, delivery, and installation if you actually paid someone to do the work and actually perform the physical labor of completing those property improvements.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misstax

Level 2

denisegvw

Level 1

romcgee1985

New Member

Juancar

Level 3

Sakana

Level 2