- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

also after it asks, DESCRIBE THE BUILDING YOU ARE MAKING IMPROVEMENTS TO, I enter the improvements

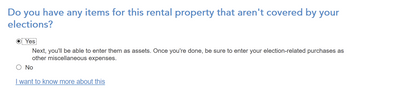

it says continue and I get this scree,

Yes or No.. I am on the ADD ASSET screen. So mostly everything besides carpet, appliances etc, are the 27.5 depreciation method? so what is the URL https://ttlc.intuit.com/community/business-expenses/help/what-can-i-expense-or-depreciate-with-the-b... on safe harbor referring to? I am hoping to depreciate quicker than 27.5. For land improvements, can roof or build. materials be used under land improvements at 15yr deprec.?

Thanks a million for all the help everyone.

September 2, 2020

3:17 PM