- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I report TurboTax Software Errors?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I only rec'd half of my 2020 taxes and I'm extremely angry. Why did this happen - I want an explanation!![address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@jamiewisner wrote:

I only rec'd half of my 2020 taxes and I'm extremely angry. Why did this happen - I want an explanation!!

Once a tax return has been Accepted by the IRS or a State, TurboTax receives no further information concerning the tax return or the status of any tax refund. Only the taxpayer listed on the tax return can obtain the status of a tax refund or a tax return.

Go to this IRS website for federal tax refund FAQ's - https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

Why is my refund different than the amount on the tax return I filed?

All or part of your refund may have been used (offset) to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. You’ll get a notice explaining the changes. Where’s My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemplo... has more information about refund offsets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

This is a public web site that can be seen by anyone—including scammers and would-be identity thieves who would love to contact you and pretend to be from TurboTax. Please remove the personal information you posted here ASAP by returning to your post and clicking the three little blue dots on the upper right to edit your post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Hi,

Even after the latest update from this week, TT2020 is calculating a $400 applicance 5-year depreciation using 200DB HY as $80, i.e., not 200DB but straight line. The asset was purchased new on January 2, 2020 and placed in service on the 10th of January. I believe the correct amount should have been $160 last year. I had the same problem for other assets placed in service (totalling about $10k) last year, so the miscalculation represents a large discrepancy overall.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

nope Turbotax is doing it correctly and it was doing it correctly last year so if you overrode any of its calculations you were in error. since it was acquired in 2020 and is 5-year personal property the 1/2 year (HY) convention applies since 40% of 5-year property acquisitions wasn't in the 4th quarter.

so while a full-year would be 40% of $400 the rules say you only get 1/2 year's depreciation the first year.

% of original cost allowed as depreciation each year (per IRS PUB 946 page 71)

1) 20

2) 32

3) 19.2

4 & 5) 11.52

6) 5.76

however, you may be doing something wrong. you should be allowed bonus/special depreciation = 100% of the cost

are you using type F for the type of asset

have you checked the box for economic stimulus qualified property (defined as:

Certain Qualified Property Acquired After September 27, 2017

You can take a 100% special depreciation allowance for property acquired after September 27, 2017, and placed in service before January 1, 2023 (or before January 1, 2024. Your property is qualified property if it meets the following.

• Tangible property depreciated under MACRS with a recovery period of 20 years or less.

if you want more information about depreciation look at the IRS PUB 946

https://www.irs.gov/forms-pubs/about-publication-946

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Thanks very much for the illustration. Yes, I had thought to amend to include the other type F property additions I made under the special depreciation allowance for 2020 (100% of the cost). However, I think that provision comes with a 2% of the total improvements or $10k maximum limit, and my expense was closer to $12 k for all property additions and improvements made in 2020.

I will check the guide. Thanks for the tip.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

when finished entering my info it showed that ineeded to pay over$7kI Filed an extension the a screen appeared stating no payment required

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I need to talk to someone. On my "File by Mail Instructions for your 2020 Colorado Amended Tax Return", you mention "Your amended tax return - Form 104X ..." but I ended up sending "DR 0104". This isn't right. I need to TALK TO SOMEONE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@jdnowlin wrote:

I need to talk to someone. On my "File by Mail Instructions for your 2020 Colorado Amended Tax Return", you mention "Your amended tax return - Form 104X ..." but I ended up sending "DR 0104". This isn't right. I need to TALK TO SOMEONE.

A Colorado amended tax return, Form DR 0104X, can only be printed and mailed to the state.

If you printed, signed and dated the amended return, did you mail the DR 0104X?

If you mailed the Form DR 0104, the question is why did you do that? That is the Colorado Individual Income Tax Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

In Form 1040-X of 2020, I mistakenly entered Head of Household instead of Join-Married. How do I fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@DucMTran If you have NOT yet filed the 1040X then go back to My Info to change your filing status to married filing jointly. Both spouses must agree to that filing status if you are changing to a joint return---and if you mail the 1040X you both have to sign and date it in ink.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Using 2020 CD TT Deluxe, I selected to create a PDF of my Maryland return. The generated PDF file name was for my IRS 1040, not Maryland's 502.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Is the federal return also in the pdf? You can change the file name to anything you want after it saves the pdf to your computer. For Windows the tax data files and pdf files should be in your Documents then in a Turbo Tax folder. Or search your computer for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

On the print form selection menu, the 1040 box is not checked; the MD 502 is. Also, I'd like to submit some suggestions to TT. How do I do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

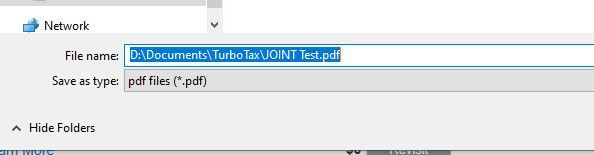

OK I just tried saving my California state return PDF. It just names the file the same as your tax file. Like my tax return file name is JOINT Test. So It saves the pdf as JOINT Test or you can give it any name you want when you save. You must have 1040 listed in your file name. Look at the very top to see the name of the file you have open. It says like Turbo Tax Deluxe [the file name].tax2020

When you save to PDF you should get this at the bottom and can change the name before you hit Save.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bkgrant10

Level 3

johnsonkm1

New Member

B Parker

Level 3

josephmbulu

New Member

user17710928336

New Member