- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I report TurboTax Software Errors?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

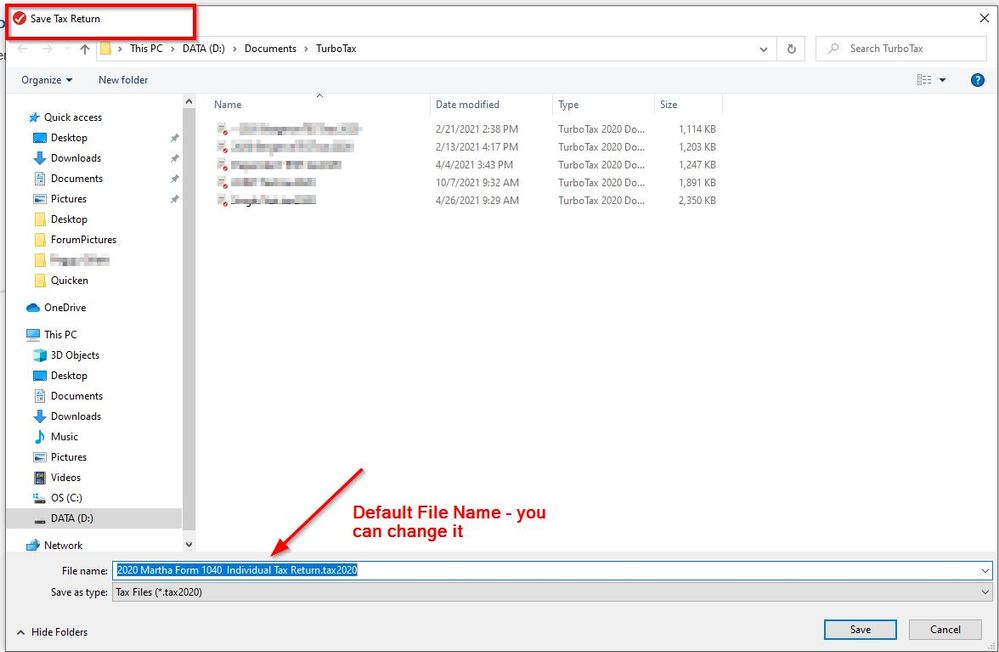

OK a couple more screen shots. When you first save the tax return it gives it a Default name like......

2020 Martha Form 1040 Individual Tax Return.tax2020

Or you can give it another name.

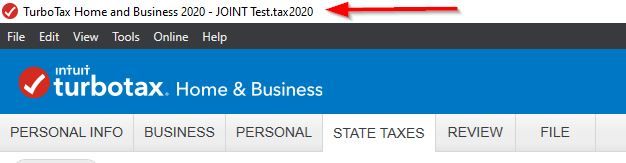

SEE FILE NAME LISTED AT VERY TOP:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Box for tax paid with extension is checked and can't be unchecked. No tax was paid with extension. This is for 2020 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

on Turbo TAX, there are two state lines. One has a number of $91 withheld that is not on my hard copy of my 1099 R for the State of Oregon pension I received

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

Help. my 1099 R form for the state of oregon shown on Turbo Tax is incorrect. Turbo tax has 2 lines on the 1099 Section for the State of Oregon pension. I need to delete one of the lines.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

There appears to have been a calculation error that occurred during my 2020 tax return. Line 43700 was miscalculated by the software and the CRA is now requiring me to pay with penalties based on this flawed calculation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@MathFrustration This is the USA forum

Here is the Canada forum

https://turbotax.community.intuit.ca/tax-help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

CANADA

This is the U.S. TurboTax public user forum. For help with Canadian taxes, please post your question in the Canada TurboTax user forum., at the following link.

https://turbotax.community.intuit.ca/community/turbotax-support/help/03/en-cahttps://turbotax.intuit.ca/tax-software/index.jsp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I just recieved another notice for my 2018 return, hiting me with penalty and interest for underpayment. I've had this problem before. It seems somehow the software assumes a 1099R I receive from Prudential from a pension fund as being paid as from NY government. This has happened in the past and I just assumed it was a bug that was fixed. I will check into the returns from 2019 and 2020 and do an amended return if it is necessary. This is frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I RECEIVED A LETTER FROM THE IRS/STATE

TurboTax does not receive any information from the IRS or your state after your return was filed, so no one at TurboTax knows about a letter you received from the IRS or the state.

(what the letters from the IRS mean)

I GOT A LETTER FROM THE IRS

https://ttlc.intuit.com/questions/3605673-i-got-a-letter-or-notice-from-the-irs

I AM BEING AUDITED

If you purchased Audit Defense:

https://ttlc.intuit.com/questions/2924451-i-bought-max-or-audit-defense-and-now-i-m-being-audited

AUDIT SUPPORT

TurboTax has a special phone number for help with IRS/state tax letters, which will be easier than going through regular Customer Support. At the page below, click on the blue button that says "Get Help from TurboTax Support". Then it will ask you what tax year is your letter. Then it will ask you what the letter concerns. Then it will show you the phone number during posted business hours.

https://support.turbotax.intuit.com/irs-notice/audit-support/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

on form 1040-SR line 12b charitable contributions if you take the standard deduction

is not being filled in when you enter contributions and take standard deductions

it does not autofill and you can't manually enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@EC2of5 Line 12b for your 2021 return? Just wait. It is very early and there will be many program updates to come. A lot of stuff isn't ready yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

TurboTax Premier 2021 does not appear to have the correct HSA contribution limit. I believe the IRS allowable maximum contribution is $8200 including the $1000 make-up contribution. TurboTax says that is $100 too much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@tcg81 wrote:

TurboTax Premier 2021 does not appear to have the correct HSA contribution limit. I believe the IRS allowable maximum contribution is $8200 including the $1000 make-up contribution. TurboTax says that is $100 too much.

The TurboTax software for tax year 2021 has not yet been updated for the 2021 HSA Contribution limit. The IRS has not yet finalized the forms, schedules and instructions needed to update the limit for tax year 2021. Once the IRS updates their instructions the TurboTax software will be updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

I am unable to enter data into fields on the social security form for Box 5 and Box 6. I t will not accept input. I am able to enter data for Medicare B and Medicare D amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report TurboTax Software Errors?

@eeebee2 In Turbo Tax Online version or in the Desktop program?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DanaOlson

New Member

symplejym

New Member

larry_parmer

New Member

chungcw3

Returning Member

acudoc37

New Member