- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do i know if turbotax calculated my unemployment tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

If you filed your tax return prior to March 26, 2021, using TurboTax, the unemployment compensation exclusion would not have been entered on your federal tax return.

If you filed on or after 03/26/2021 the exclusion would have been entered on the federal tax return.

The unemployment compensation exclusion was updated across all TurboTax platforms, online and desktop, on 03/26/2021.

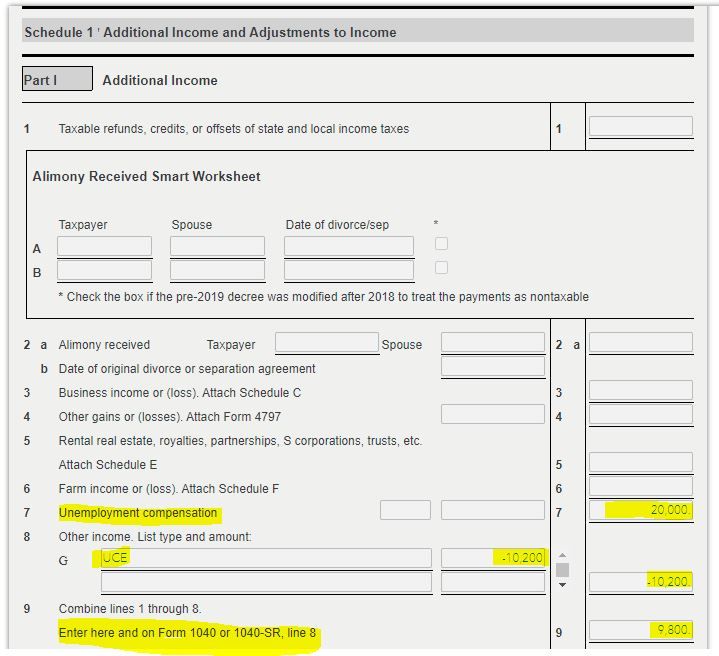

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

If you filed before March 11, 2020, it was not calculated because the law had not changed. TurboTax was calculating the change for federal very quickly after the law was passed. If you return was in process when the law changed, you would have seen the amount owed go down or the refund go up when TurboTax made the change to not tax the first $10,200 in unemployment benefits.

To check this, go to your Schedule 1 of your return. Line 7 will show your unemployment compensation. Live 8 will be a negative number which is the amount of unemployment that was deducted due to the law change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

so if there’s no number in line 8 what does that mean

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

@DoninGA @what does it mean if line 8 had nothing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

When did you file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

@DanPaul02 february

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

Then you paid and will be refunded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

@DanPaul02 @thank you but is there a way to figure out the amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

You could start an amend, delete the unemployment that you claimed and see what your new refund or owed amount is. Then subtract that amount from your return or amount due on your original return. That is what you can expect to have reimbursed by the IRS. When you have those figures, change the amounts back to how they are now and cancel the amend. It is just a way to get the information that you need. You do not want to change your records on TurboTax.

If your unemployment was more than 10,200, only the first 10,200 is exempt from taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i know if turbotax calculated my unemployment tax refund

@DanPaul02 i have a tax code 291 that says 0.00 next to it. does that mean i will not get a refund

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dbe2022

Level 3

JL97

Level 2

Marginal

New Member

gk56

New Member

tbrown31349

New Member