- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

You are asked in My Info if someone else can claim you as a dependent. Click on YES. If you missed the question, go back to My Info, click your name and go through the screens again.

If you can be claimed as a dependent and you answer the question in My Info incorrectly, here is what happens if you e-file first: Your Social Security number goes into the IRS system as having been used. When your parents try to e-file, their e-file is rejected and they will find it impossible to e-file their own tax return. Then they will have to print, sign and mail their return and wait for months for it to be processed. You, meanwhile, will have to file an amended tax return on a special form called a 1040X, which also takes months for the IRS to process. So make sure you know the correct answer to "Can anyone claim you as a dependent on their tax return?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

To prepare a dependent tax return in TurboTax Online,

- Select My Info down the left side of the screen.

- Click Edit to the right of your name at the screen Personal info summary.

- Select Yes at the question Another taxpayer can claim me as a dependent on their tax return.

A dependent Federal 1040 tax return will be indicated here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

FYI, there is a rule that says IF somebody else CAN claim a person as a dependent, he is not allowed to claim himself. If he has sufficient income (usually more than $13,850), he can & should still file taxes. In TurboTax, he indicates that somebody else can claim him as a dependent, at the personal information section. TT will check that box on form 1040.

Even if he had less, he is allowed to file if he needs to get back income tax withholding. He cannot get back social security or Medicare tax withholding.

With the tax law change, effective 2018, most students will get the same refund whether they claim themselves or not. The personal exemption has been eliminated and the standard deduction increased. However, you only qualify for an education credit or deduction, if you are not a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

@jcotomarin-gmail said "Last year I accidentally applied like a single person doing their taxes (that no one would claim me as a dependent),"

If your parent didn't get to claim you in 2022, that can be rectified by both of you filing amended returns for 2022. You mom files an amended return to claim you. You file to just check that box that says you can be claimed as a dependent.

How to amend https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

I have also gone through this process and it does NOT ask me if I'm a dependent, which I am. It only asks if I can claim a dependent. WHY is this not a question under MY INFO if it is one of the first questions asked on the 1040 form!!!!??? please help or i have to go do this myself somewhere else online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

You are asked in MY INFO if you can be claimed as someone else's dependent. Click your name in MY INFO and try going through the screens again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out my tax form and put that I am a dependent? I have only seen the question if I have a dependent not if I am one.

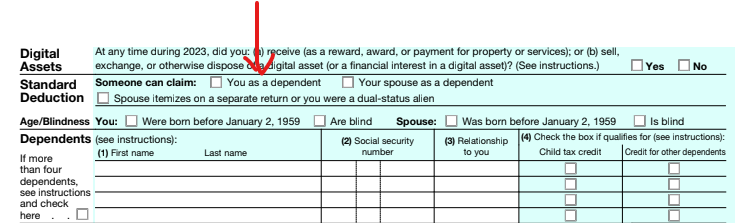

Yes, the question is very early on when you enter your personal information. See the steps below and also the image attached.

- Open your TurboTax Online/Mobile tax return.

- Select Tax Home (left panel) > Select Personal Information > Edit or Review by your name

- Continue until you see the screen Let's check for some other situations

- Select 'Another taxpayer can claim me as a dependent on their tax return.'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jyhan26

New Member

ae5880

Level 1

CuriousK

Level 1

kbarbs

New Member

BUTCHALSBURY6

New Member