- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How can I get in touch with Turbotax to report a program error with New Jersey State tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

I have to report a MAJOR error in the programming of the 2022 New Jersey State tax, but I cannot find any way to contact Turbotax directly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

I know about the link that you provided, and I tried it before posting. My problem is the fact that I do not want to call. I want to send an email describing the problem, but I cannot find any email address for Turbotax support anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

TurboTax does not provide email support. If you don't want to call, post all the details of the error here in the Community. Explain exactly what TurboTax is doing, why it's wrong, and what the correct processing would be. Give enough detail for someone to be able to reproduce the problem. If you refer to a box or line number on a form, be clear about what form it is, and double-check that the form and line numbers are correct. Give the full exact text of any error messages, word for word. And say whether you are using TurboTax Online or the CD/Download TurboTax software, and what edition (Basic, Deluxe, Premier, etc.). But do not post any personal information or contact information. This is a public web site that anyone can view, including scammers, hackers, and identity thieves.

If you are using the CD/Download TurboTax software, tell us whether it's in Windows or on a Mac. And before you post, check to make sure that you have the most recent updates. If you install any updates, check to see if the problem still occurs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Maybe I should start a new post about this, please let me know. Anyway, here is the problem:

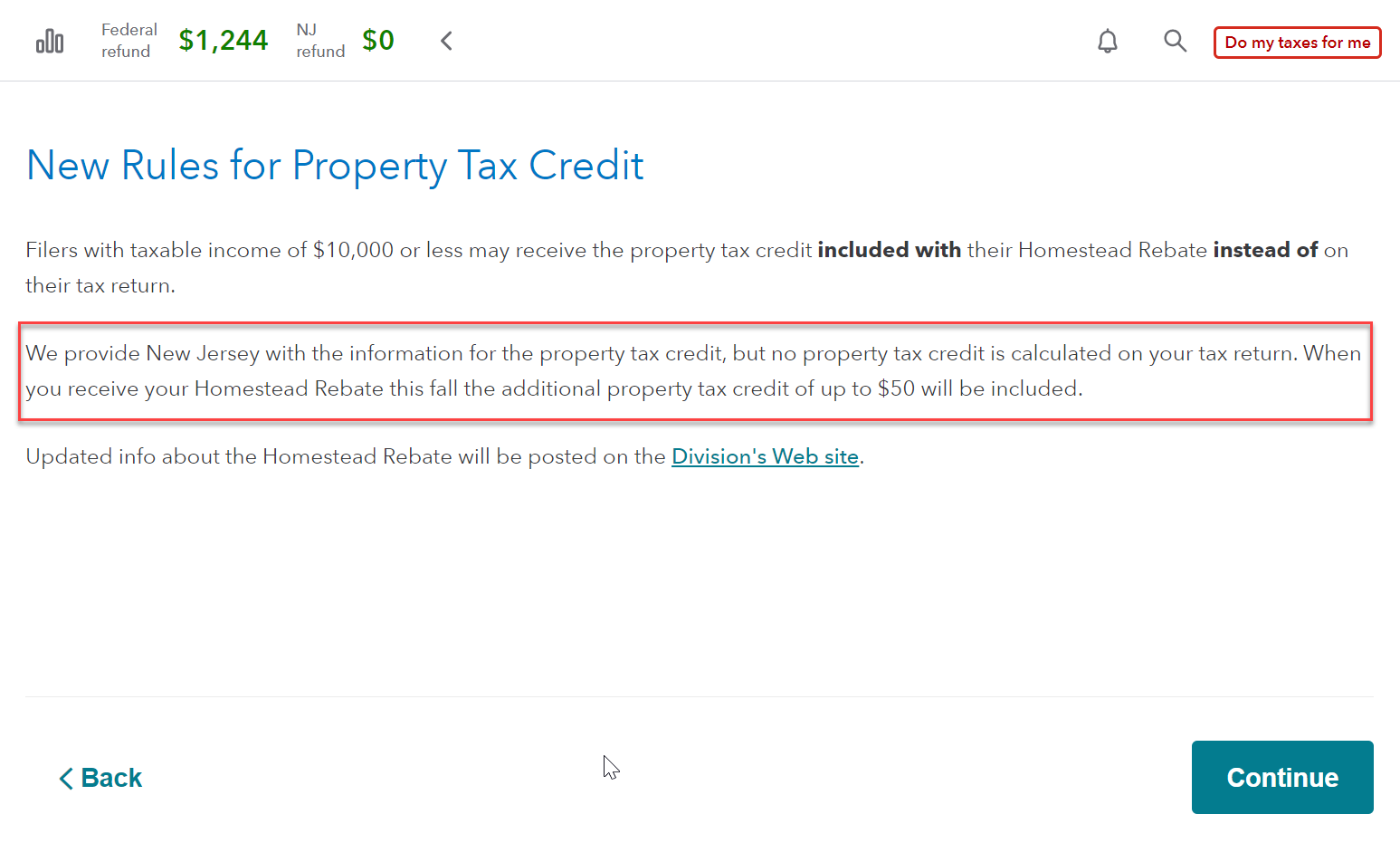

The first screen that comes up when one starts New Jersey State Taxes is this:

New Rules for Property Tax Credit There is a long blurb that I cannot copy and paste, so I am paraphrasing it here. It says that Turbotax does not calculate the $50 property tax credit for filers with taxable income of $20,000 or less because it is included with the Homestead Rebate.

According to the instructions for the 2022 NJ-1040, there are only two (2) ways to apply for the $50 tax credit. The first is to complete lines 40a and either 41 or 56. The second way is to file Form NJ-1040-HW, if you are not required to file Form NJ-1040 because your income was at or below the filing threshold.

Turbotax does NOT account for either of these.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

There is no error in TurboTax. You can file for your property tax return using an income tax return or NJ-1040-HW.

You will get your $50 property tax rebate if you include your rent or property taxes on your New Jersey income tax return.

What TurboTax says it that the rebate will be issued as a Homestead Rebate in the fall, not an income tax refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Part 2: I left some information out of the above post.

The screen that I referred to also says, "We provide New Jersey with the information for the property tax credit, but no property tax credit is calculated on your tax return." If that is true (and I do not believe it), how is that information provided to the State if not on this form? Line 56 should show $50, but it is $0. That is the only place on the NJ-1040 where the tax credit appears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Ernie,

My point is that statement is not true. You have to account for it either on NJ-1040 or NJ-1040-HW. If it is not included with the return, you will not get it. The error I am referring to is the incorrect statement AND the fact that TT does not account for it on the NJ-1040 form and does not provide a NJ-1040-HW form.

If you find something to the contrary on any NJ websites, please let me know. I searched and found nothing to support the TT statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Never heard back since the last post back in February. Has this been corrected for tax year 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Everything is different for 2023. There is no longer a Homestead Benefit. It has been replaced by ANCHOR. You do not get the ANCHOR benefit on your tax return. It's sent as a separate payment. See the ANCHOR Program page on the New Jersey Division of Taxation web site for details of the program and how to apply for it.

The TurboTax forms for New Jersey are currently expected to be available January 18. (That date is subject to change.) Until then, we cannot say with any certainty what will be in TurboTax, but your ANCHOR payment will not be on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

Actually, the $50 property tax credit was not included in the Homestead Rebate if you missed it on your NJ return,

but it is included in the ANCHOR payment.

That's insufficient excuse for TurboTax to deny the taxpayer a credit they are eligible for now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

rjs: If I wasn't clear, I apologize. I wasn't talking about the Homestead Rebate. Agreed that you don't get ANCHOR via the tax return; neither did you ever get the Homestead Rebate via your tax return. I was pointing out the problem with how Turbotax does not handle the $50 Property Tax Credit correctly. It is on Line 56 of the 2022 tax return.

In order to fully understand what I was talking about, please read the entire thread, and my thread entitled "New Jersey Property Tax Credit." under the State Tax Filing board. read the whole thing, please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

fanfare: How do you figure it is included in the ANCHOR payment? I see no reference to it anywhere. I really think we will have to wait and see what the 2023 tax forms look like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

I know because the ANCHOR payment for someone whose return I am familiar with was $50 larger than the nominal amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get in touch with Turbotax to report a program error with New Jersey State tax?

that person's tax software just issued an update - bug fix - to enter the correct $50 on the NJ tax return so they won't have to wait three years.

Evidently this bacame an issue for tax prep software due to ANCHOR.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeannnie

New Member

DennisK1986

Level 2

balynn0223

Returning Member

BME

Level 3

mcf4

New Member