- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) tur...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

Line 11 is adjusted gross income, so it should have a value. This error is about electing to not defer any self- employment tax. To resolve this error, try two troubleshooting steps:

First, revisit the section for the Self-employment tax deferral entry:

- Return to the Deductions & Credits section.

- Scroll to Tax relief related to COVID-19 and Show More.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Select Continue.

- At Tell us how much you'd like to defer, "Enter amount" should be blank.

- Select Continue.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Scroll down and select Wrap up Tax Breaks and Continue.

- At Charitable Cash Contributions under Cares Act, if you made cash donations to eligible organizations, enter the amount up to $300 for all taxpayers except married filing separate, who would each have a maximum of $150 and Continue. Otherwise, leave this section blank, do not add 0 if this is not applicable.

- I recommend running through the Federal Review again.

Secondly, if the error is still in the return,

- Delete the Sch SE that applies--(Sch SE-T is for Taxpayer, Sch SE-S for Spouse)--by following these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to Sch SE-T and/or Sch SE-S and select Delete.

- Return to the self-employment income & expenses interview in the Income & Expenses section and select Edit/Add.

- Select Edit for your business.

- Scroll down to Done so that the Sch SE is recalculated.

- Finish any other questions in the self-employment interview and click Continue.

- Review the return again.

[Edited 02/20/2021 | 5:24 AM PST]

@null515

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

@KathrynG3, I'd appreciate your advice if you have anything to add to this as I still don't have an answer and still haven't heard back from the support agent who promised to call me back...

For your first suggestion, Self Employment Tax deferral: I can't do the steps you suggested because I get a message that because I'm getting a refund, I cannot defer my taxes, then it takes me back to the deductions page.

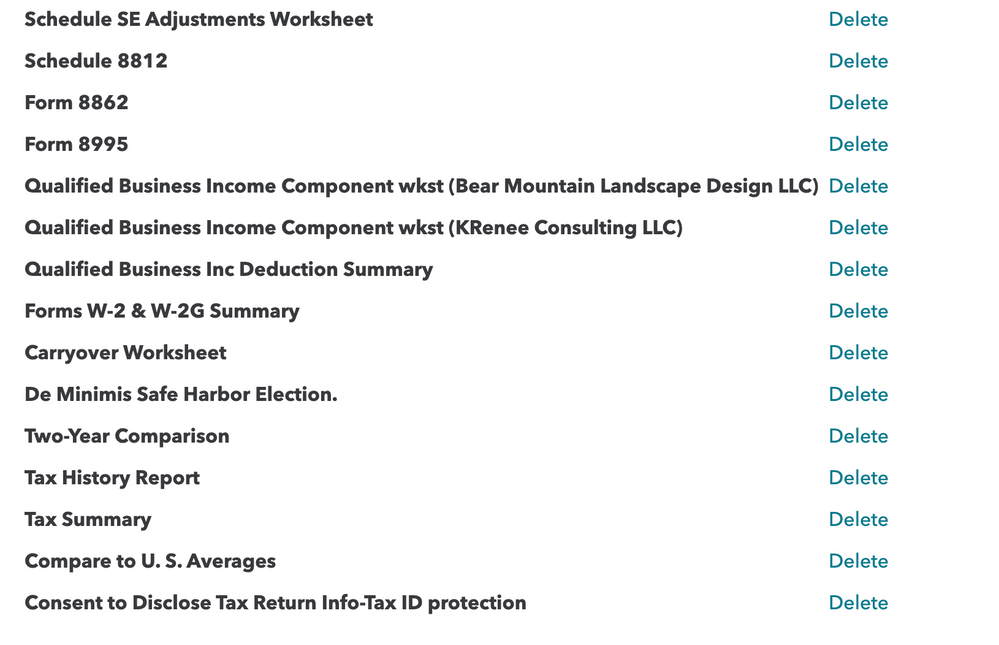

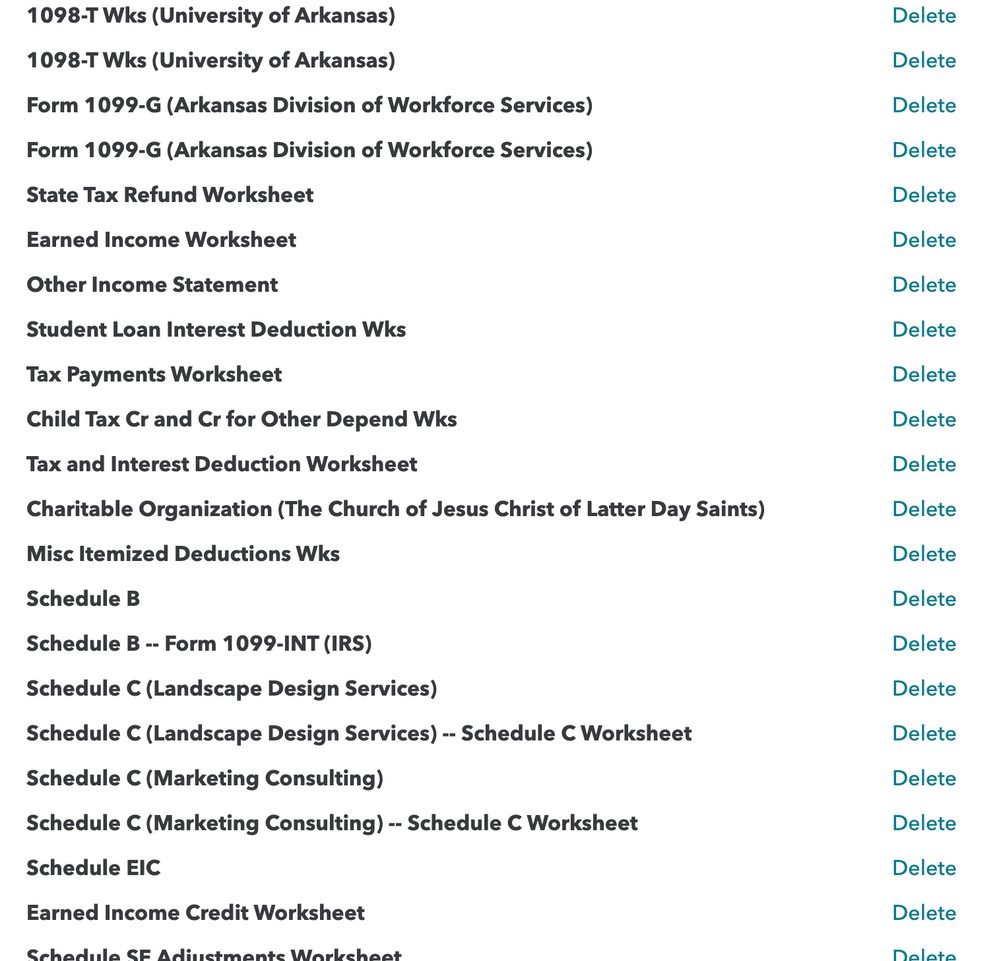

For your second suggestion: I don't have those forms on my return. (See screenshots of forms I do have.) This is one of the things the other agent was supposed to call me back about. She said I needed to delete the forms as well but I can't delete what I don't have. She couldn't find them either. She ended up getting whoever her support person is and they viewed my screen and had me try a bunch of things that didn't work, after a couple of hours they eventually said they would call me back. Which she did the following day to say she still didn't have an answer but it was in fact a glitch in the Turbo Tax system and it should be fixed in "a day or two" and she would call me back. No one ever called me back and I still can't find a solution.

Is there any other advice you can give me? The only other option I can think of is to clear and start over but that's hours and hours of work with no guarantee to fix the problem.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

Before deleting things and restarting, first be sure to have cleared cache & cookies by holding down Ctrl + Shift + Del. Clear for at least 7 days using Basic. This will log you out everywhere, so do not do this if you do not remember passwords or have them otherwise stored.

Next, be sure you are using a PC, not an iPad or Chromebook. Log out of the program completely and close the browser completely. Re-open in Chrome.

Then, try deleting the Schedule SE Adjustments Worksheet.

Go through each Schedule C to click done. This will have TurboTax generate a new Schedule SE for the two Schedule C's.

When the Review is done, you may need to enter in a fraction of the total income. March 27-December 31 is 280/366ths of the year, or about 76% of the income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

I cleared the 0. Then attempted to click on line below, it doesn't click on it but it does clear the line so you can then continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

There are 2 solutions to this issue:

- You can enter 0 or leave that box blank and it should allow you to e-file (this works for some)

- You can go back to Deductions and Credits and answer the questions, see if you qualify or not, then click Review. If you get that message again, enter 0, and it should go through.

For more details, see TurboTax Expert @DawnC's answer here, about 2/3 down the page: Resolve Sch SE-T Max Deferral Line 18 must be entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

I am getting these same two errors and have attempted all of these solutions, and I still get the same results with every review. The is extremely frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

To review how to clear the error, there are four ways to get this resolved. The initial answer can be released and the program will update. It is best to be in a Chrome browser, but I have seen people using Safari be able to update by deleting and re-adding the Sch SE, though.

When leaving the question blank or entering 0 does not work, then the next step is to force the update by deleting Schedule SE, and then running through the Schedule C again to click Done. This will force a new Schedule SE to be added.

To do this in TurboTax:

- Delete the Sch SE that applies--(Sch SE-T is for Taxpayer, Sch SE-S for Spouse)--by following these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to Sch SE-T and/or Sch SE-S and select Delete.

- Return to the self-employment income & expenses interview in the Income & Expenses section and select Edit/Add.

- Select Edit for your business.

- Scroll down to Done so that the Sch SE is recalculated.

- Finish any other questions in the self-employment interview and click Continue.

- Review the return again.

If this box cannot be left blank after updates, will not accept 0 for an answer, and after deleting Sch SE, you are still experiencing unexpected results, then there is one more process to try: temporarily trigger a balance due by adding income long enough to decline the SE tax deferral option, then remove the extra income.

To do this in TurboTax, follow these steps:

Enter a temporary amount as income in the self-employment section that will result in you not having a refund.

- From the left menu, select Federal.

- From the Income & Expenses, scroll to Self-employment income & expenses and Edit/Add.

- At Your 2020 work summary, select Edit.

- Under INCOME, select Add income for this work.

- Add Other self-employed income, includes 1099-K, cash, and checks and Continue.

- At Type of income, enter Temp income to remove deferral and enter a large amount, such as $100,000 and Continue.

Decline to defer any self-employment tax.

- From the left menu, click on Federal.

- Click the second tab from the left, Deductions & Credits.

- Scroll down to Tax Relief related to Covid-19 and Revisit.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income

- Enter 280/366ths of your income to reflect the income from March 27-December 31, 2021.

- This amount should be calculated and entered without the false added income, and will post to Line 18 of Sch SE

- Select Continue.

- At Tell us how much you'd like to defer,

- Enter 0.

- Enter 280/366ths of your income to reflect the income from March 27-December 31, 2021.

Remove the temporary income.

- From the left menu, select Federal.

- From the Income & Expenses, scroll to Self-employment income & expenses and Edit/Add.

- At Your 2020 work summary, select Edit.

- Under INCOME, select the Trash can icon next to Temp income to remove deferral and Continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

It's impossible to delete the zero. Deleting the Sch SE-S form also didn't help. The solution is to uncheck a little box that says something about printing when you are looking at the error in

1040/1040SR Wks: line 11. Support supplied this solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

Agreed, the proposed solutions are unworkable for me. I tried several times and have gotten nowhere. It seems this is a fundamental software flaw. It would be nice to have a more straight forward fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

To resolve this, it is important to also be using a PC with Windows 10 in a Chrome (try incognito) browser. When the program has not been closed out, the solution may be input but still not update. It is imperative to close out of the program and close the browser window, too.

This is a question because of initially qualifying to defer a portion of your self-employment tax, before all the details were entered into the return. Once a refund was established, the deferral was no longer an option.

For TurboTax CD/Download, it is important that the program is completely up to date. Check under Online in the menu bar to Check for Updates. Close out of the program completely and reopen it, too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

Using TT Home & Business, I had the same problem with the Sch SE-S showing a net loss, deferral amount of zero on line 18 too big, etc. None of the solutions offered worked for me: enter 260/366? of net loss amount, blank out line 18, delete Sch SE-S and recalculate, put in temporary income to allow decline of SE tax deferral and recalculate without temporary income, etc. What finally worked was ignoring the problem on line 18 (no other problems found), and going ahead to submit. After I clicked on transmit, I got a message that there was a problem found and was blocked from e-filing, the usual SE worksheet came up showing line 18 with the same error message, and the same message came up again, each time I tried to ignore and submit. Finally, I tried to blank out the value in line 18, was successful, and the transmission went through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

You are correct, a blank can sometimes resolve the issue.

280/366ths of income would cover the days from March 27 through December 31, 2020.

It is an issue that occurs when the Schedule C happened to be entered first and there was no refund. Then, once there was a refund, the option to defer self-employment taxes was no longer available.

I appreciate you sharing your solution and for your patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

I have tried all the suggested solutions on this Forum none have worked for me. HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has there been a solution found for the Sch SE-S and Sch SE-T (reference code: 5-569-197) turbotax glitches yet? I really need to file my taxes.

It may not have been clear from my original message and the reply, but nothing worked for me either, including changing the value to a blank. Finally, I just decided to go ahead and file my return electronically, even with the error message for zero value too large, which I decided would probably not cause a problem when the return is reviewed. What I found was that the filing transmission would not go through, and the same error was displayed, along with the SE worksheet, but I was able to change the value on the worksheet to a blank at that point, where I had not been able to do so before. After that, the transmission went through. Did you try that?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

feliciadc

New Member

Capstan

Level 1

rwatson123

Level 2

TomYoung

Level 13

penstruck

Returning Member