in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received any stimulus for child in 202. Only $3600. TT is saying we got all stimulus.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received any stimulus for child in 202. Only $3600. TT is saying we got all stimulus.

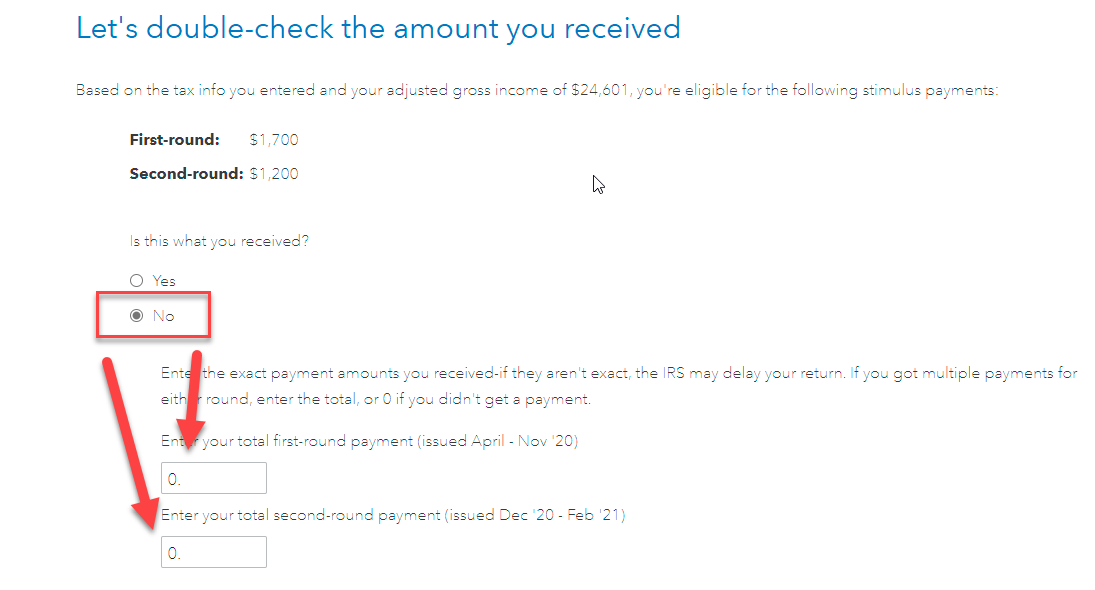

TurboTax displays the amount of stimulus you should have received based on your 2020 income tax return. It then asks whether you received that amount. If you did not, TurboTax asks you to enter the amount you actually received.

If you make that adjustment, you should receive the additional stimulus for your newborn as a Recovery Rebate Credit.

In TurboTax Online, to get to the Recovery Rebate Credit section

- Type stimulus in Search in the upper right

- Click jump to stimulus

Any stimulus amount due to you will show as a credit on line 30 of your Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received any stimulus for child in 202. Only $3600. TT is saying we got all stimulus.

Thank you - the thing is Turbo Tax is saying we only qualified for $3600 as a married jointly couple. We should’ve qualified for $4700. $1100 additional for (1) dependent. I’m thinking I need to clear everything including my cache and start over? Checked child stayed with us entire 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received any stimulus for child in 202. Only $3600. TT is saying we got all stimulus.

Before you start the entire return over, start with just deleting the dependent and re-adding them. Does the child have an SSN entered? Make sure that the relationship is correct, that you have selected lived with the whole year, double-check the birthday entered, and make sure the child is showing up on your Form 1040 as a dependent. Look in box (4) of the dependents section.....Is there a checkmark for ''Child Tax Credit'' or ''Credit for other deps''?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child born in 2019. Qualifying dependent. AGI <$150G. Lived with all of 2020. Never received any stimulus for child in 202. Only $3600. TT is saying we got all stimulus.

Good call - I will try re-entering dependent. I believe TT carried over the info from previous year so maybe that is causing an issue. Relationship and “living whole year” were correct. Child has SSN and entered as well.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

Stitha2

New Member

thereseozi

Level 2

Questioner23

Level 1

jaxsonsmommyy1624

New Member