- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

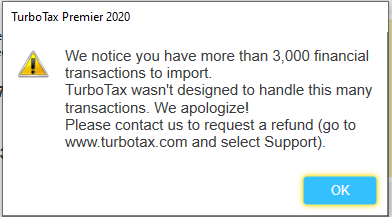

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

Hi,

I'm getting following error when I tried to import from my brokerage. Is there limit transactions on the TurboTax Premier edition? What should I do?

Please help.

Thanks

Dai

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

TurboTax cannot accept more than 3,000 transactions on a 1099-B.

I recommend that you print it out and manually post the summaries.

Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, "Box A short-term covered" or "Box D long-term covered." You'll enter the summary info instead of each individual transaction.

- Open or continue your return (if it's not already open) and search inside TurboTax for the phrase stock sales.

- Select the Jump to link in the search results.

- Answer Yes to both Did you sell stocks, mutual funds, bonds, or other investments? and Did or will you receive a 1099-B form or brokerage statement for these sales?

- If you land on Here are all your 1099-B sales, select Add sales from a different brokerage. Then answer Yes to Did or will you receive a 1099-B form or brokerage statement for these sales?

- When asked how you want to enter your 1099-B, select I'll type it in myself.

- Select or enter your brokerage on the next screen and continue.

- On the following screen (Tell us about...), answer the questions until you reach the next screen. Select the second option, Let's enter a summary instead, and select Continue.

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue.

When you are done, you'll eventually come to the Here's a summary of your broker sales screen where you can edit, delete, or enter more sales.

You will have to mail a copy of your 1099-B to the IRS. TurboTax will produce a Form 8453. You print the Form 8453 and attach the brokerage statement(s) to it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

I have same problem. Tubotax should help us solving this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

Unfortunately the 3,000 record limit can not currently be changed.

However, you can quickly enter this manually. Your brokerage statements should include a summary of your transactions, grouped by sales category.

There are seven possible "Box" designations that indicate the holding period (Long/Short Term) and the reporting status. These are the only ones you have to summarize.

Code A. This code indicates a short-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 1a, or on Form 8949 with box A checked with totals being carried to Schedule D (Form 1040), line 1b.

Code B. This code indicates a short-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box B checked with totals being carried to Schedule D (Form 1040), line 2.

Box C. Report on a Part I with box C checked all short-term transactions for which you can't check box A or B because you didn't receive a Form 1099-B (or substitute statement).

Code D. This code indicates a long-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 8a, or on Form 8949 with box D checked with totals being carried to Schedule D (Form 1040), line 8b.

Code E. This code indicates a long-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box E checked, with totals being carried to Schedule D (Form 1040), line 9.

Box F. Report on a Part II with box F checked all long-term transactions for which you can't check box D or E because you didn't receive a Form 1099-B (or substitute statement).

Code X. Use this code to report a transaction if you cannot determine whether the recipient should check box B or box E on Form 8949 because the holding period is unknown.

Open or continue your return (if it's not already open) and search inside TurboTax for the phrase stock sales.

- Select the Jump to link in the search results.

- Answer Yes to both Did you sell stocks, mutual funds, bonds, or other investments? and Did or will you receive a 1099-B form or brokerage statement for these sales?

- If you land on Here are all your 1099-B sales, select Add sales from a different brokerage. Then answer Yes to Did or will you receive a 1099-B form or brokerage statement for these sales?

- When asked how you want to enter your 1099-B, select I'll type it in myself.

- Select or enter your brokerage on the next screen and continue.

- On the following screen (Tell us about...), answer the questions until you reach the next screen. Select the second option, Let's enter a summary instead, and select Continue.

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue.

When you are done, you'll eventually come to the Here's a summary of your broker sales screen where you can edit, delete, or enter more sales.

You will have to mail a copy of your 1099-B to the IRS. TurboTax will produce a Form 8453. You print the Form 8453 and attach the brokerage statement(s) to it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

what should I write for these boxes?

Total adjustment gain or loss?

List all adjustment codes

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

At tax time, you have the option to summarize your activity by Sales Category.

As an active investor, be aware that your category Box A or Box D sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a or Line 8a.

Category A and D are the covered transactions.

If you summarize (recommended),

you only need to supply PDF of 1099-B covered transactions with adjustments that are not listed on your e-Filed Form 8949. and all non-covered transactions not listed there.

in other words, for active investors, generally this is a list of the Wash Sales.

Note: turboTax may suppress some covered transactions without adjustments. For those, no mailing is required !

--

If you have two pages (for example) of Wash Sales,

use Adobe Reader to print those two pages. That's all you have to mail to the IRS, given that those wash sales are not on your e-Filed form 8949 already.

(you might enter them manually if they are few in number.)

If you were wise enough to avoid wash sales, you won't have to list or mail anything.

Meanwhile some have reported that TurboTax will take your 1099-B PDF as an attachment avoiding the need to mail it.

TurboTax has not documented or publicized this capability.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

I have the same issue. This should be a easy change with the turbo tax software? Can you provide a fix. This is why I buy turbotax... to save time vs cost me time.

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

@taxstapp Unfortunately, 3,000 transactions is the limit. Please contact TurboTax support if you need further assistance.

What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

It is unhelpful for you to keep repeating that 3000 is the limit. Everyone here knows that 3000 is the limit.

The point that I see people trying to make is that this limit is unreasonable, both from the perspective of good software design and the perspective of typical user needs. TT Home and Business is sold specifically to people whose tax situations are complicated, and normal tax situations for such people often include many 1099-B transactions. As a career computer programmer, I can say there is no clear software design principle that would indicate imposing such a limit as 3000 transactions.

So yeah, everyone knows 3000 is the limit.

What people are looking for is some understanding on your part that this limit is bad for users and is a likely indicator of bad software design that should be fixed. If you could at least acknowledge that fixing this issue should be a high priority for TT developers, that would be a helpful response. Any other kind of response is not likely to make TT users feel any better because other kinds of responses simply make us feel that you are not taking us seriously.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

With most brokerages offering stock trades for FREE, there are now so many "active traders" that TurboTax needs to increase the limit to 5,000 or 10,000 transactions. I've used TurboTax faithfully for over 25 years, but because of this transaction limitation I will no longer be able to use TurboTax. I'd gladly pay TurboTax a $100 premium if TT would increase my transaction limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

If this is the limit, why does turbo tax still allow the import from the financial institution to work successfully, only to cause problems later on. i have been dealing with his problem since the end of February and have had 8 phone calls with turbo tax support to only find out that they now believe the limit is the number of transactions. If TT had given an error when we imported the data originally then we would have known it was a problem, but it didn't. it allowed the import to go through successfully but then got stuck later on. Does anyone have a solution to how to get through the rest of the income sections, with this issue. TT support does not seem to have an answer. how can i finish my taxes without being able to have the income section completed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

Does anyone have any suggestions as to how to get around this limit???? how can we complete our taxes if we can't import the data properly. If we have to enter it all manually, how is that done?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

In my case also, the import succeeded with a warning like, "Wow, you have a lot of 1099-B transactions; this is going to make TurboTax really slow. Press continue to hate TurboTax or cancel to go to jail for not doing your taxes."

I decided to hate TurboTax and stay out of jail, and what I found is that when I went to update any 1099-B information at all (including from other brokers) the TT program appeared to hang. It hung for a half hour or more, and I finally force-quit it. But on a lark some time later, I repeated the process and this time I just let it run for several hours. And lo and behold, eventually it un-hung itself and started working. Subsequently, some steps would be rather slow, but not in the extreme like I had experienced. If your luck is the same as mine, you'll be able to leave it seemingly hung once for a long time, and after that it will be usable (albeit slow).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

I, too, contacted TT support for help, and they didn't have a super awesome answer but they did provide this, which might help you if you want to do some portion of the calculations outside TT: https://ttlc.intuit.com/community/taxes/discussion/cannot-import-more-than-3000-transaction-on-turbo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot import - more than 3000 transaction on TurboTax Premier 2020 Windows Desktop PC version

Referring to your statement "You will have to mail a copy of your 1099-B to the IRS. TurboTax will produce a Form 8453. You print the Form 8453 and attach the brokerage statement(s) to it. ".

Since I need to mail my 1099-B and Form 8453 to IRS, does it mean I can no longer do online filing for my entire tax filing. Because only 1 of my broker account encounters the th3 3000 transaction limit issue. I assume I can still do e-filing for my federal tax and state tax. The only additional step I need to take is to only mail the one impacted1099-B and form 8453 to IRS. Is that correct?

When you said mail to IRS, does it mean I need to mail to both Federal IRS and state IRS? Sorry if this is a stupid question. Thx for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

user26879

Level 1

ydarb213

Level 1

user17545861291

Level 1

TurboLover2

Level 5