- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: cannot edit/update my schedule c deductions. using iOS 10.13.6. no jump to links.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

@Zhao wrote:

I am trying to enter 1031 exchange. I typed in Like Kind as instructed, but see no jump to link. Thanks.

Open the Search box in the upper right of the program screen. Type in like kind. Look below the search box and there will be a highlighted link Jump to like kind

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

I want to import my Coinbase .csv into Turbotax.

When I search on Cryptocurrency, there is no Jump to link like they say in the help.

Is there another way to find it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

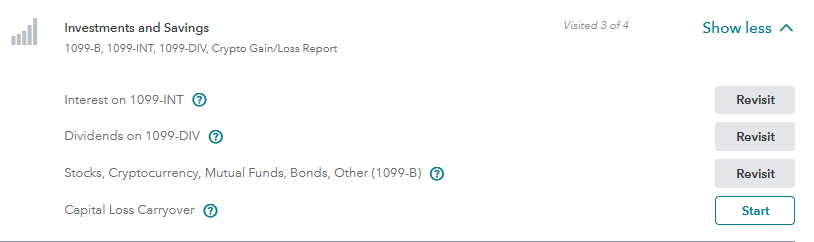

You may navigate directly to the Cryptocurrency section if the jump-to link is not displaying.

- Go to the Wages and Income section

- Scroll to Investments and Savings

- Click Start or Revisit on Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Select Add Investments

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

Where is the jump to link for “refund applied to this year” After I’ve entered it in search.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

This will allow you to pay a reduced amount for the first quarterly estimated payment or possibly wait for the second due date of June 15th. It's the best way to avoid penalties for late payment or underpayment or both.

You can reach the section to apply your refund to next year by using the steps below.

- Sign in to your TurboTax account

- Open or continue to your return, if you don't already have it open

- In the search bar type: apply federal refund to next year

- Select the Jump to link in the search results

- Follow the instructions on the Apply Refund to 2023 Taxes screen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

Sold land. Trying to get to form 4797, 6252, or schedule D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

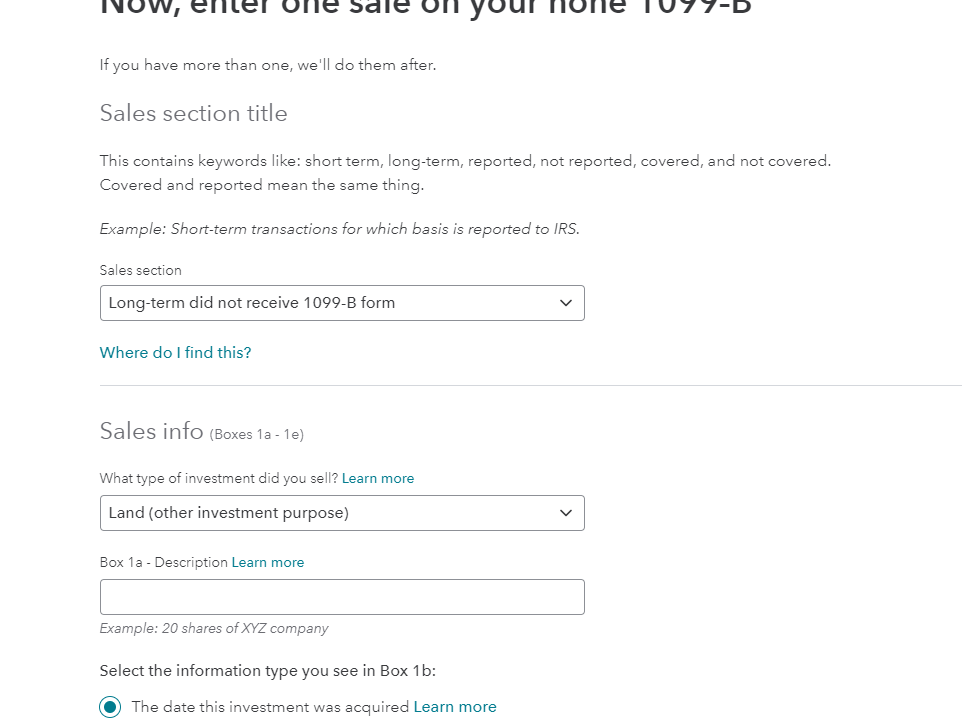

Here are instructions to enter the land sale on Schedule D using TurboTax Online:

Enter sale of land in the investment section:

Sale of land gets reported in TurboTax as a sale of an investment.

Please follow the following steps to record the sale in TurboTax:

- Withing your return, select Federal tax

- Select Wages and Income

- On Your Income page, click Start button for Stocks, Mutual Funds, Bond, Other

- On Did you sell any investments in 2021?, click on Yes button

- On next page, answer whether or not you received a 1099-B or a brokerage statement for the sale

Then you can choose land as personal sale or land as investment in the dropdown menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

I am trying to find form 8379. The jump to link is not showingup

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

You can go to Form 8379 Injured Spouse Allocation by going to section Other Tax Situations, on the left menu bar.

Scroll down to Other Tax Forms and click on Show More

Click on Start or Revisit for Report an injured or innocent spouse claim

It will walk you through completing the form from there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

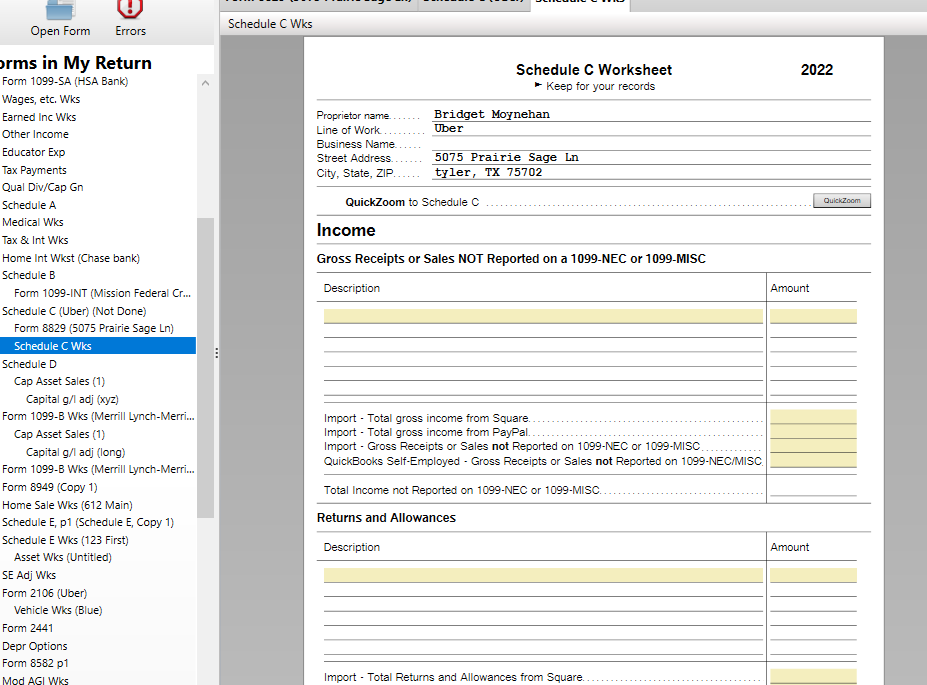

I am wanting to delete Schedule C, because it is showing up as an error. I no longer have a business and haven't since 2014.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

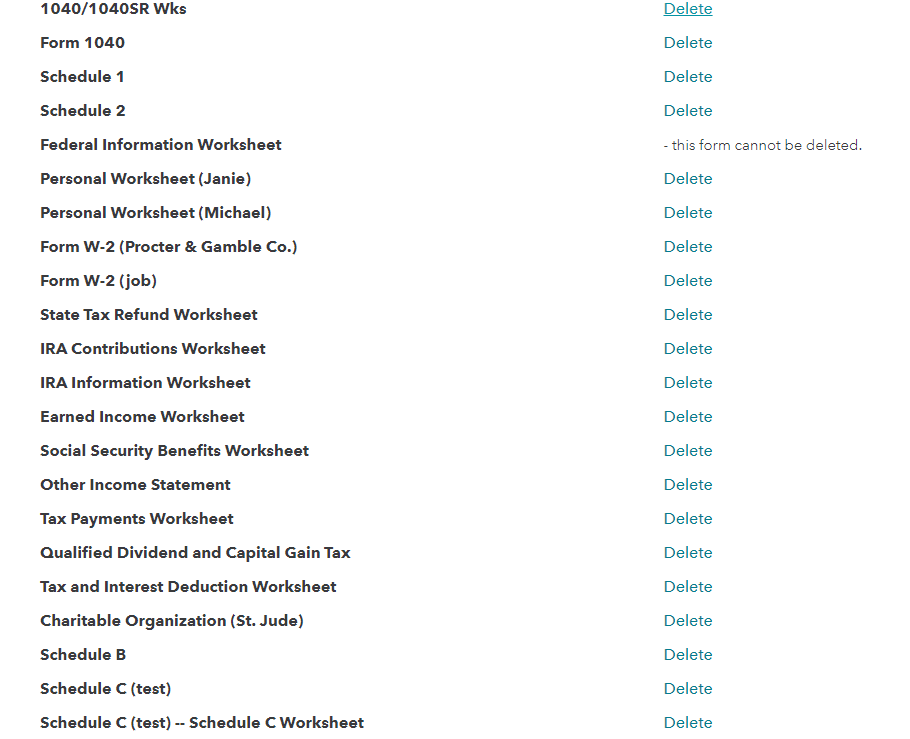

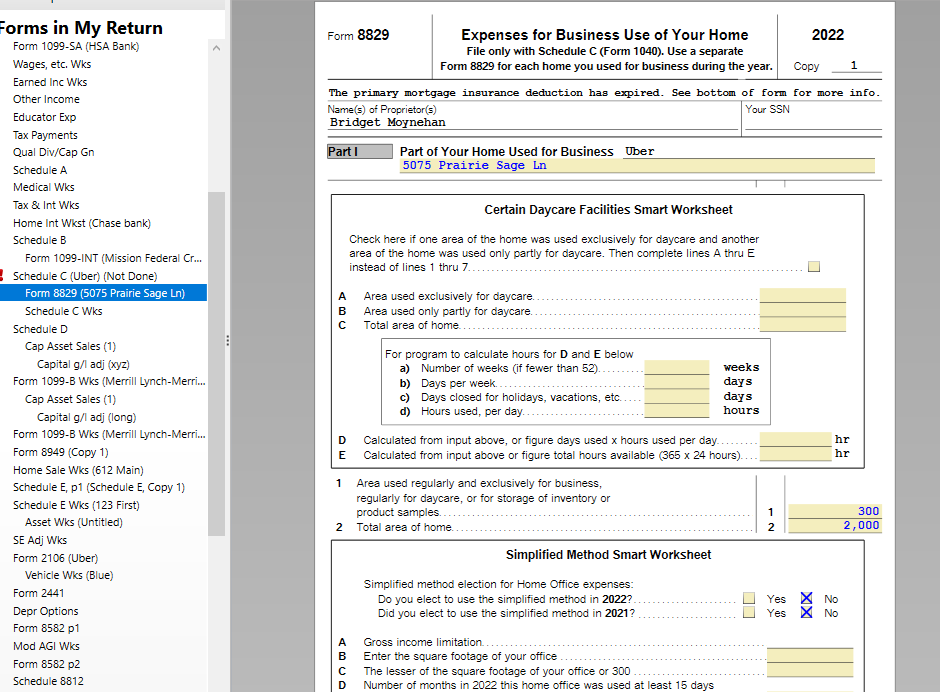

To delete schedule C please follow the steps:

Online

- Your TurboTax account.

- "Pick up where you left off."

- In the panel on the left hand side, select "Tax Tools."

- Tools > Delete a form.

5. Delete Schedule C.

6. Delete Schedule C Worksheet.

7. Delete Form 8829, it there was a home office.

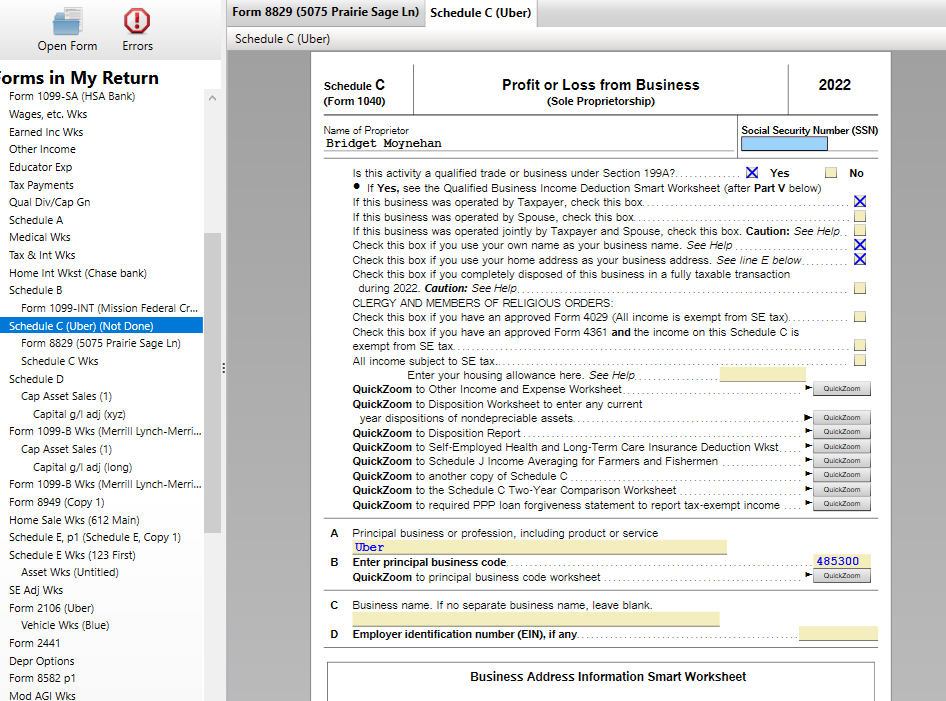

TurboTax Home and Business

- Open TurboTax.

- Select "Forms" in the top right banner.

- Delete Schedule C.

4. Delete Schedule C Worksheet.

5.Delete Form 8829, if there was a home office.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

THANK YOU!! I was just looking for the "Jump to" command / search, and it was NOT where the video said it would be. Thanks for telling us where else to look for any forms/topics.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

Thank you for THIS: If you can NOT get a jump to link to work for you, go instead to Tax Tools > Tools > Topic List. Locate where you want to go and click on those words.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

I am trying to add a 1099-NEC and I cannot get back to the page where I added income. I put it in the search and I see no jump to link. My wife has two businesses and only one was in last years return.

If I go back to the beginning I get the page for Business deductions.

I am using a MAC M1 running Ventura.

Help me I've tried for hours to do this and an afraid that I will have to start all over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

If you are using TurboTax Online, go to the left menu bar and click Wages and Income. Then, from the Wages and Income screen, scroll down to Other Common Income. Click Show More. Select Form 1099-NEC.

If you are using TurboTax Home and Business for Mac, and this Form 1099-NEC is for self-employment income, click the Business tab. When it asks how you want to enter your business income, click "I'll choose what I work on". Click Start or Update next to Profit or Loss From Business. Answer the business profile questions if you are adding a new business. When you get to the Business Income screen, select Form 1099-NEC.

For more information on Forms 1099-NEC, see this TurboTax article.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mikendamaddawg66

New Member

Spacefish

New Member

werty

Level 1

jeremy_albrecht

New Member

mdmc

New Member

in Education