- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

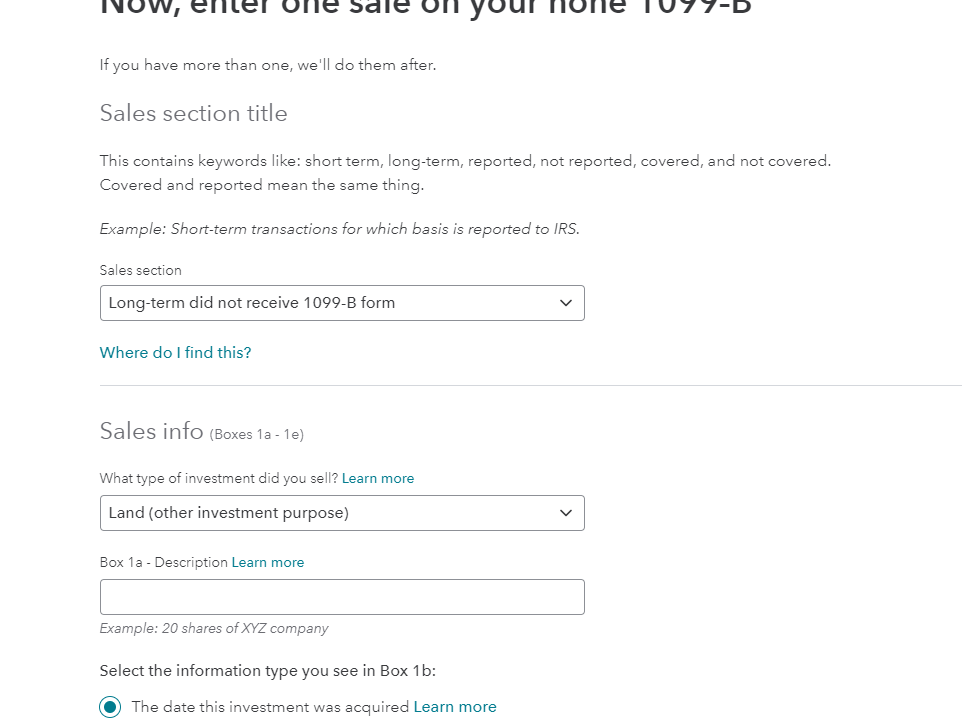

Here are instructions to enter the land sale on Schedule D using TurboTax Online:

Enter sale of land in the investment section:

Sale of land gets reported in TurboTax as a sale of an investment.

Please follow the following steps to record the sale in TurboTax:

- Withing your return, select Federal tax

- Select Wages and Income

- On Your Income page, click Start button for Stocks, Mutual Funds, Bond, Other

- On Did you sell any investments in 2021?, click on Yes button

- On next page, answer whether or not you received a 1099-B or a brokerage statement for the sale

Then you can choose land as personal sale or land as investment in the dropdown menu.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2023

4:11 PM