- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-B Turbotax calculation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

I downloaded the two 1099-B's Capital Gains/Losses from my Brokerage.

- Short Term values were $33,727 loss and +$44gain, so together a total Net Realized Short Term LOSS of $33,683

- Long Term values were $0 and $4,436, a net $4,436 gain

- I know short term and long term are treated and taxed differently)

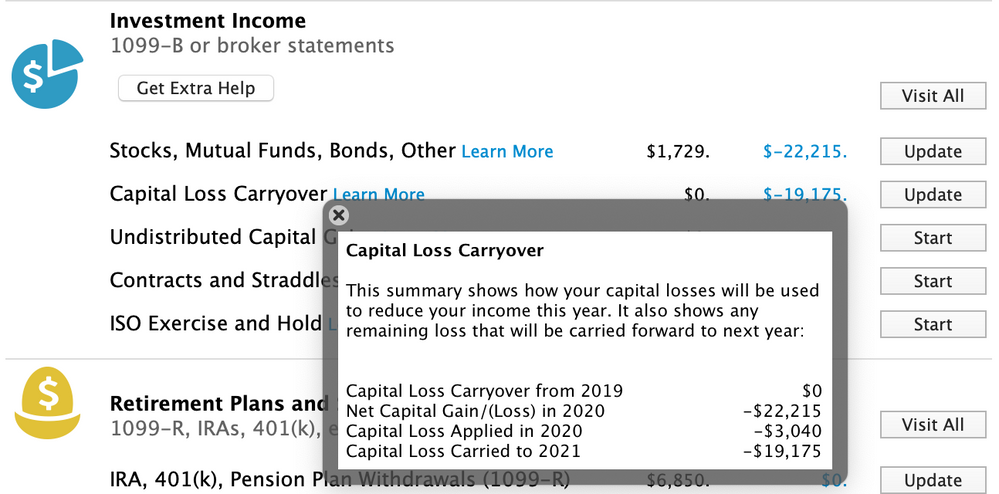

QUESTION: why did Turbotax entered the Capital Gain/(Loss) in 2020 as only -$22,215 .. seems a long way off?

P.S when i click on the update button to check the entries Turbox tax also says "the IRS is still working on finishing up the Schedule D for 2020".

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

You would have to look at Form 8949 Sales and Other Dispositions of Capital Assets and Schedule D to see what else is affecting your capital losses.

Schedule D lists a variety of things that would be included in capital gains and losses, such as the sale of business property, casualties and theft, and capital gain distributions.

You might have entries on K-1 schedules or 1099-DIV forms that could affect your capital gains and losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

Thanks Thomas. Very grateful for the advice. I will be able to check schedule D when TT says it’s available and as you mentioned, I do have Dividend distributions on 1099-DIV which will reduce my net capital losses.... but nothing else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

1) Thomas, once I was able to see the Schedule D you were correct..there were wash sale losses disallowed of $6,804 and with the long term gains and so I agreed with the $22,173 loss. Thanks

2) PROBLEM B - However , now after downloading the Turbotax update and re-importing my 1099-B's from E-Trade (I had deleted them to confirm the figures by manual entry for 1099B summary info) the data entered by Turbotax import is now grossly incorrect. Schedule D only shows $14,456 loss .

** I have traced the problem to the fact that now Turbotax is only importing the first line entry of each listing of fund sales that I see in the hardcopy printout (these are to be reported on form 8949) as is evidenced when I look at the 1099-B worksheets and the values now in Schedule D.

Any suggestions?

P.S. The turbotax box lists "Free US based product support by phone..." yet I can't find any number to call.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

You can try deleting the 1099-B form. Then, clear the cache and cookies on your computer and then try downloading the form 1099-B again.

To reach live support, you have to go to the online TurboTax and set up an account, then click on the "Live Help" option you will see on your screen.

You can do this by using the link turbotax.com

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

Thomas, many thanks again for your feedback/recommendations, very much appreciated.😀

- Per your suggestion, I deleted the 1099-B info, cleared my cache and cookies, and re-imported from E-Trade - Not Solved

- I called the Support line at 8.05am this morning and spent 1 hr sharing my screen, explaining and showing the problems with partial upload of information. The representative in parallel with the discussions contacted a senior tech support person and acted as intermediary. I answered the questions and their directions as follows:

- I was asked to update TTax again as there had been another recent TTax software release and delete the 1099-B data and re-import - Not Solved

- I created a new empty TTax file and imported the 1099-B from E-Trade - Not Solved

- I was then told that TTax support needed more time to investigate and I would get an email with next steps or updates to the issue. I was told there was another customer with the same issue on 1099-B from E-Trade (partial upload of sale line items). I was provided a case number (this platform keeps stripping the number out saying it removed a social security #) so it is four-seven-one-zero-seven-nine-six-two-six.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

A Form 1099-B is issued to report the proceeds from your stocks and bonds transactions. The transactions will generate either a long term or short term capital gain or loss depends on how long the stocks are being held. The amount will be reported on line 7 of your Form 1040 along with a Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Turbotax calculation?

Lina,

Per your link, I called customer support today to enquire exactly what the '1099-B negative value issue' is. It was confirmed it was a different issue from my partial import from E-Trade issue and completely unrelated. The link you provided describes "customers impacted by the negative proceeds values issue that is preventing the e-file submission of tax returns" and states TurboTax is working with the IRS to resolve. Clearly the IRS has nothing to do with problems accurately importing investment sales data from E-Trade brokerage.

Customer Service said the (closed) 'case number' just refers to my call-in which is always closed after a call and instead gave me an Investigation number INV11219.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gerkes

New Member

user17715354333

New Member

user17715188002

New Member

Amiller1

Level 2

grayie87

New Member