- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Quarterly Taxes from IRA Inheritance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quarterly Taxes from IRA Inheritance

I am married filing jointly. My spouse recently received an inheritance from a traditional IRA that has been completely liquidated (not sure if that's the right terminology). She simply received a check from another family member who was handling the split of assets. How do I submit quarterly estimated taxes for this? Is this money subject to self-employment tax?

We both are employed and normally receive W-2 forms each year (with normal withholding, etc.). Neither of us have ever filed quarterly estimated taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quarterly Taxes from IRA Inheritance

Is your spouse the beneficiary of the IRA? An Individual Retirement Accounts normally has a designated beneficiary. Unlike other assets, IRAs are normally paid directly to a designated beneficiary upon death of the account holder.

It’s odd that your spouse received a check from a family member, rather than from a financial institution.

It’s possible the family member was the designated beneficiary and would be liable for the tax. Or the estate would pay the tax. Or the beneficiaries would pay tax on their share.

I suggest getting some clarification before paying estimated tax. If this happened in 2021, the first period estimated tax deadline is still April 15 (not May 17). You can make an estimated payment after April 15 but that may result in some interest on unpaid tax when you file next year.

To prepare estimated tax vouchers in TurboTax:

- Type w-4 in Search in the upper right

- Select Jump to w-4

- Say NO to Do you want to change your W-4 withholdings for 2021?

- Click Prepare Now on Do you want to prepare estimated taxes for 2021?

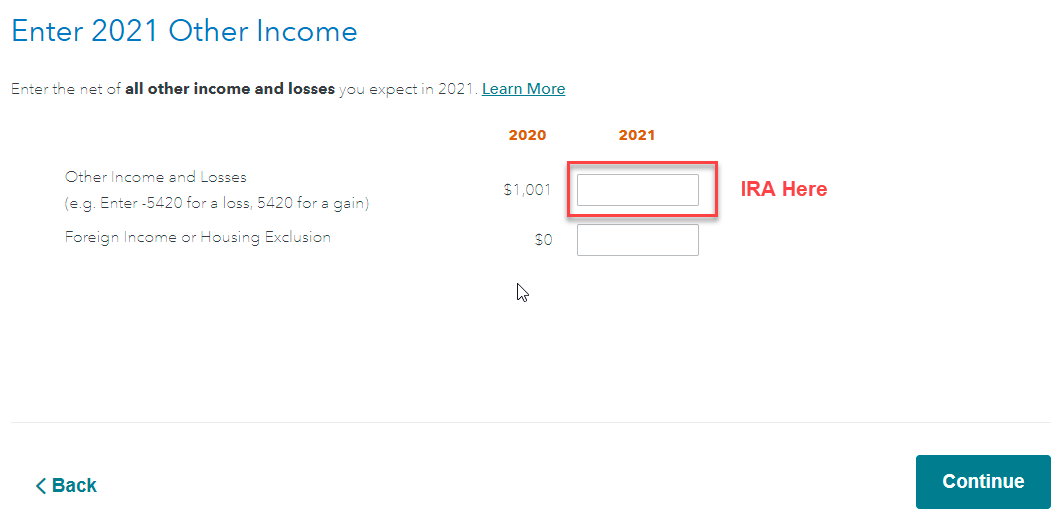

- Continue through the screens until you see Enter 2021 Other income. Enter the IRA distribution in Other income and Losses

An IRA distribution is not subject to self-employment tax. It is treated in much the same way as a pension (only you don’t receive the money in monthly installments).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quarterly Taxes from IRA Inheritance

if your family member was able to liquidate the IRA, then there were no beneficiaries named.

The custodian would not have allowed it if there were beneficiaries named.

If the estate is handled correctly you will get a tax document in January.

Ask the executor if the taxes were already paid out of the estate and where is your tax document..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quarterly Taxes from IRA Inheritance

Sorry, I think I explained this poorly. Yes, she is a beneficiary. She is listed in the will as receiving X% of the estate. A family member physically handed her the check but the check is from the family trust account, not that individual's account. The family member informed us that this specific check was part of a distribution (100% of the account value, split among the beneficiaries) from a traditional IRA.

Regarding generating the quarterly tax vouchers, I am having difficulty finding that. I have the desktop version of TurboTax, not the online version. Is there a way to create the vouchers in that version or would I need to purchase the online version to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quarterly Taxes from IRA Inheritance

You'll be able to use the CD\Download version to generate and print forms 1040-ES. See How do I print estimated tax vouchers for my 2021 taxes? and Can TurboTax calculate the estimated payments for next year's state taxes?

You may also make quarterly payments directly on the IRS website. Click here.

Related Information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kristina-marcelli

New Member

joe-kyrox

New Member

becca92335

New Member

markl128

Returning Member

user17524159637

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More