- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Is your spouse the beneficiary of the IRA? An Individual Retirement Accounts normally has a designated beneficiary. Unlike other assets, IRAs are normally paid directly to a designated beneficiary upon death of the account holder.

It’s odd that your spouse received a check from a family member, rather than from a financial institution.

It’s possible the family member was the designated beneficiary and would be liable for the tax. Or the estate would pay the tax. Or the beneficiaries would pay tax on their share.

I suggest getting some clarification before paying estimated tax. If this happened in 2021, the first period estimated tax deadline is still April 15 (not May 17). You can make an estimated payment after April 15 but that may result in some interest on unpaid tax when you file next year.

To prepare estimated tax vouchers in TurboTax:

- Type w-4 in Search in the upper right

- Select Jump to w-4

- Say NO to Do you want to change your W-4 withholdings for 2021?

- Click Prepare Now on Do you want to prepare estimated taxes for 2021?

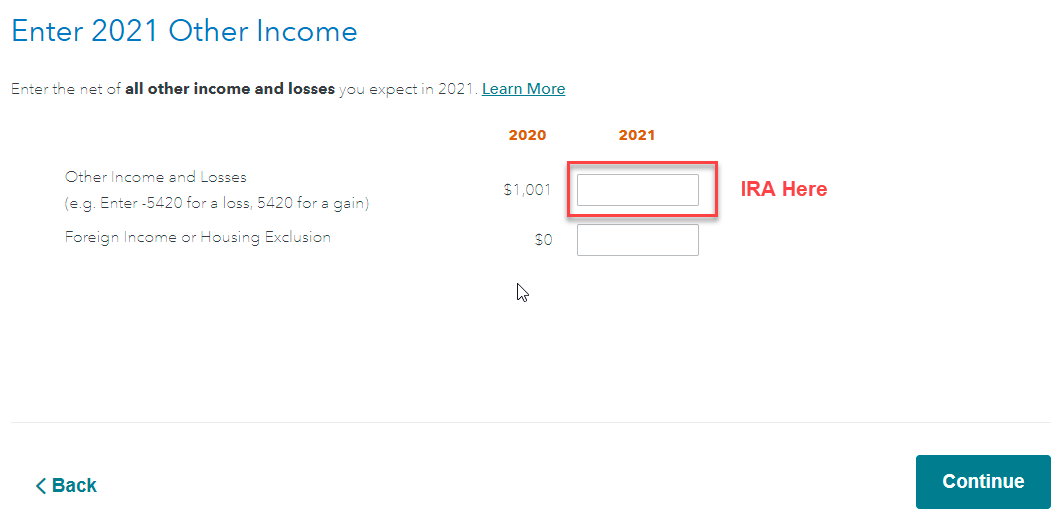

- Continue through the screens until you see Enter 2021 Other income. Enter the IRA distribution in Other income and Losses

An IRA distribution is not subject to self-employment tax. It is treated in much the same way as a pension (only you don’t receive the money in monthly installments).

**Mark the post that answers your question by clicking on "Mark as Best Answer"