- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Hello,

i've entered all my K-1 information for a LP that ended last year but baffled by how to enter the Sale Information in TurboTax Premier. If I can get this done, my taxes are done.

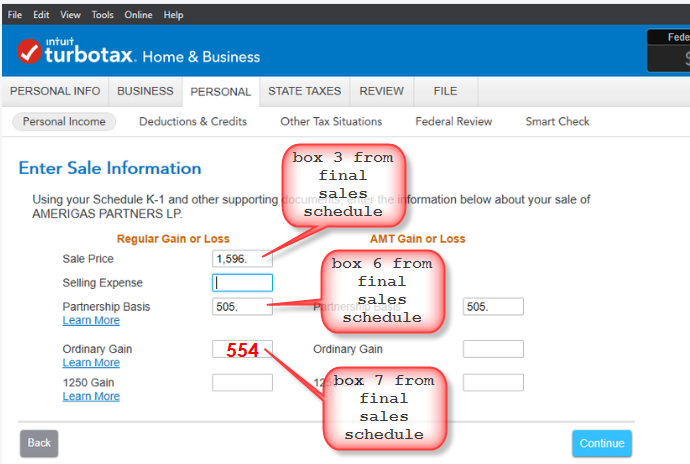

There are 2 columns in TT Regular Gain or Loss AMT Gain or Loss

with below fields

- Sale Price

- Selling Expense

- Partnership Basis

- Ordinary Gain

- 1250 Gain

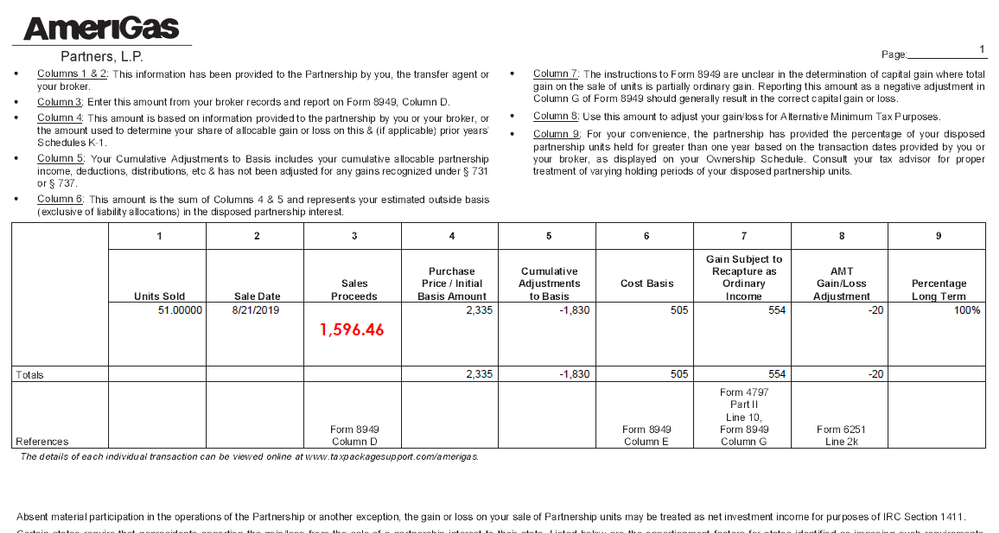

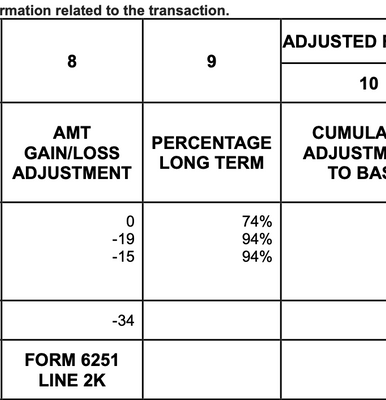

and I have no idea how to fill out based on the K-1 which gives me Sales Proceeds, Purchase Price / Initial Basis, Cumulative Adjustment to Basis, Cost Basis, Gain Subject to Recapture as Ordinary Income, AMT Gain/Loss Adjustments, Percentage Long term.

Any help is greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

you need all your K1s from past years....contact the LP if you don't have them b/c you need those numbers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

was that a publicly traded partnership (PTP). the k-1 would be marked to that effect and the sale would be misreported on the 1099-B. the broker reports the original basis as cost which is almost always wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

I have this exact same question. I do have my K1 from last year and this year, however unable to figure out what numbers from my K1 map back to the specific fields in Turbo.

What should Sale Price, Selling Expense, Partnership Basis, Ordinary Gain be populated from in the K1?

Details: K1 is from a LLC partnership (real estate rental) that started in 2019 and the property was sold in 2020. Since I have indicated that the partnership closed in 2020, I see the following additional section in Turbo:

'Enter Sale Information'.

Although I filled out the fields that were specific to the boxes 2 through 20 in a later section, the above seems to be an additional step with the the following fields:

1. Sale Price

2. Selling Expense

3. Partnership Basis

4. Ordinary Gain.

Could you suggest what numbers from my K1 map back to the specific fields in Turbo stated above?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

DISCLOSURE: I AM NOT A TAX PROFESSIONAL, THIS ISN'T TAX ADVICE, ETC. 🙂 I ONLY OFFER THIS SINCE NOBODY ELSE HAS GIVEN ANY GOOD INFORMATION ABOUT HANDLING THIS PART OF THE K-1 INTERVEIW. THIS WILL AT LEAST GIVE YOU A GOOD SHOT OF GETTING TO THE FINISH LINE. PROS WILL CORRECT ME WHERE I'M WRONG.

That said:

In order to understand what you need to fill out, you need to understand why.

A) When you sold your share in your partnership, the partnership didn't know at what price you sold it. They only know that you sold such and such number of units on a specified date. They only know what you see in the K-1 Transaction Schedule.

B) When you sold your share in your partnership, your broker (Ameritrade, Robin Hood, etc.) didn't know what your TRUE cost basis was. And the reason for this is that in an MLP, for example, your cost-basis can go up and down over/under the cost basis info provided by your broker (what you bought the partnership for from Fidelity, Robin Hood, etc.) due to the taxes and fees and dividends paid by that partnership over time. You agreed to take on your portion of the partnership's tax burden at sale when you purchased units of the partnership. You may have bought that partnership 6 years ago, or this year. So that basis may have changed drastically with the taxes and fees and dividends that you accumulated during that time. If you held it for a month, it may not have changed much at all, or not at all. And those only ever get taxed during the year of sale, which is why MLPs etc are best as long-term dividend payers in the first place. You never agreed to take on the tax burdens of, say, T$la by comparison when buying/selling its stock.

What this section of your K-1 is doing is trying to match up your partnership's REAL basis info with your broker's REAL selling price info, since neither has the complete picture of what happened. So, in short--it's a capital gains calculator that will generate an entry on your capital gains section of the return (form 8949) that specifically stipulates that the information provided here is cap gains for investments where "basis was not reported to the IRS on a 1099-B." And it wasn't on the 1099-B, as I stated before, because your broker couldn't know what the TRUE basis was. BTW, if you imported a 1099-B from your brokerage (Fidelity, Ameritrade, RobinHood,etc.), that form will also generate entries on your form 8949. I don't believe that TT issues a warning that you'll wind up with duplicate entries if you imported your 1099-B for a K-1 that you sell. You only learn this the hard way after stressing out over this section and its consequences. When you're done with your return, specifically check Form 8949 to make sure you don't have duplicate entries (in the part where " (short/long-term transactions reported on form(s) 1099-b showing basis wasn't reported to the IRS" and "short/long-term transactions not reported to you on Form 1099-B" for the K-1 concerned.

**ONLINE EDITION FLUKE: In theory, if you only have one sale and one purchase date, then the information entered into the "SALES INFORMATION" interveiw during the K-1 entry will automatically remove the 1099-B entry when TurboTax completes your return. HOWEVER!!!!!! If you have multiple purchase/sales dates, the ONLINE version of TurboTax won't allow you to enter multiple sales/purchase dates during this section of the K-1 interview. You can utilize the lump-sum; but it won't remove each entry in the 1099-B. And so, the return that TurboTAx ONLINE Premium (or greater) creates will double report your capital gains. You'll have to actually go and delete each entry for the sale from your 1099-B import for the K-1 that you're entering. Your K-1 Sales SCHEDULE, after all, only reports the sales on one date and purchases on one date (ignoring the multiple dates on the TRANSACTION SCHEDULE). I don't believe that you need to worry about this. During the K-1 interview, just enter the total sales proceeds (sales price) for all of the sales dates, and then go delete the multiple 1099-B entries. The IRS will look for the information from the multiple 1099-B sales dates; but they should quickly find it on the 8949 entry now being created during the K-1 interview, now marked "(C) transactions not reported to you on Form 1099-B". REMEMBER: whatever you choose to do, before you file, double-check form 8949 when you're done to ensure that you don't have duplicate entries for these K-1 sales, and that you aren't missing any of them either.***

The Sales Information at this point of the K-1 TT interview should then slide into the 8949 to correct the 1099-B SALES PRICE information that the IRS already has (but with no info about basis to calculate correct cap gains), along with the necessary "(C) transactions not reported to you on form 1099-B" to show that you've adjusted the basis. This then points the IRS to the information it expects from the 1099-B.

This part of the TT interview for the K-1 is like a cap gains calculator.

1. Sale Price: This doesn't come from your K-1. Look at the 1099-B that you got from your broker (Fidelity, RobinHood, etc.). It will tell you at what TOTAL price you sold your units. You want the total proceeds for all units sold here (not the gain/loss). It cannot be below 0. The "Sale Price" SHOULD NOT be confused for information about purchasing prices or "Withdrawals" on your K-1 Sales Schedule, Box L. Your K-1 will not tell you anything about what the Sale price is.

2. Selling Expense: did your broker charge you for a transaction? With most, it's zero nowadays. I think this usually is for anyone dealing in real-estate partnerships and rentals, where there are realtor fees, etc.

3. Partnership Basis: This has nothing to do with your sales. It's strictly an evaluation of your partnership's performance during the time you held the units. Look at your K-1 Sales Schedule. Pay attention to 3 specific columns: "Purchase price," "Cumulative Adjustments to Basis," and "Cost Basis." Purchase price - Cumulative Adjustments =Cost Basis.

**You'll notice that "SALES PROCEEDS" is completely empty, for the reasons stated before (your partnership never knew this portion of the sale). You had to get that info from your 1099-B.***

In other words, The "Cost Basis" (Usually column 6) is your actual "PARTNERSHIP BASIS." If you have an adjustment in column 5 that takes you negative for your Cost Basis in column 6 (it's possible in cases of reverse-splits), then you enter "0" for the Partnership Basis. The IRS will not allow you to have a negative partnership basis, per its instructions for calculating adjusted basis. And the final review performed by Turbotax will not allow you to file if you list a negative basis here for any of your K-1s.

**You need to understand this because you'll have to adjust the "cost basis" (or delete the entry altogether) on your 1099-B now to avoid double-paying your cap gains and/or double-paying different amounts for your cap gains. This is especially true if you imported your 1099-B directly. Remember, they aren't reporting the correct "Cost Basis" anyways, since they don't know it.**

4. Ordinary Gain: Don't enter anything unless you have a box 7 (some sales schedules wont) that reports GAINS SUBJECT TO RECAPTURE AS ORDINARY GAINS. Those would normally go here (section 751 gain/loss, which should be somewhere else as well in box 20 of K-1 Part III). These will actually be subtracted from your capital gains because they get added to your basis. So if your selling price is 10 and your partnership basis is 5, and your GAINS SUBJECT TO RECAPTURE is 3, you'd wind up with 10 - (5 +3) = [after you press "Continue"] $2 cap gains. I'm assuming USO wouldn't have gains to recapture.

IF you only have PURCHASE PRICE / CUMULATIVE ADJ / COST BASIS, then you're done with the K-1 Sales Schedule info. Don't enter anything else on this screen FROM YOUR K-1(at least, if you didn't hold this long-term). Just make sure you have the right "Sale price" from the 1099-B filled out. If you enter the "SALES PRICE" and "PARTNERSHIP BASIS", then the form will do the calculation (sales price - partnership basis) for you to show what your true cap gain/loss and AMT amounts are when you proceed to the next screen.

Now your K-1 reflects the actual profitability or loss associated with the partnership. What you may find is that all of the taxes and fees associated with the partnership during your ownership actually benefited you or punished you. But this is your true gain/loss. **Your Broker Statement WILL NOT show that truth because it didn't have the correct "cost basis". And your K-1 only now shows this because you gave it the broker's sales price.**

Once you complete this section, you will now have an entry on your 8949 that shows the capital gains subject to federal taxes, which your 1099-B never had correct in the first place. If you notice, in the final form, that 8949 reports your sale twice---once for the (A) transaction where basis wasn't reported on 1099-b and once for (C) transaction not reported on 1099-b, then you have two choices. Either delete the entry from your 1099-B in the "Wages and Income" Section (where it shows your broker's stock sales imports ), or else find a way to bypass the K-1 Sales Information interview: see pages 1 & 3 of this thread for the latter method, which I've never tried but understand the utility of if you prefer the broker's info better: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Thank you TaxationIsTheft1776 for the detailed explanation. This definitely helps clear up some of the concepts.

The K1 (1065) that I have is from an LLC which deals in residential real estate and I am a limited partner. The LLC sold the entire property and hence the sale. There is no broker involved and I do not have any corresponding 1099-B.

What this makes me believe is that the section that asks for the Sale Price and Basis information probably corresponds to 1099-B. As I proceeded further (leaving the sale information page blank), there were screens that asked me to enter the information from the various K1 boxes.

It is possible that Turbo Tax is not account for the fact that K1 need not always be accompanied with a 1099-B. Wdyt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

If you have a K-1, you need to report capital gains.

This portion of the interview is like a cap gains calculator.

If you left it blank because you don't have a 1099-B, then you should have some kind of receipt from someone in lieu of a 1099-B that shows you the sale price for the patnership. The information entered in this interview (in my experience) generates a section on your 8949 that specifically states that "basis information was not reported to the IRS on 1099-B." You don't just want to leave it blank, because you do have to report gains/losses on the 8949 someplace. You just don't want to do it twice.

The K-1 should show you your basis, adjustments, and purchasing price, no? Well then, enter the sale price from your receipt and the other info from the K-1. Then you'll get your cap gains/losses on the form 8949. You don't want to pretend that there were no such details.

FOR A VISUAL BREAKOUT OF THE SALES SCHEDULE, AND WHICH BOXES REPORT WHERE ON THE K-1 "SALES INFORMATION" SECTION, SEE ABOUT HALFWAY DOWN ON THIS THREAD. SOMEONE WAS KIND ENOUGH TO BREAK IT DOWN PICTORIALLY.: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Thanks much. This method makes the most sense to me relative to other methods.

One question: I sold all of my MLP last year (2021) and a large ordinary gain is flowing through to "Sale of business property". Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Yes, it is possible to experience a gain from the sale of property. This is just stating there was a sales price higher than your value in the property or partnership as a whole.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

This was extremely helpful! However, after I entered my K1, I went back and deleted the duplicate info from the 1099 & my refund went up by around $1 more than when the investment was only accounted for as a 1099. I assumed that once I entered it as a k1 and removed the 1099, the refund amount would have been similar. It seems I was taxed less on the k1 entry. Does this mean I did something wrong? I followed your instructions very carefully! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

you wrote: "Purchase price - Cumulative Adjustments =Cost Basis."

However, on my K-1, it shows the "purchase price + the cumulative adjustments to basis = cost basis"

Which is correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Cumulative Adjustments can be positive or negative. The instructions show the addition of cumulative adjustments, but if your cumulative number is negative, you would subtract that total from the purchase price.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Thank you TaxationIsTheft1776 for the detailed explanation. This definitely helps clear up some of the concepts.

I had similar Q that I posted here - https://ttlc.intuit.com/community/business-taxes/discussion/how-to-file-a-k-1-correctly-if-robinhood...

From reading your post, it seems after entering the Sales Info section in K-1, I should just go and delete the entries added by importing 1099-B from Robinhood (USO sale was made on multiple dates that's why mutliple entries). But My problem is I see you mentioned that the Broker (Robinhood for my case) wouldn't report Cost Basis for this transaction. But I see in 1099-B tax document received from Robinhood it says "Basis is provided to the IRS" for all the USO sell transactions.

So I'm not sure then I should still just delete these entries.

Please help

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

When the broker provides a basis to the IRS, they are providing what they know to be the basis. The IRS expects you to file with the correct basis and have the records if asked. Provide an accurate return and keep a paper trail of the money and the IRS will be okay with it.

@djain

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

I have another question regarding the box 9 PERCENTAGE LONG TERM. How to enter the percentage long term to TurboTax when it's not 100%?

Any help is greatly appreciated!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

beny

New Member

sam992116

Level 4

RicsterX

Returning Member

texasgranny

Level 1

ew19

New Member