- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

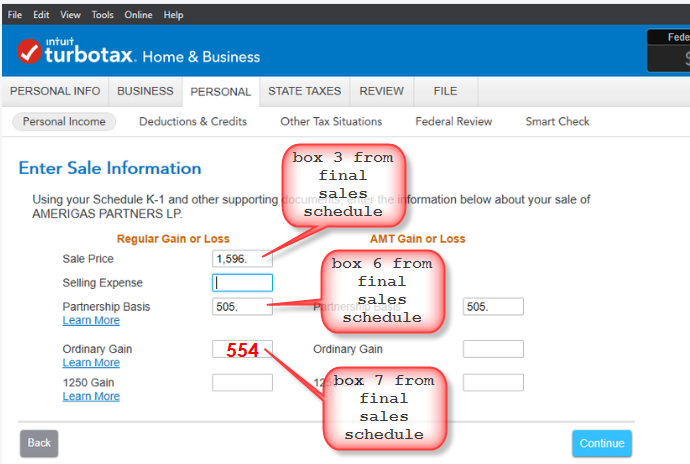

If you have a K-1, you need to report capital gains.

This portion of the interview is like a cap gains calculator.

If you left it blank because you don't have a 1099-B, then you should have some kind of receipt from someone in lieu of a 1099-B that shows you the sale price for the patnership. The information entered in this interview (in my experience) generates a section on your 8949 that specifically states that "basis information was not reported to the IRS on 1099-B." You don't just want to leave it blank, because you do have to report gains/losses on the 8949 someplace. You just don't want to do it twice.

The K-1 should show you your basis, adjustments, and purchasing price, no? Well then, enter the sale price from your receipt and the other info from the K-1. Then you'll get your cap gains/losses on the form 8949. You don't want to pretend that there were no such details.

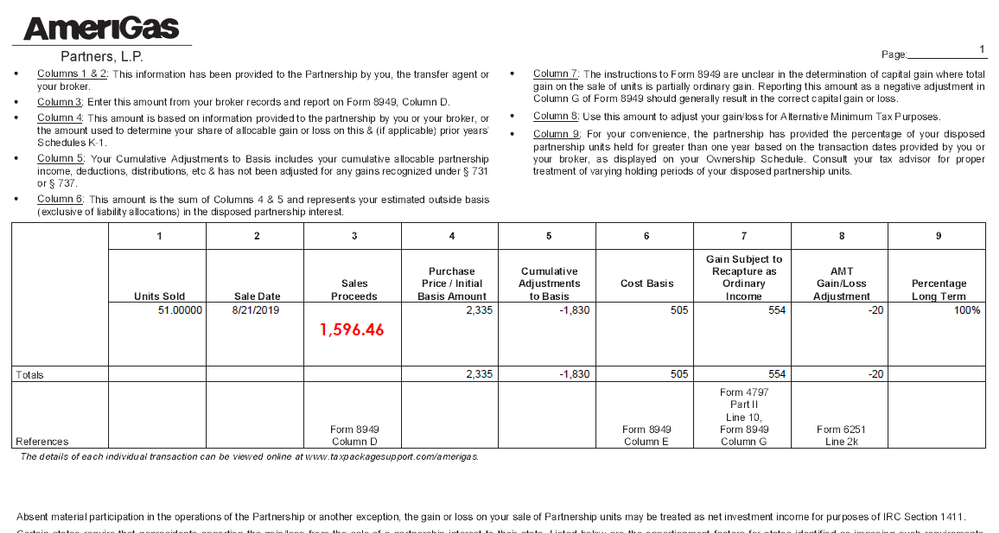

FOR A VISUAL BREAKOUT OF THE SALES SCHEDULE, AND WHICH BOXES REPORT WHERE ON THE K-1 "SALES INFORMATION" SECTION, SEE ABOUT HALFWAY DOWN ON THIS THREAD. SOMEONE WAS KIND ENOUGH TO BREAK IT DOWN PICTORIALLY.: https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...