- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

I bought and sold shares in an oil fund (USO) that sent me a K1, but I see Robinhood is already reporting the sale in their 1099-B, do I need to fill out the K1 also? If so how to fill K-1 correctly and avoid duplication of tax?

Like for my case - I sold all shares of USO in 2021 (i.e. partnership ended).

So I entered Sales Information while filing K-1 ("Sale Price", "Partnership Basis" etc, I don't think I have "Selling Expense", "Ordinary Gain" for this..right?). The numbers entered here affect my tax amount, as well as the numbers entered in the 1099-B section reporting sales proceeds and cost basis for the same sale (done by Robinhood's 1099-B form automatically).

For eg -

From Robinhood's 1099-B entry, Cost Basis is 2750 USD and Proceeds is 4900 USD, so a total Gain of 2150 USD (Long term sale). And according to the Sales Schedule that comes with K-1, my updated Cost basis is 5000 USD (after it added 'CUMULATIVE ADJUSTMENTS TO BASIS' 2250 USD to Initial Basis amount/Purchase Price) and the K-1 instructions on the sales schedule say to get the sales proceeds from the broker, i.e. Robinhood, i.e. 4900 USD.

Also, the K-1 form has 1750 USD amount in Part III, Line 11, c (Sec1256, Contracts and Straddles), which also increase the total tax I owe. In Part II, Section L, the K1 form has "Beginning capital account" as 3300 USD, "Current year net income" as 1700 USD, "Withdrawals and distributions" as 5000 USD and "Ending capital account" as 0.

So where exactly do I enter what numbers? Do I change the adjusted basis in the 1099 section entry (that is added by Robinhood) to 5000 USD as per K-1 or just delete this entry whole together. If so I see Robinhood mentions in 1099-B form for this entry "Basis is provided to the IRS", so not sure if I can change it?

If I adjust the basis in 1099-B, then do I leave the "Enter Sale Information" screen of the K-1 section completely blank? Because if I fill the Sales detail at both places then Turbo-Tax double-counts the gain from the sale. Also what to do with "Part III, Line 11, c (Sec1256, Contracts and Straddles)" entry because as soon as I enter it I see my tax amount increases a lot.

Please help me out in telling where I have to fill what numbers. Do I just fill out the K-1 part and not include the sale on the 1099 at all (i.e. delete the Robinhood 1099-B entry, remember acc to Robinhood "Basis is provided to the IRS" for this).

EDIT - I bought these shares in 2020, so I got K-1 form in 2020 also and last year I filled all info in Turbo Tax in 2020 Tax return and K-1 form's "Part III, Line 11, c (Sec1256, Contracts and Straddles)" had 550 USD for which I paid some extra tax last year (this amount splited and ended up in Line 4 and Line 11 of Schedule D form in tax return).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

You definitely enter all the K-1 info. In the K-1 sale section, you can leave everything blank (or 0). This will make sure the other K-1 entries are categorized correctly.

On the 1099-B interview, you'd change the cost basis to 5000. Note that the 1099-B from Robinhood should be code B or E (meaning cost NOT reported to IRS). If they didn't code it that way, they made a mistake because they can't know the correct cost basis. You might be able to get the to correct it, but if not you still need to make the correction yourself. In the unlikely case that the IRS ever sends an inquiry about it, the K-1 is all you need to explain why you made the change.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@nexchap

Yeah, Robinhood mentioned it as Code D in 1099-B form (i.e. Basis is provided to the IRS). I will try to contact them but I'm not sure If they will correct it and I will get an updated tax document from them before 18th April deadline. Is it still ok to modify the cost basis or delete the entry in such a case?

So which Sales entry I should keep -

1. Leave everything in K-1 Sales section as blank. And manually adjust the cost basis in corresponding Robinhood USO sale entries.

2. OR, enter the K-1 sales sections while using the Proceeds amount from RobinHood 1099-B form and delete the 1099-B entries made by RobinHood for USO.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@djain Definitely change the cost. They're your taxes. Robinhood's error doesn't change the requirement that you report accurate data.

As to approach, either gets you to the same tax return. My preference is to avoid using the K-1 for Cap Gain reporting, since there are circumstances where it can create errors. So I always handle the Cap Gains in the 1099-B interview for consistency.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@nexchap

Thanks for clarifying. Just couple more questions -

1. While changing the actual Cost basis in 1099-B entries from RobinHood for USO, in Turbo Tax should I also change the Sales section of this transaction entry from "Long term basis reported to IRS (covered)" to "Long term basis not reported to IRS (non-covered)"?

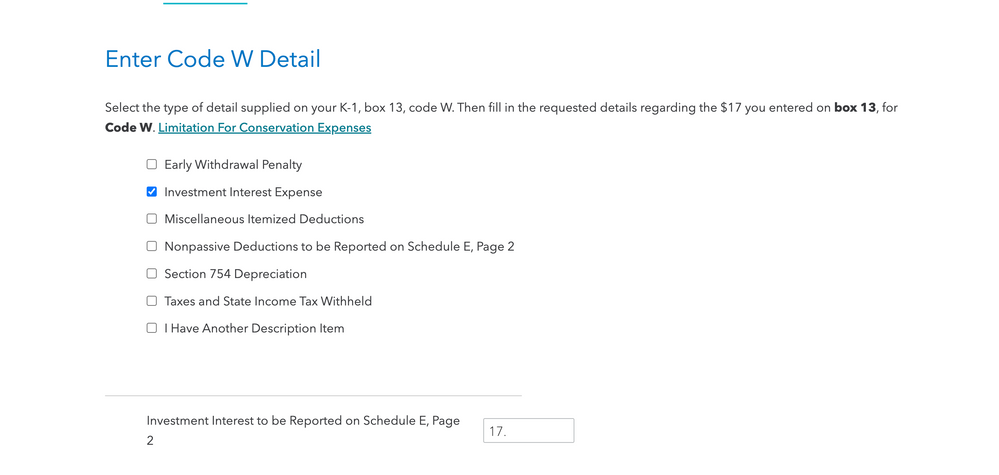

2. About K1 form, I have entry in Part III, Line 13 as W-Other Deductions as 17 USD. The K1-form instructions describe it as - "Line 13w Other deductions – Trader expenses. For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k)".

So while entering this in Turbo Tax, what I should write in "Enter Code W Detail" ? Check the below pic for all the options. I'm thinking as 'Investment Interest Expenses' or should it go in "I have another Description Item"?

EDIT - Also 1 more thing, while I leave everything in K-1 Sales section as blank. Later on while reviewing all the tax info, Turbo Tax complained about the missing Sales price and Partnership Basis in K1-Sales section. So I had to enter both as 0 mentioning actual assest acquired date and disposed date. I guess this will make an entry for this in 8949 form with buy, sell dates and both proceeds, cost basis as 0. That should be fine I guess.. right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@djain 1) Don't change the coding on the 1099-B. Robinhood reported the cost, so the coding is right. Changing it will just confuse the IRS.

2) "Trader expenses" is not the same as investment interest expense (which is related to money borrowed to make trades). I'd suggest posting a separate question to ask how / where to get this on your taxes (I don't know the answer). None of the options look quite right, but if you use "I have another description" TT won't actually put the entry anywhere: you still have to find a spot to enter it.

3) 0 instead of blank on the K-1 form is fine. TT won't actually create a new 8949 since there's no cap gain/loss.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

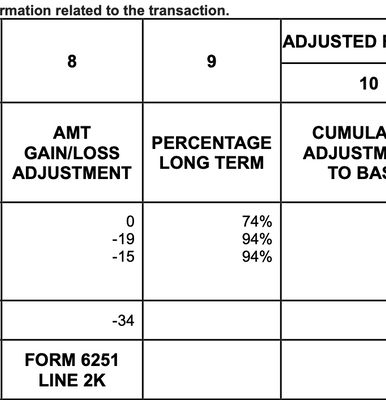

I have another question regarding the box 9 PERCENTAGE LONG TERM. How to enter the percentage long term to Turbox tax when it's not 100%?

Any help is greatly appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@cchu01 Assuming this is a sale of a PTP, you'll be reporting all cap gains by modifying the cost basis of the 1099-B you received from the broker. What that sales schedule is telling you is that each of your sales is partially short term, and partially long term.

As an example, if the 3rd line item (adjustment of $15 and 94% long) was the sale of 100 shares with a purchase price of $100, you'd report the sale of 94 shares as long term and 6 shares as short term. 94% of the $15 adjustment would be applied to the long term shares ($14.1, so cost basis of $94-14.1 = 79.90) and the remainder to the short term shares ($6-$.90 = $5.10)

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@nexchap Thanks so much. If I understood it correctly, I'll be reporting the cap gains for the PTP sales by modifying the cost basis of the 1099-B I received from the broker under the investment income section instead of reporting the cap gains via K-1 interview questionnaire under the Schedule K-1 section in turbo tax, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@cchu01 Correct. In the K-1 section, you do not want any Cap Gain. Note that if you have Ordinary Gain reported on the K-1, you have to fill out the sale questions like this:

- Enter $0 for Sale Price

- Enter Ordinary Gain in the "Regular" and "AMT" columns

- Enter the inverse of the Ordinary Gain (e.g., -100 if Ord Gain is 100) in the Partnership Basis columns.

If done correctly, the next screen (Review Investment Gain or Loss) will show "zero" everywhere and then you can go to the 1099-B to report your Cap Gain/Loss

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

Thanks for all of this nexchap,

I have the same situation (sold S-Corp PTP shares completely, and in my case a mix of 90% long term and 10% short term) and just want to make sure I did it correctly. I hope it is ok if I tag on since the same subject.

Per your instructions I entered 0 for sales price in the K-1 interview, and entered the same only negative values for partnership basis as I had put in the ordinary gain entry. The next page shows all zeros. I entered the box number values as shown on the K-1.

I went to the 1099-B and adjusted the total cost basis by subtracting 90% of the cumulative adjustment to basis figure from my K-1 sales schedule from the total cost basis for long term not reported to IRS and 10% from the short term.

I did not make any other changes. I am reviewing my tax docs now before filing and it is all incomprehensible to me so just hoping it is right.

I am so thankful I found this and other conversations where you have helped out with this issue!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@Sis-Q It sounds like you did the K-1 fine. But the adjustment on the 1099-B may have missed a couple things:

- The broker sent you a 1099-B with a cost filled in. That cost -- the one the broker supplied -- may not be correct. It should be the initial amount you paid for the shares. Some brokers adjust that cost, so make sure you double-check.

- Adjusting the 1099-B requires you use both the "Adjustments" as well as the Ordinary Gain. The cost you enter on your 1099-B should be "Purchase Price"+"Adjustments"+"Ordinary Gain". So if you bought for $100, had ($30) in adjustments, and $10 in Ord Gain, you'd enter $80 as your cost. All of that would be split 90/10 in your example.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

OK Nexchap - I am following those instructions but do find it confusing since we zero'd out the ordinary gain for the K-1 and then also add it to the cost basis on the 1099. It just seems unintuitive to increase the cost by adding in the gain...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

@Sis-Q You zeroed out the "Capital" gain on the K-1, not the "Ordinary" gain. The Ordinary Gain you entered in the K-1 is being reported on Form 4797, so you're paying tax on it.

The issue is that the "Cumulative Adjustments" that reduce your basis include 2 different types of adjustment: some that are taxed at Capital Gain rates, and some that are taxed at "Ordinary" (or regular W-2 like) rates. So they give you the total adjustments (e.g. -$30), and then they also tell you how much of that was "Ordinary" (e.g. $20). So you pay Ordinary tax on the $20 via form 4797, and you back it out of your 1099-B so you don't report it twice.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a K-1 correctly if Robinhood is already reporting the sale of shares for which I also got a K1?

OK, I think I am tracking. In my case the adjustments (-$256) are less than the ordinary gain ($306).

I see turbo tax is having me upload a pdf of the 1099B so I think I should add a note on it saying it was adjusted per the K-1 for that investment.

Thank you again for your incredible patience and knowledge.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hijyoon

New Member

6616jm

New Member

NMyers

Level 1

Ivan L

Level 2

a-e-shch

New Member